Edition 600 - December 04, 2015

This is our second newsletter using our new format and recently updated website. We've received a lot of positive feedback and have really appreciated everyone's patience while we work out a few kinks. Our CELEBRATION30 sale ends December 6, 2015. Be sure you don't miss this opportunity to save YOUR money! This edition is brought to you by our three Master Traders who are willing to share their knowledge and experience to guide you to your next level of trading. Success to you!

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Coffee Trading

This week I will show you one of my favorite trades in Coffee, using the daily chart. I've been doing this one for many years, and it is a great trade. The trade is about inside bars, and the rules are really simple: buy one-tick above the high of an inside bar, or sell one-tick below the low of an inside bar. In case you don't know what an inside bar is, it is a bar that makes a lower high and a higher low than the one that preceded it.

You are looking for 50-100-ticks/contract - you decide based on recent volatility. Do a little back-checking to see what you could have gotten on the last 10 or 12 times this has happened.

Where does the Law of Charts (TLOC) come into the picture? Try to get in by using an intra-day Traders Trick Entry (TTE) just ahead of the breakout of the high or low of the inside bar.

Here's a daily coffee chart: if you look closely, you will see many inside bars.

I marked a couple of inside days for you to see what it is I'm talking about. Now it's your turn to go back to see what would have happened on the days there were inside bars. If only one end of the bar is inside, it doesn't count. Anything with an equal high or low does not qualify, but knowing how traders think, you will no doubt see that many of those work as well, and will mess around with the method.

We could easily sell this method, but we received so much flack for daring to sell one of our methods that I thought we should give you a freebie. Sometimes I wonder how Internet users think a company can pay its staff while just giving stuff away.

You should make enough by using this coffee method to pay for lots and lots of the resources we offer at Trading Educators.

I'll answer one and only one question about this method: if the breakout comes on both sides of the inside bar, you go both ways.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Planning Trades to Control Risk

The problem with many traders is that they have only half a plan, the easy half. They know how much profit they're willing to take, but they don't have the foggiest idea how much they're willing to lose. They're like a deer in the headlights, they just freeze and wait to get run over. Their plan for a position that goes south is, “Please God, let me out of this and I'll never do it again,” but that's wishful thinking, because if by chance the position turns around, they'll soon forget about their promises. They'll go back to thinking that they're geniuses, and they'll always do it again, which means that they're sure to get caught, and get caught bad.

I have a true story I’d like to share: It’s about a broker I knew and a Coffee trade he made. It goes like this:

I received a phone call from this guy moaning about a Coffee trade he was in. He was managing money and had all of his clients in this particular trade.

Coffee, at least at that time, was, and still can be, an illiquid and extremely volatile market, and is often best traded by people who have a genuine need to trade there. But he was in and in up to his neck in trouble. He said, “Joe! I don’t know what to do! If the Coffee goes down any more, I’m going to wipe out all of those accounts.” He told me he had been so sure the market would move up that he never even planned the amount of risk he was willing to take, and by the time he had determined where to put a protective stop, Coffee had shot past that point.

I told him I had no idea of how he could get out of his predicament, and that was an honest answer. I really did not know what he could do.

Apparently, he decided to pray! He called me back that evening and told me he had gone into the restroom, closed the door on the booth, and knelt down and implored God to get him out of the mess he was in. He promised that he would never again trade Coffee if God would just save his skin from disaster.

The following day, Coffee opened gap up, and moved to a point where he could get out at breakeven. He took the opportunity and got out. Later that day, Coffee moved even higher. Two weeks later, he was back trading it once again.

The broker had no plan for what he would do if the market moved against him. Whatever planning he did was done after, not before, entry into the market. His irresponsibility took unlimited risk with client accounts, having no idea of his exit point.

But perhaps worst of all, he was dishonest with both himself and his clients. He vowed to never trade that market again. Where were the discipline and self-control he needed to keep his promise?

How many of us do the same thing when we trade. We make mistakes, vow to never make them again, and then do the same dumb things all over again. We take risk without planning, or realizing just how much risk we are truly taking. Then the market teaches us a painful lesson. I think you would agree, markets are very good at doing that.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Spread Scan with Commentary

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Today we are looking at the Japanese Yen. As you can see on the chart below, the Yen has been trading sideways for some time (almost one month), and the volatility is very low. Traders might enter on a breakout either to the upside or the downside, with the stop at the other side of the range. First target to the downside would be 80,000 and to the upside 83,000. If the normal contract is too expensive for you, you can use the Forex or the ETF with the symbol FXY.

.png?i=027)

Profitable trades are attainable! To find out how to manage this and other trades, and also to receive our daily detailed trading newsletter, subscribe to Traders Notebook.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Ambush Method Trade and Performance Report

by Master Trader Marco Mayer

Educator for Forex and Futures, System Trader, and Creator of Ambush Trading Method

This week we are looking at the Henry Hub Natural Gas Futures (NG) traded at the NYMEX.

There’s one question regarding Ambush that is frequently asked, and that is if Ambush can be combined with the Law of Charts (TLOC).

My answer to this is that not only can it be combined with other trading methods, but it’s actually a good idea to do so!

Let’s look at the example below. As you can see on the chart, we have been very happy with the various recent Ambush trades with positive results. But we’ve also seen a consolidation (red box) and a breakout giving us a Ross Hook (RH) on the first correction of that breakout. One way to enter here would have been by using the Traders Trick Entry (TTE)!

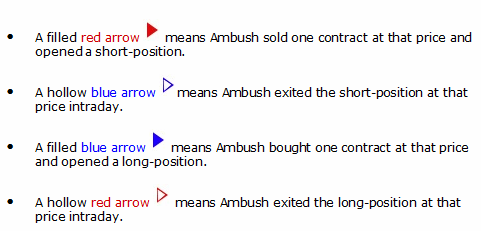

On the chart above are four different kinds of arrows:

Let's examine the results of those trades (including $10 for commissions and slippage round-turn) trading just one Henry Hub Natural Gas Futures (NG) contract:

As you can see, Ambush managed to make a total of $3,280 profit (including $10 for commissions and slippage round-turn) trading just one contract, without keeping any positions overnight!

Click on the link below and look at the menu on the right to see the long-term performance of the Henry Hub Natural Gas Futures (NG) and all other markets supported by Ambush:

View The Reports Now

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

To view previous published Chart Scan newsletters, please log in or click on "Join Us," shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2015 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.