Martha Ross-Edmunds

Free eBook - The Law of Charts (TLOC)

Welcome to the Law of Charts. This section introduces you to the basic formations of the Law.

The impetus, the driving force behind the law, is that of human action and reaction to the reality of prices.

We are traders, and, just like you, we experience our winning times and our losing times. We have no magic to offer you, but what we do offer is what we have learned over decades of trading in many markets, using many methods and techniques. We are survivors of some of the most volatile times in history. Markets have changed drastically from when we first began trading.

However, the laws that govern the markets have never changed. The Law of Charts dates as far back as the making of charts to depict the action of prices in a market. Regardless of time frame, whether it is yearly, monthly, daily, or intraday, you will see the Law of Charts in action. The formations, while not identical, can be defined, which has made our presentation of the Law of Charts possible.

We are here to serve, as well as to trade. We hope you enjoy this adventure through the Law of Charts. It is by no means complete. There is so much more to be said, so much more to explain, which is why we hope you will go past the basics presented here to delve into the depths of the law.

As with any other law of nature, knowing about the law is not directly profitable. It is only by implementing the law that profit can be derived. Knowing about electricity never made anyone any money, but harnessing the power of electricity has made many fortunes over time.

Let’s begin our exploration of The Law of Charts. At the end, we will invite you to take our online webinar course, which will enable you to go even deeper into the law, and will show you how the law is implemented.

THE LAW OF CHARTS™

1-2-3 HIGH AND LOWS

A number 1 high is created when a previous up-move has ended and prices have begun to move down.

The number 1 point is identified as the last bar to have made a new high in the most recent up-leg of the latest swing.

The number 2 point of a 1-2-3 high is created when a full correction takes place. Full correction means that as prices move up from the potential number 2 point, there must be a single bar that makes both a higher high and a higher low than the preceding bar, or a combination of up to three bars, creating both the higher high and the higher low. The higher high and the higher low may occur in any order. Subsequent to three bars, we have congestion. Congestion will be explained in depth later on in the course. It is possible for both the number 1 and number 2 points to occur on the same bar.

The number 3 point of a 1-2-3 high is created when a full correction takes place. A full correction means that as prices move down from the potential number 3 point, there must be at least a single bar, but not more than two bars, that form a lower low and a lower high than the preceding bar. It is possible for both the number 2 and number 3 points to occur on the same bar.

Now, let’s look at a 1-2-3 low.

A number 1 low is created when a previous down-move has ended and prices have begun to move up. The number 1 point is identified as the last bar to have made a new low in the most recent down-leg of the latest swing.

The number 2 point of a 1-2-3 low is created when a full correction takes place. Full correction means that as prices move down from the potential number 2 point, there must be a single bar that makes both a lower high and a lower low than the preceding bar, or a combination of up to three bars creating both the lower high and the lower low. The lower high and the lower low may occur in any order. Subsequent to three bars we have congestion. It is possible for both the number 1 and number 2 points to occur on the same bar.

The number 3 point of a 1-2-3 low exists when a full correction takes place. A full correction means that as prices move up from the potential number 3 point, there must be at least a single bar, but not more than two bars, that form a higher low and a higher high than the preceding bar. It is possible for both the number 2 and number 3 points to occur on the same bar.

The entire 1-2-3 high or low is nullified when any price bar moves prices equal to or beyond the number 1 point.

LEDGES

A ledge consists of a minimum of four price bars. It must have two matching lows and two matching highs. The matching highs must be separated by at least one price bar, and the matching lows must be separated by at least one price bar.

The matches need not be exact, but should not differ by more than three minimum tick fluctuations. If there are more than two matching highs and two matching lows, then it is optional whether to take an entry signal from either the latest price matches in the series (Match ‘A’) or those that represent the highest and lowest prices of the series (Match ‘B’).

A LEDGE CANNOT CONTAIN MORE THAN 10 PRICE BARS. A LEDGE MUST EXIST WITHIN A TREND. The market must have trended up to the Ledge or down to the Ledge. The Ledge represents a resting point for prices; therefore you would expect the trend to continue subsequent to a Ledge breakout. See below:

CONSOLIDATIONS

A Trading Range (See below) is similar to a Ledge, but must consist of more than ten price bars. The bars between ten and twenty-one are called Congestions. The bars from 21 and on are called Trading Ranges. Usually, from bars 21-29, there will be a breakout to the high or low of the Trading Range established by those bars prior to the breakout.

THE ROSS HOOK

A Ross Hook is created by:

1. The first correction following the breakout of a 1-2-3 high or low.

2. The first correction following the breakout of a Ledge.

3. The first correction following the breakout of a Consolidation.

In an up-trending market, after the breakout of a 1-2-3 low, the first instance of the failure of a price bar to make a new high creates a Ross Hook. (A double high/double top also creates a Ross Hook).

In a down-trending market, after the breakout of a 1-2-3 high, the first instance of the failure of a price bar to make a new low creates a Ross Hook. (A double low/double bottom also equals a Ross Hook).

If prices breakout to the upside of a Ledge or a consolidating formation, the first instance of the failure by a price bar to make a new high creates a Ross Hook. If prices breakout to the downside of a Ledge or consolidating formation, the first instance of the failure by a price bar to make a new low creates a Ross Hook (A double high or low also creates a Ross Hook).

We’ve defined the patterns that make up the Law of Charts. Study them carefully.

What makes these formations unique is that they can be specifically defined. The ability to formulate a precise definition sets these formations apart from such vague generalities as “head and shoulders,” “coils,” “flags,” “pennants,” “megaphones,” and other such supposed price patterns that are frequently attached as labels to the action of prices. Our online video seminar, if you decide to take it, will take you much more deeply in to the Law of Charts and show you several implementations of that law that are currently making money for numerous traders around the world.

CONSOLIDATIONS

Sideways price movement may be broken into three distinct and definable areas:

1. Ledges - consisting of no more than 10 price bars

2. Congestions - 11-20 price bars inclusive

3. Trading Ranges - 21 bars or more with a breakout usually occurring on price bars 21-29 inclusive.

Trading Ranges consisting of more than 29 price bars tend to weaken beyond 29 price bars and breakouts beyond 29 price bars will be:

• Relatively strong if the Trading Range has been growing narrower from top to bottom (coiling).

• Relatively weak if the Trading Range has been growing wider from top to bottom (megaphone).

We have written considerable material about breakouts from Ledges, primarily that since by definition, Ledges must occur in trending markets, the breakout is best traded in the direction of the prior trend, once two matching highs and two matching lows have taken place.

The next discussion deals primarily with Congestions and Trading Ranges:

Under the topic of the Law of Charts, we have defined the first correction following the breakout of a Trading Range or Ledge as being a Ross Hook.

The same is true after a breakout from Congestion, i.e., the first retracement (correction) following a breakout from Congestion also constitutes a Ross Hook.

A problem most traders have in dealing with sideways markets is determining when prices are no longer moving sideways and have indeed begun to trend. Apart from an outright breakout and correction which defines a Ross Hook, how is it possible to detect when a market is no longer moving sideways, and has begun to trend?

In other writings, we have stated that the breakout of the number 2 point of a 1-2-3 high or low formation ‘defines’ a trend, and that the breakout of the point of a subsequent Ross Hook ‘establishes’ the trend previously defined.

However, while a 1-2-3 formation occurring in a sideways market still defines a trend, the 1-2-3 formation, when it occurs in a sideways market, is not satisfactorily traded. This is because Congestions and Trading Ranges are usually composed of opposing 1-2-3 high and low formations.

If a sideways market has assumed an /\/\ formation, or is seen as a \/\/ formation, these formations will more often than not consist of a definable 1-2-3 low followed by a 1-2-3 high, or a 1-2-3 high followed by a 1-2-3 low. In any event, the breakout of the number 2 point is usually not a spectacular event, certainly not one worth trading.

What is needed is a tie-breaker. The tie-breaker will not only increase the likelihood of a successful trade, but will also be a strong indicator of the direction the breakout will most probably take. That tie-breaker is the Ross Hook.

When a market is moving sideways, the trader must see a 1-2-3 formation, followed by a Ross Hook, all occurring within the sideways price action. The entry is then best attempted by using the Traders Trick ahead of a breakout of the point of the Ross Hook. The Traders Trick is explained in great detail in the online video.

Of course, nothing works every time. There will be false breakouts. However, on a statistical basis, a violation of a Ross Hook occurring when price action is sideways, consistently results in a low risk entry with a heightened probability for success. Since the violation of a Ross Hook occurring in a sideways market is an acceptable trade, then an entry based upon a Traders Trick entry ahead of the point of the Ross Hook being violated offers an even better entry, which is why you will want to hear Joe Ross explain it. His explanations go far beyond what you will find in his books.

Trading the Ross Hook Hardback Book - Buy Today!

The few examples of the Traders Trick Entry (TTE) included in this presentation are unrefined, and are meant to excite your curiosity as to exactly what the TTE is, and how and why it is used.

Over the years, the TTE has undergone many refinements based on the experience of many traders in addition to the personal experience of Joe Ross.

We are grateful for the feedback we have received about the TTE. The proper use and understanding of the TTE has made the difference between winning and losing for many hundreds of traders. To properly learn the TTE it is essential that you further your education and make the effort to learn what TTE is all about. The material for the TTE goes far beyond the examples shown for TLOC in this introduction.

What you see with the examples of the TTE in this document show that the TTE gives a better entry into a trade then simply waiting for a breakout of a #2 point or a breakout of the point of a Ross Hook. However, the refinements made to the TTE create even better trade entries.

POINTS OF CLARIFICATION FOR 1-2-3 FORMATIONS

We have had a number of people ask about the trading of the 1-2-3 high or low formation. They ask, “When do you buy and when do you sell?”

Although we prefer to use the Traders Trick Entry whenever possible, the illustration should be of help when not using the Traders Trick.

THE BREAKOUT OF A 1-2-3 HIGH OR LOW

Let's illustrate what a 1-2-3 is:

Note: The #3 point does not come down equal to or as low as the #1 point in an uptrend, or equal to or as high as the #1 point in a down trend.

We set a mental or computer alert, or both, to warn us of an impending breakout of these key points. We will not enter a trade if prices gap over our entry point. We will enter it only if the market trades through our entry point.

1-2-3 Highs and Lows come only at market turning points that are in effect major or intermediate high or lows. We look for 1-2-3 lows when a market seems to be making a bottom, or has reached a 50% or greater retracement. We look for 1-2-3 highs when a market appears to be making a top, or has reached a 50% or greater retracement.

Exact entry will always be at or prior to the actual breakout taking place.

POINTS OF CLARIFICATION FOR ROSS HOOKS

We are asked the same question with regard to the Ross Hook as we are about 1-2-3 formations: “When do I buy, and when do I sell?” Our answer is essentially the same as for the 1-2-3 formation. Although we prefer entry via the Traders Trick, such entry is not always available. When the Traders Trick entry is not available, enter on a breakout of the point of the Ross Hook itself.

Some comments about the series of graphs that follow might clear up a few questions:

That leaves us with a 1-2-3 low and a Ross Hook in the event of a breakout to the upside. It also leaves us with a 1-2-3 high and a Ross hook in the event of a breakout to the downside. A breakout of the double top (Rh) will set us up for any subsequent upside Ross Hooks if prices take out the double resistance area and then later correct.

The following comments apply to the chart above and the one below. We may want to put on our entire position but we have only two opportunities. It may be best to put on 2/3 of the position at the higher of the two entry points, and only 1/3 at the hook, if we are given the choice. Once prices start back down, we try for 2/3 immediately. If we still cannot get our position on, then we will have to place the entire position on at the hook. You may recall in a similar situation we looked at the 3x3 moving average of the close and considered it a filter for the trade because the 3x3 was running through a five bar consolidation. In this instance, the 3x3 moving average was still displaying containment of the downtrend.

The following comments apply to the chart above and the chart below: As we take profits out of the market, we come to a point where we have accumulated sufficient profits that if we wish to risk those profits, we can begin to keep our stop further away from the price action.

If we don’t want to take additional risk, then it’s best to trail a 50% stop as the market moves down, and pull stops even tighter on reversal bars, or any indication that something is amiss.

Note with regard to the last four charts: An adequate trailing stop would have kept us in the market throughout the four days show on these charts. We would have been able to build a position by adding contracts.

But keep in mind that adding contracts also adds all new risk. Furthermore, the risk which is incurred may be greater in nature than the risk originally accepted. Why? Because each time we add to our position, we are closer in time to the end of the move being made.

The method of trade management that we have been showing you in this entire series of charts is here is to demonstrate to you an alternative method of trade management. It is up to the trader to decide how to manage his/her own positions. In our minds there are two basic approaches, both of which may be acceptable to some.

The first is that of putting on the entire position upon the initial entry and then liquidating portions of that position to cover costs, take a small profit, and finally to ride the trade as far as it will go with what remains of the position after partial liquidation.

The converse of this method is to build the position by entering a portion of it to test the waters. If the initial portion becomes profitable, you then add to the position by adding contracts in stages until you have put on the entire position.

Much of any acceptability depends upon your personal comfort level in handling risk, and your financial capacity for handling risk.

We’ll look at two more charts now. In actuality, the market continued downward for quite some time after the last chart below.

CONGRATULATIONS!

You have just completed your first of two free trading lesson eBooks that were created by Trading Educators - Joe Ross which launched Joe’s successful trading career in all markets.

Traders Trick Entry (TTE) eBook will follow in 24 hours via email.

Keep reading for a fabulous special offer from Master Trader Joe Ross!

Our main goal is to help you reach YOUR goals of becoming a successful trader, and to show you that consistent profits are attainable! It’s important to remember, while learning the “trade” of trading that you must have a general understanding and the proper resources before even placing trades. Take this seriously, and treat it like it’s your own business. If you stumble across products promoting “Get Rich Quick” or “The Holy Grail”, you’ll only learn what false-hopes products are all about. We’ve heard this story from many of our traders, so don’t fall into that trap. Learning how to trade takes time and patience. We are here to help you learn with our many resources that we offer, and the experience of our master traders that can properly guide you.

After you have studied our free explanation of The LAW of CHARTS (TLOC)...

Traders Wish List

Gift ideas for even the most particular of traders

Hot Picks!

Suggestions by

Master Trader Andy Jordan

Movies:

Trader – I like this 1987 documentary about Paul Tudor Jones, because it shows him trading over the telephone at the open outcry markets. It is very interesting to see his enthusiasm. This video can be found on vimeo.com.

Music:

The Whipsaw Song by Ed Seykota. This song tells you everything you need to know about trading, and can be found on YouTube.com.

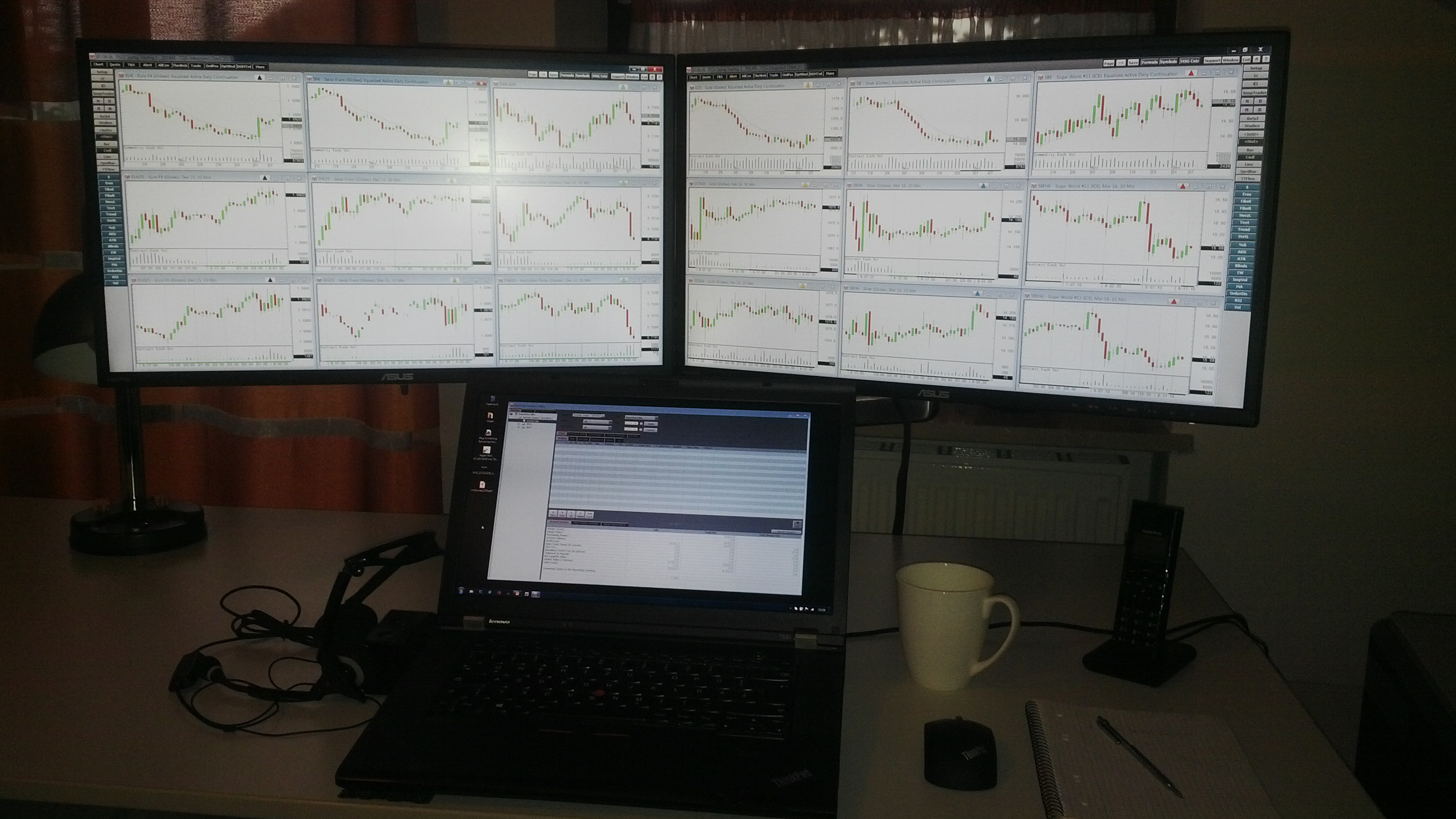

Computers:

When trading from Germany and the Dominican Republic, I use the Lenovo ThinkPad, a docking station to connect two or more Asus monitors. Because of its service and

reliability, I’ve been using ThinkPad since the old IBM times. I haven't used a desktop PC because I like the idea of being able to trade from wherever I travel.

Books:

Trading Is a Business by Joe Ross

The Little Book of Market Wizards by Jack D. Schwager

Both books are a "must read" for every trader.

Software:

In addition to a good charting service (Trade Navigator from Genesis) and a reliable trading software (CQG Integrated Client), I think a trader needs Excel, Open Office, or what I am using, Libre Office, to do bookkeeping on his trades. I keep all my trades on an Excel sheet, which allows me to do calculations about my targets, stops, and whatever else is needed.

And a Coffee Mug like this one!

Suggestions by

Master Trader Marco Mayer

My movie and book selections are more entertaining than real "trading-work" related.

Movies:

Floored - on BlueRay

The Big Short - Cinema gift

The Wolf of Wall Street - on BlueRay

Books:

The Big Short by Michael Lewis

Reminiscences of a Stock Operator by Edwin Lefevre

Trading Is a Business by Joe Ross (Marco agrees with Andy on this choice!)

Notebook:

I trust in www.moleskine.com for notebooks with paper

Evernote.com (premium subscription could be a gift)

Computer:

I am using an Apple MacBook Pro 15" Retina (the high spec version) for a year now, and will probably never go back to anything else. Running Windows in a Virtual Machine (Parallels) where needed, and it's faster and more reliable than on any Windows computer I have previously had. It's a joy to use, and perfect for trading while traveling.

Chart Scan Newsletter

Chart Commentary and Invaluable Trading Articles

from our three Professional Traders:

Joe Ross

Andy Jordan

Marco Mayer

SIGN UP TODAY!

RECEIVE TWO FREE EBOOKS BY JOE ROSS

The Chart Scan weekly newsletter was created by Founder and Master at Trading, Joe Ross to teach his students how to trade. He successfully held his promise for over 60 years and had thousand of students from every continent. Joe Ross passed away on September 7, 2021 and will be greatly missed, but his writings will stand the test of time for generations to come. Take it to heart and learn from the best through his products and archived weekly newsletters.

Joe emailed a weekly newsletter to his students for decades and it will continue with archived copies because his teachings are still relevant in today's trading world. Technology may have change, but not how Joe wanted you to learn about trading. "A chart, is a chart, is a chart." Those words ring in all the ears of his students that mentored under him. Sign up for a weekly newsletter that includes Chart Scan and Commentary, Trading Articles, Announcements, Free eBooks about the Law of Charts and the Traders Trick Entry. See the Law of Charts in action. We will not sell, rent, or trade your information.

Chart Scan Newsletter is designed to assist you in becoming a better trader by showing you in the context of the markets how to apply the Law of Charts™ in today's markets. It was created to show you The Law of Charts™ in action. Implementing the Law of Charts is how thousands of traders are making bundles of money in today’s markets. The Law of Charts™ benefits you, by working in all markets and in all time frames. It works to make you money with bar charts, candlestick charts, line charts (as used with spreads), and point and figure charts. Part and parcel with the Law of Charts™ is one implementation of the "Law" - the Traders Trick Entry™ (TTE). There are many additional implementations, which are through our hardback books, eBooks, webinars, and private tutoring by our Professional Traders.

In this newsletter, you will see applications to a variety of markets, including forex, futures, spreads, and stocks.

The best way to understand the concept of the Law of Charts™ is to see it in action in a variety of time frames. The Law of Charts™ is applicable to all markets and all time frames.

Combined with the Law of Charts™ concept is the Traders Trick Entry™, which offers you a best entry implementation of the law.

Accompanying each week's chart are invaluable commentary, examples, and special promotions about our products and services. This newsletter has helped many traders to become more successful.

Sign up today to receive your free weekly Joe Ross-Trading Educators Chart Scan Newsletter emailed every Friday. As a bonus, you'll receive 2 FREE eBooks, trading articles, and much more! All you have to do is check your email to confirm permission. Your first free eBook is the "The Law of Charts™" and the second one is our "Traders Trick Entry™” eBook. Start your trading education today!

We will not sell, rent, or trade your information.

Click Here to read some of our past Chart Scan Newsletter Editions!