These FAQs are listed questions and answers from various e-mail correspondence between our trading students/customers, all supposed to be frequently asked in some context, and pertaining to a particular topic.

Links throughout the answers will guide you to further information on our website or from other sources. Should you have any further questions, please consult our Contact Us page.

Q: Can I make a living trading? Is it really possible to trade for a living?

A: Yes, it is possible. Our trading team is hard proof that it can happen and they have worked very hard to get where they are today. That is why, Trading Educators takes pride in developing educated traders who are independent thinkers. We want you to succeed as a trader. It is imperative that you first evaluate your financial situation and emotional state, as there has probably been a lot of marketing thrown at you to purposely get you off track. Stay away from "get rich quick" schemes, they don't work and only offer empty promises.

Next, take the appropriate steps to educate yourself, learn patience, which will then lead you to developing a trading plan, and most important is to test your trading plan by using a simulated trading program before going live with real money. Aligning your trading plan with a simulated trading program will put you and your plan to the true test. The overall average among professional traders is that they make 6%/month on the amount of money they have in their trading account. When you compound 6%/month the result is 100%/year, which is an excellent return. For example, if you have a margin account of $10,000, you should be able to double it in a year.

If you're new to trading, click here to start with Level, Time, Market, and Goal. For our intermediate to advanced traders, you should already have a trading plan in place, so take advantage of our One-on-One Private Sessions with one of our three Master Traders to evaluate and strengthen your trading plan. Joe Ross, Andy Jordan or Marco Mayer.

—

Q: Where do I put my stop?

A: There are many variables involved in stop placement and at Trading Educators, we believe it makes no sense whatsoever to use a fixed dollar amount, a fixed percentage of your account, or a fixed number of ticks or pips for stop placement. The markets change from one day to the next. Due to variations in volatility, no fixed method of stop placement is going to be any good in all situations. If you are asking "Where to place your protective stop loss at the time you initiate a trade" or "How much risk should I take when I enter a trade?", then you've got to start educating yourself further and deeper into trading materials. Those answers can only come from you.

Trading Educators webinars and private turtoring are your best options to help you with your trading plan. Our three master traders will guide you through your end result questions on the amounts for your stop placement in forex, futures, stocks, spreads, and options. We also show you how to figure out objectives, position size, determine which markets, and time frames you could trade in. There is no way for us to tell you how much risk that you can afford to take. Ask yourself the following questions, keeping in mind that these are tough and direct, so be very honest with yourself:

- What is my risk tolerance (level of comfort), emotionally, mentally, physically, or financially?

- How much money do I have or it’s intended use?

- What is my initial reaction under pressure?

- How will I behave during a winning or losing streak?

- Trading isn't predictable, so how will it impact my family situation?

- How will greed affect my trading?

- Fear plays a big role when it comes to trading, put yourself in these situations:

- Fear of missing a move.

- Fear of being wrong.

- Fear of losing money.

- Other moral and emotional fears.

- How will pride affect your trading?

These are just a few of the things that only you know about yourself. So when the question arises, "Where do I put my stop?" Remember, the answer solely depends on you and the steps you should take to educate yourself as a trader. It takes the will to learn, patience, and an understanding that this process won't happen overnight. But, if you've gotten this far into your quest as a trader, then you've come to the right place. Trading Educators has over eighty-seven years of combined trading experience, giving you the luxury of having all the necessary resources right at your finger tips. Through our products and services, we encourage independent thinkers and want you to succeed! Take the time to read through our website, and let us help you answer your own question of "Where do I put my stop?" Our recommendation to you is starting with Joe Ross' eBook "Stopped Out!" and One-on-One Tutoring with one of our three Master Traders.

—

Q: Is a Ross Hook that is also a doji bar valid?

A: A Ross Hook (Rh) is formed when there is a failure of prices to move higher (rising prices) or lower (falling prices), following the breakout of the #2 point of a 1-2-3 formation, or the breakout from any kind of consolidation. The Rh has nothing to do with location of the Open or Close of a bar, so a doji bar that becomes the point of a Rh, is as valid as any other bar that becomes the point of a Rh. Read more about Trading the Ross Hook.

—

Q: How long should a time stop be?

A: There is no definitive answer to how long a time stop should be. A time stop is completely subjective, and must be determined by the trader based on testing and experience within the chosen market and time frame. Some traders are content to wait longer than other traders. You simply cannot say a time stop should always be a certain number of minutes or hours.

—

Q: What is the difference between these three products: Day Trading Hardback Book, Day Trading E-Mini S&P 500 eBook, and the Day Trading Forex eBook? I already have the Day Trading book, will the Day Trading E-Mini and the Day Trading Forex give me more information?

A: The Day Trading Hardback Book is a full-size text book that is loaded with lessons, and examples taken from real trades. It reveals to you the many concepts you need to know to succeed at trading. It is really the first step in the process of learning to day trade.

The Day Trading E-Mini eBook can be used to learn how to day trade almost anything you would like to day trade. It teaches some concepts that go beyond what is taught in the Day Trading book. However, the focus of the book is specifically the E-Mini S&P 500. This eBook can be a second step in the learning process, or you can choose to jump ahead to the full 2-day Day Trading Webinar or Private Tutoring by Master Traders' Andy Jordan and Joe Ross.

The Day Trading Forex eBook teaches concepts not taught in either of the other day trading books. Although it, too, can be used to day trade a variety of markets, the focus is on currency trading in Forex, or currency futures. The Day Trading Forex eBook can be used as a second step in learning to day trade. Our students tell us that the 2-day webinar, or even better 3 days of tutoring with Joe Ross is a marvelous experience that will change your life and take you to the pinnacle of trading. You will never again see the markets the way you have in the past. You will know and understand how markets work, and how to make money in them.

Q: I have Analysis Paralysis. Can you help?

A: There are two reasons you have Analysis Paralysis. You can be the victim of one or both of the following:

- You don’t believe in yourself and what you are doing.

- You don’t believe that what you are doing truly works.

Trading Educators can't emphasize enough that you must regularly evaluate your trading plan to work through or shorten length of time while in analysis paralysis. You are on the right track, if 1) you acknowledge analysis paralysis, and 2) you are ready to break away from it. If you think that our Master Traders don't ever get analysis paralysis, then it's time to clue you in. Our Master Traders are constantly reading up on the latest market materials, and seeking out new resources which helps them evaluate their trading plans. This only pushes them further along into becoming better traders. Sometimes it good to start from the beginning, remind yourself as to why you started trading and celebrate the months, quarters or years where you showed a profit. Revisit a book or article that helped in your education or got you excited about becoming a trader. Try a fresh and new prespective, sort through the many products and services that fits your trading need. Learn with the best, you have the skill set, and we are here to help break you out of this temporary state of mind.

Q: What information do I need to trade?

A: This is a great question and Trading Educators is excited to walk right along side of you while you gain confidence in getting your answer. We have purposely set up our website to guide you through and answer questions along the way. We can help you determine which market(s) and style of trading that best suits your trading goals. Visit our home page and read through the four sections: Level, Time, Market, and Goals. We offer a wide range of products and services to help get your started such as books, eBooks, Webinars, Private Tutoring, and Daily Trading Advisory Programs. If you still have questions after visiting our site, feel free to Contact Us, so we may assist you.

—

Q: I have trouble Pulling the Trigger on a trade. Can you help?

A: There are two reasons you can't pull the trigger on a trade. You can be the victim of one or both of the following:

- You don’t believe in yourself and what you are doing.

- You don’t believe that what you are doing truly works.

We can help. It can be done in a number of ways:

- Read one or more of our eBooks or Hardback Books.

- Private tutoring with Master Traders Joe Ross, Andy Jordan, or Marco Mayer.

—

Q: Does "The Law of Charts" work in any market, any time frame or under all conditions: for example: a panic market or irregular price action?

A: A "Law" is not something that "works." A "Law"” is something that is always true. The question asking whether or not The Law of Charts works implies that The Law of Charts is some kind of system or method, and you want to know if it "works."

The Law of Charts as applied to prices describes in graphic form the emotional action and reaction of human beings to the movement of prices. Therefore, it ALWAYS "works" because as long as people trade markets, you will see the same basic patterns over and over again.

The Law of Charts "works" with any chart graphic that describes an underlying movement that has a range of values.

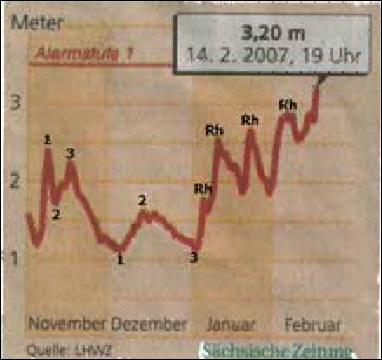

You can see the Law of Charts working on gas meter readings, water levels of a river or random coin flips, anything that has a range of values.

The chart below shows water level readings for the Elbe river in Germany.

In the case of gas meter readings, the impetus for what you see on the chart is consumption of natural gas, which will have a range of values because usage will vary seasonally. In the case of water levels in a river, the impetus will be the range of values that will vary due to water usage, and the amount of rainfall, snow-melt, or both.

In the case of coin flips the impetus is the pure statistical probability of a series of heads or tails.

Below is a chart of coin flips. In the case of price charts the impetus is human emotion as seen in the action and reaction of traders and investors to the movement of prices. If something is true, it is always true. The Law of Charts is always true—there is no way to get around it.

The purpose of studying The Law of Charts is to gain an understanding of how and why prices move to create 3 basic chart formations: The 1-2-3, the Ross Hook, or various types of consolidation. Whether or not you make money from this knowledge will be in direct accordance with how you implement that knowledge.

Electricity follows the laws of physics. But unless you implement the laws that govern electricity the best you can hope for is a shocking experience. With proper implementation you can turn a motor, generate heat, or create light.

The Traders Trick Entry (TTE) that we teach at Trading Educators is one way to implement the Law. There are probably dozens, maybe even hundreds of ways to implement The Law of Charts (TLOC). To learn more about the "Law," check out The Law of Charts In-Depth Webinar and during private tutoring we will reveal numerous ways to implement The Law of Charts.

—

Q: How much money do I need to trade full-size contracts in forex, futures, or anything else?

A: The amount of money you need is entirely determined by your broker. Follow this link for a broker referral.

—

Q: Ross Hook: How far can a RH be from point 2?

A: It’s kind of a judgment call, but you can read what Joe has done on page 300 of Trading the Ross Hook, where it states that the #3 point should be between 1/3rd and 2/3rds of a point 1 to 2 retracement. It is all going to depend on what works for you in the time frame and market you are trading.

—

Q: Trend Lines: Do you use 1-2-3 highs and lows; and Ross Hooks with trend lines to help buy or sell in better places?

A: The best thing we can recommend is to do what works for you. Joe Ross does not use trend lines nor does he use support resistance lines. He trades using a plain vanilla chart with no indicators or studies of any kind on the chart. That doesn’t mean that’s best for you. It’s best for Joe. You must do what works for you. He also does not use Fibonacci retracements and is aware of them, and uses them in an unconventional way. But, he doesn't trade based on them. The most important and only truth available for trading is the price bar directly in front of you. You can't trade the past and you don't know the future. Therefore, you must trade what you see.

—

Q: Support and Resistance: Do you use support and resistance to help you to buy or sell in better places?

A: Joe Ross does not use support and resistance. Nor does he use trend lines. He trades using a plain vanilla chart with no indicators or studies of any kind on the chart. That doesn’t mean that’s best for you. It’s best for Joe. You must do what works for you. Joe also doesn't use Fibonacci retracements and is aware of them, and uses them in an unconventional way. But he doesn't trade based on them.

—

Q: Fibonacci: Do you use Fibonacci ratios to get better entries for buying and selling?

A: Joe Ross does not use Fibonacci retracements, ratios, or confluence in his trading. He is aware of them, and uses them in an unconventional way. But he doesn't trade based on them. Nor do he use trend lines or support and resistance lines. He trades using a plain vanilla chart with no indicators or studies of any kind on the chart. That doesn’t mean that’s best for you. It’s best for Joe. You must do what works for you. Joe is aware of them, and uses them in an unconventional way. But he doesn't trade based on them. Fibonacci ratios, Gann ratios, the "Golden Ratio," and Elliott waves are all attempts to mathematically (scientifically?) trade markets that are both emotional and psychological. You cannot successfully or consistently apply mathematics to human emotional and psychological actions and reactions, which is why the field of psychology is a pseudo-science. The mathematical approach to markets is a vain attempt to put price action into a predictable box with known dimensions and parameters. However, markets do not behave in accordance with mathematics. Markets go wherever human emotion takes them.

—

Q: I’m concerned that my data supplier does not provide all the trades through their feed. I’ve heard that they are aggregating the trades and making an average of “X” number of trades. Can you explain?

A: There is one caveat with all data feeds. In order to make them appear faster, providers will typically aggregate trades. Joe Ross doesn't know of a single data provider that will, or even could show you every single trade, and even if they did, he seriously doubts that your computer would be able to receive every trade that was made. What you see on your screen is at best an approximation of the actual trading. Think about it for a moment. Let's put everything that is happening into slow motion so we can see what is really going on. As the prices come into your computer, they are cached for distribution. At some point your computer must distribute what it has saved in its cache. During a distribution phase, the computer is not receiving prices it is posting them to the screen. Although the entire process is taking place in fractions of a second, there is no way you could possibly receive all of the ticks. To add insult to injury, your computer is probably also doing other things. The operating system does things; if you have any kind of spam filter, firewall, antivirus, or program running in the background your computer is monitoring those other things as well. In the fractions of a second it takes your computer to pay attention to its other tasks, you are not receiving ticks sent out by the data vendor. Your computer is like a one arm wallpaper hanger. It can do only one thing at a time. Your concerns are without real foundation. Any data supplier has similar problems with their computer receiving prices from the exchange, and the exchange's computer has the same kind of problem distributing the data as your computer has receiving it.

—

Q: Which order type would be the best for let’s say Crude Oil or the EuroFX on a 5 or 3-minute chart?

A: There is no best order type for any market or time frame. The best order type depends on your strategy.

The type of order you use is one of the tactics you use to carry out your strategy.

- Do you absolutely want to be filled? If yes, use a market order.

- Do you absolutely want to be filled if prices reach a certain level or go through that level? If yes, use a stop market order.

- Do you want to be filled if prices reach a certain level, but not be filled at a price past that level? If yes, use a limit order.

- Do you want to be filled if prices reach a certain level, but are happy if prices are filled within a range you specify, but not be filled at a price past the specified range? If yes, you a stop limit order.

Keep in mind that limit orders and stop limit orders have no requirement to be filled. They can be passed right over and leave you behind with no fill.

—

Q: What does it mean when #2 point is very close to Ross Hook?

A: Most of the time it means you should expect sideway action to follow. Unless prices break through the Rh with force, you are probably going to see a consolidation area, with the #1 point of the 1-2-3 as the low of the area and the Rh as the high of the area.

However, the areas of so-called accumulation at the low and distribution at the high are not as long as in years past. This is due to people trading with indicators, which also causes markets to mostly swing instead of trend.

—

Q: Will your stuff work with tick charts?

A: Our "stuff" works with any kind of chart that depicts a range of values. Therefore, we have students who trade tick charts, range charts, volume charts, line charts, even point, and figure charts. One of the greatest traders we know uses our "stuff" to trade point and figure charts.

—

Q: I haven't been trading long and want to learn more about trading. Will I be able to understand your products?

A: If you are a beginner trader, the terminology may seem overwhelming at first, but as you start educating yourself, it will come easier. Click here to get a clearer path as to which market(s) and trading style that will best suit you. For intermediate and advanced traders, your biggest challenge will be retraining yourself from old habits. We are here to assist and help you learn the art of trading, email us with any questions, at any time.

—

Q: If I buy a product, will I need to continue to buy more products to learn to trade?

A: Learning to trade is a lifetime experience. Joe Ross has been in the markets for fifty years and says he is still learning. There are certain products you should want to buy to give you a proper foundation for building a trading career. How many you will need is something only you can know. It is highly doubtful that you will be able to read a single book and then become a successful trader. Trading is a serious business, one in which you cannot afford to make many mistakes. The more time and money you spend on building a firm foundation, the greater will be your chances for success.

With proper preparation, trading can make you wealthy. Without adequate preparation, it can make you poor. Whether you succeed at trading, depends in great part on how much you are willing invest in your education. If you’re not willing to invest in yourself, you are probably better off putting your money in a mutual fund and hoping for the best.

—

Wishing you all the best and happy trading!

From the Trading Educators Team