Trading Educators Blog

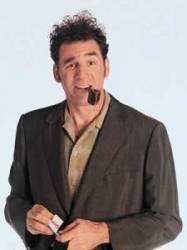

Kramer (from the Seinfeld show) on the Swiss Franc

“Hello, Kramer? You got a minute? Take a look at the Swiss Franc chart what do you think?”

“Well, I’ll tell you what I think! If the market is not going up, then it ought to be going down. But, if it’s not going down or up, it must be going sideways unless, of course, it’s making a correction. But, if it’s not making a correction, maybe this is a small congestion, unless, of course, it’s a Trading Range. On the other hand if it’s not a trading range, maybe it’s an Elliot wave. And if it’s an Elliot wave, it could be a breakout wave, or maybe it’s just an a-b-c correcting wave, in which case, it might result in a Fibonacci correction. However, if it’s not a Fibonacci correction, it could be it’s a retracement to a Gann line, unless it’s correcting to a speed line. Now, if it’s a speed line, then maybe, just maybe, it’s the bottom of what will be a channel, unless of course it’s not really a channel line but instead its a channel defined by a Bollinger Band; in which case I’m going long, unless, of course, I go short because of Andrew’s pitchfork.”

Is this how you reason when you trade? Shame on you!