Trading Educators Blog

The next big thing in equities trading is here!

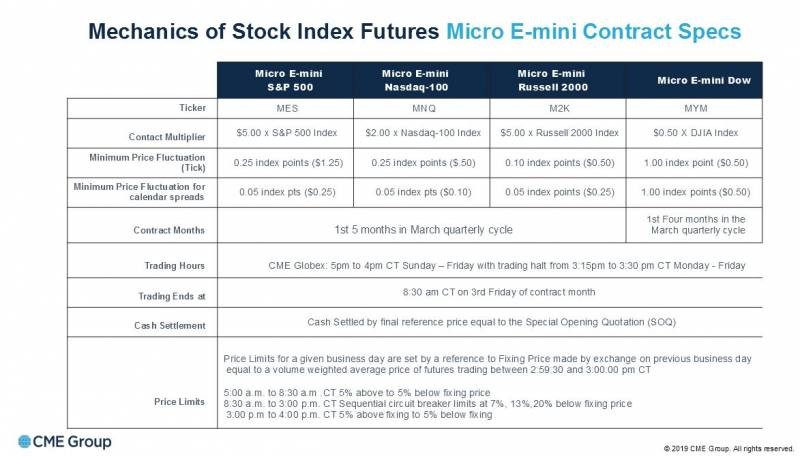

This is what the CME says about their new product the Micro E-mini futures for the 4 major US indexes. The S&P 500, the Dow, the Nasdaq and the Russell 2000.

https://www.cmegroup.com/cme-group-futures-exchange/micro-futures.html

From what I can tell, this new products are really great especially with all the high volatility we see right now in the US indexes.

While it was easy to trade in the indexes with a small account and little risk, it got almost impossible during the last few years. The average amount on a 15 minute bar in the Nasdaq is about $400 to $500 these days which makes it almost impossible to trade these markets with small accounts.

That's where I see a lot of potential with the Micros which are only 1/10 of the E-minis and a commission of about ½ of what we pay on the E-minis.

Finally you can open a futures account with only $2k and trade the indexes and you do not have to move into the stock market. No! You can trade real futures now with very little money.

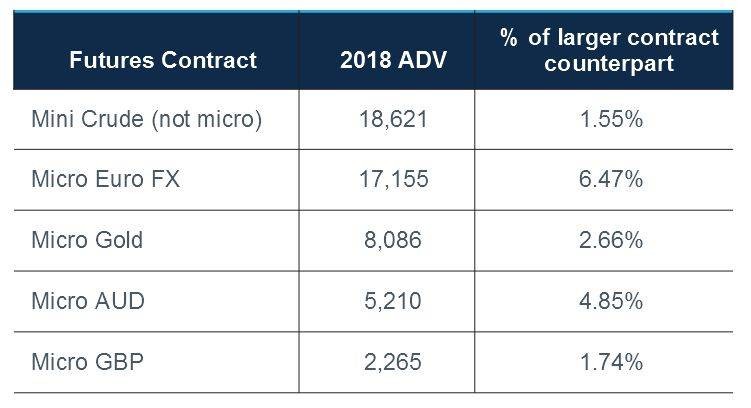

By the way, there are not only micros or minis in the indexes now, you can also find them in the Currencies or Gold or trade Mini-Sized products in Crude or even Wheat, Corn or Soybeans.

In my opinion all the Micros and Mini-Sized products in the futures market are a big step forward for the retail trader, especially at the beginning of his or her trading career.

Good trading,

Andy Jordan