Trading Educators Blog

Middling the Market

Do you ever wonder why there has to be a spread between what you can buy an option for and what you can sell it for? The simple answer is someone needs to make money and that someone is usually the market maker. Many option traders don't even think about the bid-ask spread. They don't even try "middling."

Middling the market means you try to get close to the middle of the bid price and ask price. This is done whether buying or selling. If buying, the order should be filled at the ask price, but option traders try to buy closer to the mid-price. For selling, the bid price should be filled, but option traders will move close to the mid-price to bring in a bigger premium.

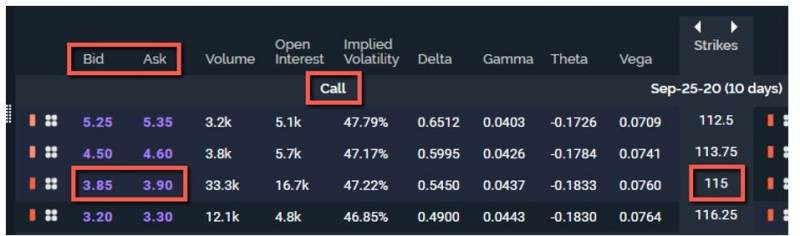

Take a look at the above example. The 115 calls have a bid of 3.85 and an ask of 3.90. The spread between the two is 0.05 (or $5 in real terms. The call can be bought for 3.90 ($390) or sold for 3.85 ($385). There is not much room to "middle," but the option trader is not losing much money ($5) whether the option was bought or sold.

When the spreads are bigger, yes, you can middle the market to some degree at times, but it is debatable whether you could do the same when exiting the position. Most likely it cannot be done, so an option trader needs to make up the difference just to have the position trade at breakeven.

In the example above, the bid is 4.20 and the ask is 5.00. If the option trader wanted to buy the 160 call, the ask is 5.00 but an option trader might try to "middle" the market and offer 4.60 (or the middle between the bid and ask). If that is not filled, he or she may work their way up closer to the ask until filled. The problem becomes that many times an option trader cannot do the same or near as much middling when trying to sell the option based on the bid.

The bottom line is to be careful of wide bid-ask spreads. What are wide bid-ask spreads? Consider the 10% rule. The spread between the bid and ask cannot be more than 10% of the bid. For example, if the bid is 2.50, the ask should not be more than 2.75 (10% of 2.50 is 0.25). Eventually you will know from experience what you are willing to accept and not accept as an option trader. One of our students asks 25% more than our recommended sell price when selling naked put options. He gets fewer fills, but he is happy taking in more premium. Like a lot of things when it comes to option trading, experience cannot be taught right away.

Sign up for our FREE weekly Chart Scan newsletter. Master Trader Joe Ross wants you to learn trading and has created several products to do just that, teach you how to trade. Take a few moments to check our website to see which ones best fit your trading style.