Trading Educators Blog

After writing about why good trading usually is quite boring last week, I’ll continue down that road today and write about another similar topic. And again it’s more of a rant that many of you maybe don’t want to read about. But I believe it really can be an eye-opener to those of you who’re really serious about trading and these are the traders that I care for the most. Actually I wish I ha...

When you start out trading, it’s pretty much all about the excitement. You watch every trade tick by tick, gazing at a chart ticking up and down together your P&L. You’re long. When it goes up, you feel excited because you’re making money, if it goes down you’re excited because you’re losing money. But boy you’re making sure you don’t miss any of this. You sit there and gaze at that chart as i...

I’m happy to tell you that AlgoStrats:FX is Live and Trading will start on Monday July 25th! To celebrate the Launch we’re starting with a Free Trial Week. Meaning you can follow AlgoStrats:FX completely free for a whole week. No strings attached, no credit card required - 100% free. Registration is already open, so go ahead and register your Free Account! I’ve also uploaded a new video ...

FYI: Get 20% off Ambush through July 13th. Simply enter the coupon code ambush20 when you check out. No doubt, the decision if or if not one should trade through the BREXIT-event and on which days was not an easy one for traders. But like most of the time, the answer at least in hindsight for Ambush traders was a clear "Yes". I personally didn't have any positions on going into the BREXIT...

If you don’t want to learn how to backtest automatically right now but still want to profit from backtesting, you got to do it manually. That’s how I started too many years ago. I still remember sitting there with printed charts and writing down trade results on a separate sheet of paper. Now there are some pitfalls you better know about when doing manual backtests and that’s what this weeks video...

I just posted another video on our YouTube channel about another very common trading mistake, and that's trading your P&L instead of the actual market. While there are many variations of this, I guess I covered some of the most common ones that I've done myself again and again when I started trading. Go check it out and let me know if you have any questions or comments!

Walk-forward testing is the first real step in testing any system on live data. A trader should be somewhat confident that the system or method can produce results in line with the hypothetical results received from back testing. At this stage of testing, it’s important to watch a trading system or method run over live data for a period of weeks or months until a large, statistically valid u...

I just wanted to let you know about a new video that I uploaded to YouTube about one of the most common trading mistakes out there: To Stop Trading/Following your method/system/yourself at the worst time possible. This is something I see over and over again especially among beginning traders. You won't believe how often I've trapped into this myself during my first years of trading! Happy Trading!...

One of the questions every trader has to think about at some point is, how much of my account should I risk per trade? A percentage? If so, what percentage? I’d love to have the right answer in my pocket for you, like "exactly 1.25% per trade/market and no more than 5% at the same time," but unfortunately, I don’t. Again I know you don’t want to waste too much time with this bo...

I just uploaded Episode 3 of my Questions & Answers Series to YouTube. It covers questions on the usefulness of demo-trading and on trading 123 formations. In the last part I talk about why I developed my own python-based backtesting platform which is probably only interesting for those of you who're hardcore into system-development. So if you're not, just stop there ;)

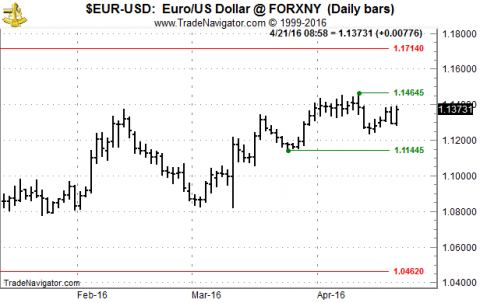

The last I did a post about what's going on in EUR/USD and that it's unlikely we'll see a significant move unless the pair breaks out of it's established range. Now that finally happened and the Euro is on a strong run for a few days now already. Now what to do? If you're already long, should you keep on holding the position? If you're not in the trade already, should you still buy at the market? ...

About a year ago I wrote an article about measuring performance where I explained the concept of measuring trading performance in Rs instead of $s. Everyone who trades for a while quickly realizes that $s don't really say too much about performance. You made $10? Maybe great. You made $50.000? Maybe not so good. The question always is in relation to what? What account size does the t...

There seems to be a massive obsession out there among traders about the EUR/USD, what's going on with it, where it's going and why. Whenever I go on twitter or Facebook or any of the financial news pages, I find at least a couple of posts on what's going on in that market, usually with some bogus comment on why. Classic one would be "EUR/USD moves higher after breaking through 1.1350" or "EUR/USD ...

The second Episode of my Q&A Series is uploaded to YouTube. I only managed to answer two questions this time, so I probably should be a bit briefer in the future... Topics are disciplined trading and the lifetime of trading methods, and how to decide when to stop trading them. Enjoy!

Hi Trader, now this has been a quite volatile week so far in many markets and I hope you've also been able to capture some nice profits out of these wild moves! Thanks to my trading being almost completely systematic right now I still had a few minutes to record a new video for YouTube and actually start of a new Series. In the first one I explain what a BID/ASK spread is for those of you who're c...

After my last two spot-on calls on the EUR/USD, here's the next one, plus a video on why you shouldn't pay any attention to it: My feeling is that since everyone expects the EUR/USD to correct right now, it won't but will instead move up for another day or two. Again I won't trade on this, actually I'll probably be short again tomorrow... And here's the video why you shouldn't care about any marke...

Today we had the long awaited ECB press conference and Draghi did his thing by surprising traders with their decisions. This is what happened so far (13:00 NY Time) and as you can see the volatility hasn't been that high for weeks with EUR/USD moving 400 pips intraday. So what to do on such a day where you can expect higher volatility than usual? Take trades or not? For me it's a no-...