Trading Educators Blog

The spread is defined as buying one futures contract, and selling a different, but related futures contract. Specifically, when trading the crush spread, you would buy soybeans and sell its respective products, the soybean meal and soybean oil. This is what is referred to as being crushed. If you buy the soybean meal or the soybean oil and sells soybeans, that is what is referred to as being rever...

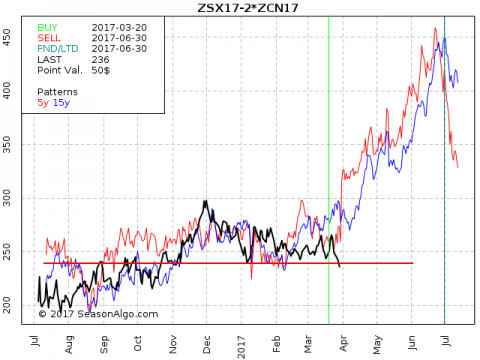

Today I am looking at a so called ratio spread: Long 1 November Soybean and short 2 July Corn. The spread looks interesting to me because it is trading at a level where it could turn around again and follow its seasonal pattern to the up-side. The current level (approx. 235) has provided support several times. The seasonal statistic looks promising as well, with 17 winning trades in a row. But thi...

Today I am looking at a very “strange” butterfly spread: Long 1 April Feeder Cattle and one May Corn and short 2 Live Cattle August. I have to admit that it is difficult to find an entry into this trade by looking for chart patterns but it is easy to see the possible support around the current level. OK, the spread moved a bit lower in July last year but this happened when there was not eno...

Optimized entry (green vertical line on the chart below) or exit (red vertical line on the chart below) is part of seasonal patterns. For example: the spread X–Y shows a strong seasonal up move in July with an optimized entry date on July 3 and an optimized exit date on July 28. This means “usually” the spread moves up between July 3 and July 28, but this is just based on statistical data of the p...

There are two important components of federal market activity which affect long- term economic activity and stock and commodity values; these are interest rates and money supply. A contracting money supply was one of the factors that caused the Great Depression of the 1930's. In the early 1980's most traders focused almost totally on the money supply figures, which would cause cash bonds and T-Bil...

Something you should be aware of if you're trading the TF: Starting today (December 5th) the E-Mini Russel 2000 (TF) has a tick value of USD 5.00 instead of USD 10.00 while the tick size stays the same. For more info see the ICE FAQ. Happy Trading! Marco

Question from a subscriber: "Once I’ve achieved success as a trader, then what? I’ve heard that after a while trading can become boring." I know you would all like to have that problem, but I can vouch for its being true. I always have to find new ways to trade or I do become bored. However, I have never run out of ways to trade that remain exciting, at least for a fairly long time. After the obje...

As a trader, it's essential that you set specific goals. Trading is chaotic enough without trying to achieve unstructured goals that are difficult to manage and reach. Making profitable investments requires you to prepare carefully. You have to develop hypotheses regarding current market conditions. You have to devise ways of identifying setups and determine how and when to enter and exit the trad...

I’m happy to tell you that today a new AlgoStrats service was launched: Ambush Signals for Futures. To find out more have a look at the following video presentation: Happy Trading! Marco

Just wanted to let you know that I uploaded a new video to YouTube a couple of days ago. This time it's about why Entry Signals are important and one way to test an Entry Signal isolated from Exit Signals. If you like the video or my videos in general, and would like to see more of these in the future - please go ahead and like it on YouTube, leave a comment, add it to your playlist and share it o...

Today I want to show you a trade we had the other day with our new service. As you can see below, we were looking for a few entries in several markets. We were filled in the long Soybean Meal trade at 301.5 with an initial stop at 299.0 (the risk was $250 per contract traded). During the overnight session the market moved a bit, but everything was very quiet. At the open of the day session the mar...

When I started out trading I had the illusion that being a successful trader meant to no longer have drawdowns or at least on very rare occasions. And I think most traders start out with that idea in their mind even though they don’t understand what it actually means. In Trading, you are in a Drawdown anytime you don’t make new equity highs on your account, or if you have multiple accounts across ...

Whenever the Federal Open Market Committee meets and releases its rate decision and its statement, it’s seen as one of the most important data releases in the markets in the currency markets. And it is, as sometimes there’s a real surprise that can have a huge impact on the markets. Because of that the whole FX world goes crazy days before it and waits for the statement in anticipation of big move...

As I’m about to go on vacation I thought it’s a good idea to write down my thoughts about trading on vacation. Is it a good idea to do so, or just crazy? I believe it depends. If you’re longer-term position trader and have a couple of positions open that are doing great and you don’t want to close them out now for example, I think there’s nothing wrong managing your position once a day while you’r...

After writing about why good trading usually is quite boring last week, I’ll continue down that road today and write about another similar topic. And again it’s more of a rant that many of you maybe don’t want to read about. But I believe it really can be an eye-opener to those of you who’re really serious about trading and these are the traders that I care for the most. Actually I wish I ha...

I think there is no “best way” to enter or exit spread trades, there is only “your way”. Let me explain: I personally prefer the open and the close to enter all my spreads. I don’t like to watch my spreads during the day and I focus only on the closing price.Most buying and selling is at the open and at the close, especially in thin markets. When you use a limit order...

When you start out trading, it’s pretty much all about the excitement. You watch every trade tick by tick, gazing at a chart ticking up and down together your P&L. You’re long. When it goes up, you feel excited because you’re making money, if it goes down you’re excited because you’re losing money. But boy you’re making sure you don’t miss any of this. You sit there and gaze at that chart as i...

I've received the following email from one of our Traders Notebook subscriber regarding the new Outright Futures trading ideas. I think it is VERY informative! Thank you Tom!!! "This new program sounds very interesting. Here are a few thoughts about trading with the mini/micro contracts. I would advise everyone to put up a chart of the full size contract side by side with one of the mi...

FYI: Get 20% off Ambush through July 13th. Simply enter the coupon code ambush20 when you check out. No doubt, the decision if or if not one should trade through the BREXIT-event and on which days was not an easy one for traders. But like most of the time, the answer at least in hindsight for Ambush traders was a clear "Yes". I personally didn't have any positions on going into the BREXIT...

And a few days after the surprise from UK (sorry to see you guys leave!) the markets seem to calm down a bit already which is nice. But I expect to see a few more crazy days and regarding the FX markets it’s all one big Risk ON/OFF scheme right now, driving up correlations between the pairs. Now I keep on getting emails asking when the Free Trial for AlgoStrats:FX will start but I won’t rush it as...