Trading Educators Blog

The spread is defined as buying one futures contract, and selling a different, but related futures contract. Specifically, when trading the crush spread, you would buy soybeans and sell its respective products, the soybean meal and soybean oil. This is what is referred to as being crushed. If you buy the soybean meal or the soybean oil and sells soybeans, that is what is referred to as being rever...

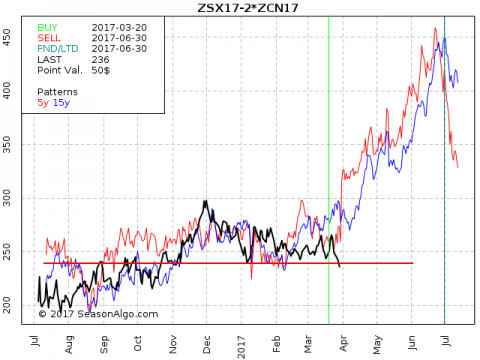

Today I am looking at a so called ratio spread: Long 1 November Soybean and short 2 July Corn. The spread looks interesting to me because it is trading at a level where it could turn around again and follow its seasonal pattern to the up-side. The current level (approx. 235) has provided support several times. The seasonal statistic looks promising as well, with 17 winning trades in a row. But thi...