Trading Educators Blog

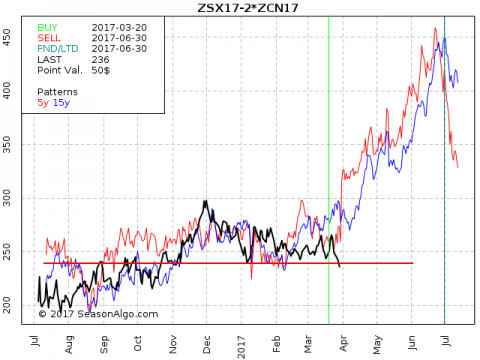

Spread Trading Idea 03/31: ZSX17 - 2*ZCN17

Today I am looking at a so called ratio spread: Long 1 November Soybean and short 2 July Corn. The spread looks interesting to me because it is trading at a level where it could turn around again and follow its seasonal pattern to the up-side. The current level (approx. 235) has provided support several times. The seasonal statistic looks promising as well, with 17 winning trades in a row. But this is a volatile spread and therefore the risk is high. I would recommend a risk of about $1,500 per spread contract or even a bit more. The seasonal time window goes from approx. 03/20 until 06/30.

Do you want to see how we manage this trade and do you want to get detailed trading instructions every day? Please visit our website for additional information: http://www.tradingeducators.com/tradersnotebook.html