Trading Educators Blog

The importance of how you learn the business of trading cannot be minimized because of the factors that determine your success or failure. Learning the business of trading is basically no different from learning any other business. Winning means learning major guidelines and concepts that you repeat so often in your own behavior that they become good habits. These good habits then become automatic...

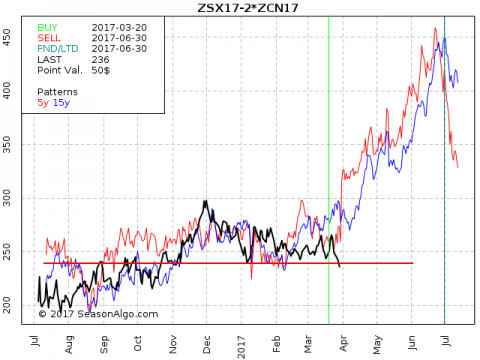

Today I am looking at a so called ratio spread: Long 1 November Soybean and short 2 July Corn. The spread looks interesting to me because it is trading at a level where it could turn around again and follow its seasonal pattern to the up-side. The current level (approx. 235) has provided support several times. The seasonal statistic looks promising as well, with 17 winning trades in a row. But thi...

Today I am looking at a very “strange” butterfly spread: Long 1 April Feeder Cattle and one May Corn and short 2 Live Cattle August. I have to admit that it is difficult to find an entry into this trade by looking for chart patterns but it is easy to see the possible support around the current level. OK, the spread moved a bit lower in July last year but this happened when there was not eno...

Optimized entry (green vertical line on the chart below) or exit (red vertical line on the chart below) is part of seasonal patterns. For example: the spread X–Y shows a strong seasonal up move in July with an optimized entry date on July 3 and an optimized exit date on July 28. This means “usually” the spread moves up between July 3 and July 28, but this is just based on statistical data of the p...

There are two important components of federal market activity which affect long- term economic activity and stock and commodity values; these are interest rates and money supply. A contracting money supply was one of the factors that caused the Great Depression of the 1930's. In the early 1980's most traders focused almost totally on the money supply figures, which would cause cash bonds and T-Bil...

Question from a subscriber: "Once I’ve achieved success as a trader, then what? I’ve heard that after a while trading can become boring." I know you would all like to have that problem, but I can vouch for its being true. I always have to find new ways to trade or I do become bored. However, I have never run out of ways to trade that remain exciting, at least for a fairly long time. After the obje...

As a trader, it's essential that you set specific goals. Trading is chaotic enough without trying to achieve unstructured goals that are difficult to manage and reach. Making profitable investments requires you to prepare carefully. You have to develop hypotheses regarding current market conditions. You have to devise ways of identifying setups and determine how and when to enter and exit the trad...

It’s been three months since AlgoStrats:FX launched so I guess it’s time for a more detailed update on what happened so far. Here’s the up-to-date equity curve of the live trading account: The summary is that we had a tough start and two months of slow, steady drawdown until things turned around nicely in October. Nothing unusual, no problem but hey…couldn’t the markets have given us a slightly ni...

As I’m about to go on vacation I thought it’s a good idea to write down my thoughts about trading on vacation. Is it a good idea to do so, or just crazy? I believe it depends. If you’re longer-term position trader and have a couple of positions open that are doing great and you don’t want to close them out now for example, I think there’s nothing wrong managing your position once a day while you’r...

An option buyer has the odds strongly stacked against him. What most option buyers don't realize is that in order for them to make money, they must be right in three areas: He has to be right about market direction He has to be right about the degree of market direction He has to know when the market move will move in a certain direction That is definitely worse than being a trader in the underlyi...

Not many traders are familiar with futures spread trading. Even fewer traders understand multi-leg spreads. However, trading these types of spreads is as easy as trading an outright futures contract. Below is a 3-leg butterfly spread in Lean Hogs that we recently closed out in Traders Notebook: short one contract in June and in August, 2016, and long 2 contracts in July, 2016. The blue line on the...

I've got asked a few times about the 3-leg or butterfly spreads we have been trading in Traders Notebook and therefore I want to show you one of our latest trades. What you can see on the seasonal chart below is a butterfly Lean Hogs spread, long 2 contracts in July and short 1 contract in June and 1 short in August. We've entered the spread on June 30 at 0.0 (red arrow), we covered some c...

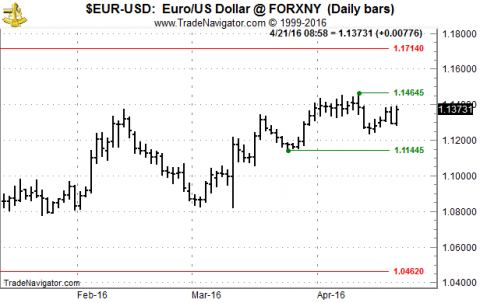

There seems to be a massive obsession out there among traders about the EUR/USD, what's going on with it, where it's going and why. Whenever I go on twitter or Facebook or any of the financial news pages, I find at least a couple of posts on what's going on in that market, usually with some bogus comment on why. Classic one would be "EUR/USD moves higher after breaking through 1.1350" or "EUR/USD ...

Of course, I have watched the ECB Press Conference today at 7:30 AM CT (Thursday 03/10) together with the markets. I did not intend to enter any trades before Draghi had his moment and I was surprised by the strong down move at 6:45 AM CT. In just a couple of minutes the Euro FX went down about $1,600. Stop running or was it because of the ECB announcement of lower interest rates (actually everyon...