Trading Educators Blog

Traders are willing to gamble a lot of money to avoid a potential loss, rather than immediately accepting a smaller but certain loss. Likewise, traders will hold on to a losing trade, and continue to watch it loses money, rather than face the loss. Why is it that we see money as being so important? The answer stems from our culture. What we esteem as good things are associated with money. Money i...

As a trader, it's very important that you keep accurate records of all factors that may impact the outcome of your trades so that you can learn from your losses, improve your performance, and do better next time. From a psychological viewpoint, by documenting actions, thoughts and emotions associated with both wins and losses, you will come to see what works and what doesn't. When it comes to loss...

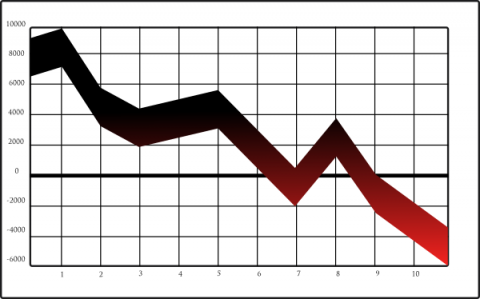

Keeping Losses Small I cannot say this enough times, so I'm saying it again, you must learn to keep your losses small. It is the single greatest concept that I can show you that will help you make profits in the market. This principle is of such magnitude that it dwarfs all other principles for trade, money, and risk management. Did you know that if you keep your losses small, you can flip a coin...

There are at least three things you can do to avoid mounting losses: 1. Write off a relatively small loss 2. Admit your mistakes 3. Don't let the desire to protect your reputation interfere making logical trading decisions. The three are common human shortcomings, and you need to be aware of them. None of us are immune and if you are not aware of these weaknesses you will not be able to keep them ...

How should you feel about losses? I once read somewhere that you are supposed to love losses. Does that make sense to you? It doesn't to me. The worst aspect of losing is that it tends to create pessimism. Traders should feel bad when they lose money only if they fought the market trend, or violated their own trading strategies. The best traders have a healthy "so what, big deal!" attitude that ma...

When you are in a slump and feeling frustrated and disappointed, you tend to think, "I'll never be profitable, and there is nothing I can do about it." The consequences of such reasoning are that you'll never feel like putting on a trade ever again. It is better to think, "Profitable trading is almost impossible, but I can learn how the markets work, develop the necessary skills, and eventually ac...

Trading is a business where you expect to see more losing trades than winners. Expecting to win is apt to produce more disappointment than joy. That doesn’t mean you won’t have a high percentage of winning trades, but it is safer to anticipate otherwise. To the beginning trader, especially, this fact of life can be stress producing and somewhat disappointing. How you cope with losses i...

When you put your money on the line, it's hard to avoid getting a little emotional. Beginning traders may be especially prone to experience a roller-coaster ride of emotions, feeling euphoric after a winning streak, yet disappointed after a string of losses. How well do you handle emotions? Winning traders control their emotions. They don't let their emotions control them. But emotions don't happe...

Question from a subscriber: "Once I’ve achieved success as a trader, then what? I’ve heard that after a while trading can become boring." I know you would all like to have that problem, but I can vouch for its being true. I always have to find new ways to trade or I do become bored. However, I have never run out of ways to trade that remain exciting, at least for a fairly long time. After the obje...

Winning traders cannot afford to be influenced by their emotions. The nature of trading demands an objective, logical approach. If you experience extreme excitement after a win and extreme disappointment after a loss, you will be living on an emotional roller coaster: up and down, up and down. Many beginning traders have head knowledge of what it means to control their emotions. They can imagine a...