Trading Educators Blog

In this instance, you spread by taking an opposite position in a related contract. You might spread corn against wheat. You might spread heating oil against unleaded gasoline. Quite often, operators who trade large size and are market makers hedge the S&P 500 by taking an opposite position in the Nasdaq or the Dow. Soybean traders often hedge by spreading off against the meal, the oil, or bot...

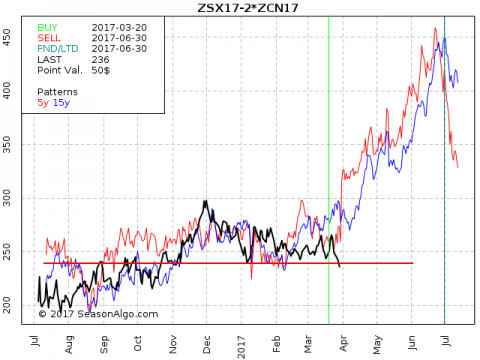

Today I am looking at a so called ratio spread: Long 1 November Soybean and short 2 July Corn. The spread looks interesting to me because it is trading at a level where it could turn around again and follow its seasonal pattern to the up-side. The current level (approx. 235) has provided support several times. The seasonal statistic looks promising as well, with 17 winning trades in a row. But thi...

I've got asked a few times about the 3-leg or butterfly spreads we have been trading in Traders Notebook and therefore I want to show you one of our latest trades. What you can see on the seasonal chart below is a butterfly Lean Hogs spread, long 2 contracts in July and short 1 contract in June and 1 short in August. We've entered the spread on June 30 at 0.0 (red arrow), we covered some c...