Trading Educators Blog

3-leg Butterfly Lean Hogs Spread

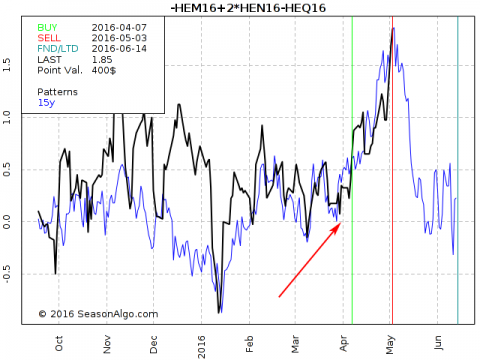

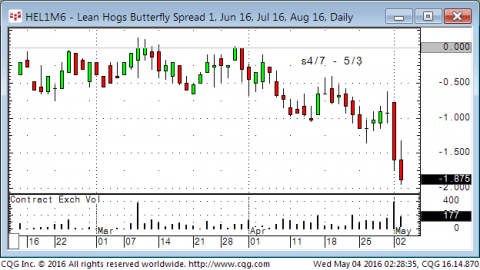

I've got asked a few times about the 3-leg or butterfly spreads we have been trading in Traders Notebook and therefore I want to show you one of our latest trades. What you can see on the seasonal chart below is a butterfly Lean Hogs spread, long 2 contracts in July and short 1 contract in June and 1 short in August. We've entered the spread on June 30 at 0.0 (red arrow), we covered some contracts at 1.000 and we are still holding the last lot using a trailing stop.

How can you trade these type of spreads? The butterfly spread is trading like a single contract at the exchange and you can trade it the same way as a calendar spread. As you can see on the chart below, the chart is up-side-down and we had to sell the exchange traded contract (the exchange traded butterfly is HEM6-2*HEN6+HEQ6).

We've been trading these kind of spreads for a few months now in Traders Notebook and we are very successful with it.

Please get in contact with me whenever you have any questions.