Trading Educators Blog

Optimized Entry or Exit

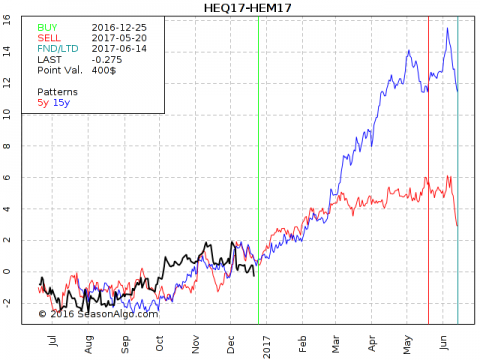

Optimized entry (green vertical line on the chart below) or exit (red vertical line on the chart below) is part of seasonal patterns. For example: the spread X–Y shows a strong seasonal up move in July with an optimized entry date on July 3 and an optimized exit date on July 28. This means “usually” the spread moves up between July 3 and July 28, but this is just based on statistical data of the past and does not give any guarantee about the future. A lot of statistical analysis is involved in seasonal trading. Think of a bell curve used in statistical analysis of distribution. The optimized date point lies at the top of such a curve, and is probably not the best in any one year, but best if used overall. Such a statistical sample usually uses 15 years to calculate seasonality, but, as you can imagine, the optimized entry or exit date cannot fit each single year. That’s why we cannot look only at seasonal patterns. We also have to look at the chart, or use any other tool to optimize our own entry. Seasonality gives you an edge, especially in spread trading. Combined with good money management, you should come out a winner.