Trading Educators Blog

Trading Idea: GFJ17+ZCK17-2xLEQ17

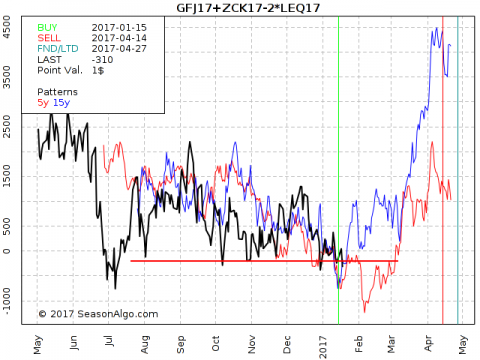

Today I am looking at a very “strange” butterfly spread: Long 1 April Feeder Cattle and one May Corn and short 2 Live Cattle August. I have to admit that it is difficult to find an entry into this trade by looking for chart patterns but it is easy to see the possible support around the current level. OK, the spread moved a bit lower in July last year but this happened when there was not enough volume in all 3 legs of the spread. Since then the spread stayed above -$500 on a close basis. Unfortunately, there is no way to trade this spread as a single contract and we need to “leg in” into each leg separately. I would also give this spread enough room to develop and therefore a risk of about $1,000 - $1,500 per butterfly seems to be necessary.