Trading Educators Blog

Actually I didn't want to jump on the BREXIT bandwagon but since a few of you asked me if I trade the Brexit and if so how, I'll let you know and give you a bit of a warning along the way. There's tons of traders out there on social media, blogs, trading sites and forum talking about how they'll trade the Brexit event, stay up over night and so on. Now I'm not one of them. Actually the Brexit is o...

What’s better to trade the currency markets? Trading Futures or Forex? This is the question I try to answer in my new video, where I briefly discuss the major differences between trading Futures and Forex from my perspective. At the end though there’s no “right” answer to that question, as it really depends on your needs.

I just posted another video on our YouTube channel about another very common trading mistake, and that's trading your P&L instead of the actual market. While there are many variations of this, I guess I covered some of the most common ones that I've done myself again and again when I started trading. Go check it out and let me know if you have any questions or comments!

An option buyer has the odds strongly stacked against him. What most option buyers don't realize is that in order for them to make money, they must be right in three areas: He has to be right about market direction He has to be right about the degree of market direction He has to know when the market move will move in a certain direction That is definitely worse than being a trader in the underlyi...

Not many traders are familiar with futures spread trading. Even fewer traders understand multi-leg spreads. However, trading these types of spreads is as easy as trading an outright futures contract. Below is a 3-leg butterfly spread in Lean Hogs that we recently closed out in Traders Notebook: short one contract in June and in August, 2016, and long 2 contracts in July, 2016. The blue line on the...

I just uploaded Episode 3 of my Questions & Answers Series to YouTube. It covers questions on the usefulness of demo-trading and on trading 123 formations. In the last part I talk about why I developed my own python-based backtesting platform which is probably only interesting for those of you who're hardcore into system-development. So if you're not, just stop there ;)

I've got asked a few times about the 3-leg or butterfly spreads we have been trading in Traders Notebook and therefore I want to show you one of our latest trades. What you can see on the seasonal chart below is a butterfly Lean Hogs spread, long 2 contracts in July and short 1 contract in June and 1 short in August. We've entered the spread on June 30 at 0.0 (red arrow), we covered some c...

About a year ago I wrote an article about measuring performance where I explained the concept of measuring trading performance in Rs instead of $s. Everyone who trades for a while quickly realizes that $s don't really say too much about performance. You made $10? Maybe great. You made $50.000? Maybe not so good. The question always is in relation to what? What account size does the t...

As you can see on the chart below, the 90000 level is an important one. It was a clear resistance level in February and March of this year and could now work as support. I'd try to buy the June Japanese Yen one tick above today's high using the TTE with a first target at around 90470 with the idea of a possible 1-2-3 low. I would risk about $300/contract on the trade. Update 04/28, 6 AM CT: The Ja...

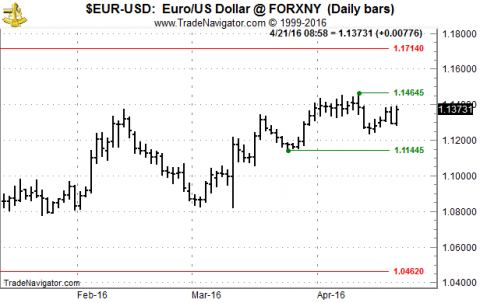

There seems to be a massive obsession out there among traders about the EUR/USD, what's going on with it, where it's going and why. Whenever I go on twitter or Facebook or any of the financial news pages, I find at least a couple of posts on what's going on in that market, usually with some bogus comment on why. Classic one would be "EUR/USD moves higher after breaking through 1.1350" or "EUR/USD ...

Hi Trader, now this has been a quite volatile week so far in many markets and I hope you've also been able to capture some nice profits out of these wild moves! Thanks to my trading being almost completely systematic right now I still had a few minutes to record a new video for YouTube and actually start of a new Series. In the first one I explain what a BID/ASK spread is for those of you who're c...

Hi Traders, after a much needed vacation I'm back from the hills where I could hike long enough to get all relaxed and clear headed again! Now back to the markets, when it comes to currencies, everyone is talking about the Yen these days, especially against the USD (USD/JPY). And yes the USD/JPY dropped quite significantly during the last two weeks, but for the Yen this isn't that unusual. Still i...

I wrote an article with the headline "Sometimes others get to play and you don't" some time ago and today (Friday 04/01) was such a day. And I tell you, it is difficult to watch markets are going my way knowing I could have made my shares for April but I missed the trade. Well, I haven't missed the trade actually because it wasn't my train. Here comes what happened. At 7:30 AM CT this morning we h...

I hope so since thanks to Ambush we're short the USD across the board today. Entry in the Euro FX Future for example was at 1.11825 around the low of the day.

With the ICE rising their market data fees to $117 per month, many traders are thinking about alternatives to trading the Russell 2000 (TF) for example. Sure, it's just 12 ticks in the TF you might say, but that doesn't make it better...any additional trading costs you can save, you want to save! Regarding the Russell 2000 (TF) you might want to have a look at the EMD traded at Globex. Yes it has ...

After my last two spot-on calls on the EUR/USD, here's the next one, plus a video on why you shouldn't pay any attention to it: My feeling is that since everyone expects the EUR/USD to correct right now, it won't but will instead move up for another day or two. Again I won't trade on this, actually I'll probably be short again tomorrow... And here's the video why you shouldn't care about any marke...

Of course, I have watched the ECB Press Conference today at 7:30 AM CT (Thursday 03/10) together with the markets. I did not intend to enter any trades before Draghi had his moment and I was surprised by the strong down move at 6:45 AM CT. In just a couple of minutes the Euro FX went down about $1,600. Stop running or was it because of the ECB announcement of lower interest rates (actually everyon...