Edition 604 - January 8, 2016

Carrying out your New Year's trading resolutions can be exciting and fulfilling. Trading Educators is here to assist you by offering resources which can help you to become a winning trader in all markets.

Instant Income Program (IIP) Summary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

2015 was a year in which the Instant Income Program (IIP) really showed its worth. IIP formally began in May of 2014, and has incurred no losses whatsoever. Below is the IIP track record.

IIP began in 2008 as we started developing this product from my own trading. I tested it for six years during which time I modified it, refined it, and tested it with my own money. It was so good that I hesitated to bring it public. I was correct in thinking that no one would believe its success, but that some traders would be curious enough to give it a try. It is only by experiencing IIP that true belief is able to take place. We now have had dozens of traders prove to themselves that it is possible to trade in this way without losing money. There is the slimmest of chances that, when traded correctly, a trader will ever experience a loss.

Early in 2015, I turned all of the preparation and trading of IIP over to Philippe Gautier, a long-time student and excellent trader. Philippe has added his own style and acumen to trading the IIP, and it has been thrilling for me to watch him in his mastery of the program.

I look forward to 2016, and the success we expect to continue throughout the year. In all, IIP has proven itself for seven years. I fully expect it to give our students another outstanding year without losses.

To all of our students, I wish 2016 to be the best trading year you have ever had, and that life itself brings you joy, prosperity, and good health.

JR

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

50% OFF RECORDED WEBINAR

"TRADING ALL MARKETS"

COUPON CODE: goal2016

Offer good thru January 13, 2016

Spread Scan with Commentary

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

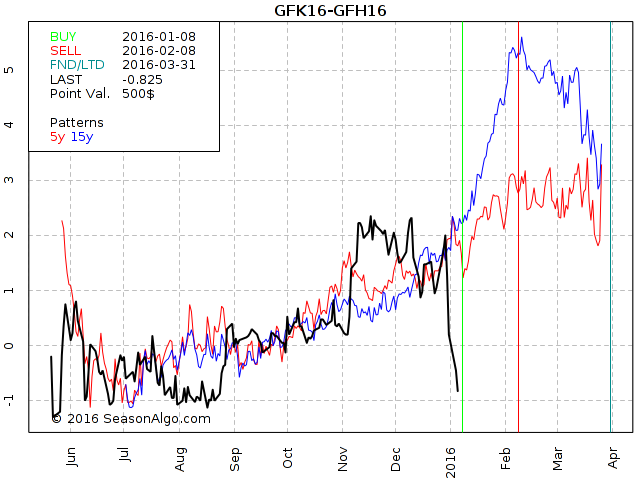

This week we're looking at GFK16 – GFH16: long May 2016 and short March 2016 Feeder Cattle (CME on Globex).

Today we consider a Feeder Cattle calendar spread: long May 2016 and short March 2016 Feeder Cattle (elec. symbols: GFK16 – GFH16). This spread is not yet ready for an entry because it is currently in free-fall, and it might fall much lower (levels of -4 were reached in the past). But the level around -1 is an interesting level, because the spread has found support several times last year between June and August. That is why I would keep this spread on my watch-list, ready to enter as soon as I get a reversal signal.

Profitable trades are attainable! To find out how to manage this and other trades, and also to receive our daily detailed trading newsletter, subscribe to Traders Notebook.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Stealth Trader with Commentary

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

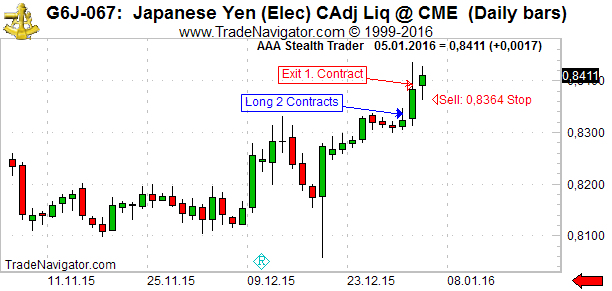

On December 30th, our "Stealth Trader" method generated an entry signal for the next trading day. We got long with 2 contracts the March Japanese Yen (first blue arrow), and we reached our first target on the next day (first red arrow). We are still tailing the stop for the second lot at the low of each daily bar.

With an initial risk of approximately $680 per contract, the method generated a profit of $680 with the first contract. We are still long with one contract with a stop at 0.8364 (for 01/05).

Find out more about Stealth Trader!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Welcome to 2016 - time to set some trading goals!

by Master Trader Marco Mayer

Educator for Forex and Futures, System Trader, and Creator of Ambush Trading Method

A new year has now started, and as I do every year, I’ve set myself some trading goals for the year. While I won’t share my specific goals with you, I’d like to give you some ideas of what you as a trader could write down for yourself, and why this is important.

Of course, you could do this anytime, but a new year is psychologically a good time to do so. You can write off the old one to start all fresh!

I personally like to set goals for myself regarding profits that I want to earn for the year, plus a drawdown I don’t want to exceed. One example might be to plan to make 30% profits this year, with no more than 20% drawdown.

Let’s be realistic here. Set yourself goals that are achievable, and make them specific so that you can measure your success. In other words, deciding that you want to make a ton of money trading this year with very small drawdowns isn’t specific enough because you can’t measure it. Also deciding to make 1000% this year with a maximum of 10% drawdown sounds great, but probably isn’t very likely to happen.

There’s a lot more you can do of course. One idea is to simply think about what you did wrong last year, and set your trading goal to stop doing it. Here's an example: "I will not get into any trades without knowing exactly when to get out of the trade before placing the entry order," or "I will not move my stop-loss to give a trade more room."

And of course, set goals where you want to improve. For example, I will let my winning trades run instead of moving the stop-loss to breakeven.

Or you may want to change your trading-style by decreasing your daily trading hours down to two hours a day by trading only during the most active time of the day.

You can also set goals for learning about trading strategies you want to develop. Here’s a few examples:

- Learning about a backtesting platform and how to use it.

- Developing a new strategy to day-trade stocks.

- If you’re new to trading, learning about trading futures and finding a good mentor to speed up the process.

As you can see, the possibilities are almost infinite. It’s essential to think about what’s important for you, and define these goals in detail. I think it’s better to have only a couple of things on your list that are really important for you, and then really focus on those during the year.

We invite you to join us, please visit our "members only" area for a newly opened thread in our Trading Forum. Share your ideas for goals, and ask any questions you might have on these topics!

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

50% OFF RECORDED WEBINAR

"TRADING ALL MARKETS"

COUPON CODE: goal2016

Offer good thru January 13, 2016

To view previous published Chart Scan newsletters, please log in or click on "Join Us," shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.