Edition 609 - February 12, 2016

A famous quote by Winston Churchill should resonate with all of you during these volatile trading times: "To improve is to change; to be perfect is to change often." Trading Educators encourages you to improve in this way. Seek out those professionals who will guide you in the right direction. "False hope" products are all over the place, so beware, traders! We are here to answer your questions and to assist you in changing to following the right paths.

A special "Thank You" goes out to all of those who completed our survey. This information will be used to better serve our customers. Congratulations to Rik D., USA, who won a FREE one-hour mentoring session!

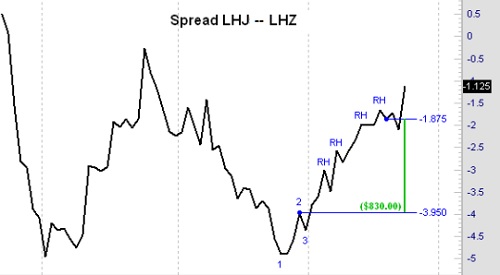

Hog Spread

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Spread trading can be fascinating. If you would have entered this spread at the breakout of the #2 of the 1-2-3 low, and exited the spread at -1.875, you could have made $830 per contract. The margin requirement of the spread at the time I did it was only $810, so it was possible to have made more than 100% on margin in less than three weeks.

Spread trading is one of the most profitable, yet safest ways, to trade stocks, ETFs, or futures. It offers many advantages, which makes it the perfect trading instrument for beginners and traders with small accounts (less than $10,000), and for professional traders who use spreads to optimize their trading profits.

While spreading is commonly done by the market "insiders," much effort is made to conceal this technique and all of its benefits from "outsiders," you and me. After all, why would the insiders want to give away their edge? By keeping us from knowing about spreading, they retain a distinct advantage.

We created a website with lots of free information about spread trading, follow this link: Spread-Trading.com. Andy Jordan, our expert spread trader, or myself, would be happy to give you training in spread trading.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

In a Trading State of Mind

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

When navigating through the minefields of the trading day, it's crucial to stay calm and optimistic. There can be days when you have to overcome setback after setback, and unless you're mentally resilient, you can get beaten down to the point where you don't feel like getting back up. It's necessary to trade with the proper mindset. You must be ready to act effortlessly and skillfully. You must be in the right state of mind.

We can involuntarily and unexpectedly move back and forth between different states of mind.

Have you ever gotten into an emotional fight with a family member or friend? You may not know what came over you, but you may suddenly conjure up old memories. You may feel wronged, manipulated, or disrespected. The next thing you know, you're yelling at the top of your voice. In this angry and frustrated state of mind, you're likely to strike out in self-defense.

There are also positive states of mind. For example, you may fall in love with someone you just met, and believe that you've found the love of your life, a person who makes you feel safe and secure, and can do no wrong. At that point, you are consumed with thoughts and feelings that take over.

States of mind consist of thoughts, emotions, and expectations. They are powerful. When we are in a particular state of mind, we can lose control and act on impulse.

It's essential that you trade in the right state of mind. The proper state of mind for trading is that of a logical, calm, and objective thinker. But many times, we enter states of mind that aren't conducive to trading.

For example, it's easy to get yourself worked up by thoughts and images that create a sense of panic: "I'm losing too much money. If I keep making losing trade after losing trade, I'll wipe out my account. And worse yet, I won't be able to meet my future financial responsibilities. What will I do?"

When you start thinking negatively, you'll be consumed with self-doubt, and even a minor setback can cause extreme feelings of frustration and panic. If you let this negative state of mind take over, however, you'll start making trading errors. You'll stagnate, and become blind to new market opportunities.

You can also fall prey to positive states of mind. For example, when you let your fantasies of fame and glory take over, you may start to believe that you've found the perfect trade that will make all your dreams come true. Or you may think you are on an invincible winning streak. In this overconfident state of mind, you may take unnecessary risks and fail to look at the markets objectively.

Don't let overly positive or negative states of mind bias your ability to read the markets accurately. Be aware that your states of mind can change rapidly while under stress and uncertainty. And when you are in the grip of these thoughts and feelings, you can lose some of the psychological control you need to trade the markets objectively.

If you find yourself in a state of mind that interferes with your ability to stay objective, you might want to stand aside until it passes. In addition, it's also useful to identify which states of mind are likely to creep up while you trade, and script an "internal dialog" to counter it.

When you're overconfident, for example, you might think, "Don't get too excited. Stay objective and rational. Don't blow things out of proportion."

While frustrated with minor setbacks, you might think, "Look at the big picture. As long as I manage risk, I can get through this. I just need to keep my cool, and concentrate."

States of mind will overpower you only if you let them. If you can identify them quickly and counter them, you can cultivate the peak performance mindset you need to trade profitably.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea with Commentary

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Click on the video below to learn about the Brent Crude traded on the CME Globex.

Profitable trades are attainable! To find out how to manage this and other trades, and also to receive our daily detailed trading newsletter, subscribe to Traders Notebook.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Five Steps to the Next Level

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Here are my five steps towards moving your trading up to the next level:

1. Focus on markets, trading vehicles (i.e. equities, futures, options, spreads), strategies, and time frames that are comfortable for you, and that suit your personality. The trades you make have to be "yours," not mine or those of anyone else.

2. Identify non-random price behavior, while recognizing that markets are random most of the time. Look for repetitive price patterns, but realize that once you begin trading them they may become short-lived.

3. Absolutely convince yourself that what you have found is statistically valid and tradable in the way you like to trade. Not all statistically valid situations will be comfortable for you, nor will they all fit your management style.

4. Set up trading rules, but remember that rules may have to change.

5. Follow the rules, but never to the point of destruction. You created the rule. If it stops working, change the rule, or throw it out entirely!

The bottom line: Personalize your trading (independence); and consistently do the right thing (discipline).

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Q&A: Best time of day to day trade EUR/USD

by Master Trader Marco Mayer

Educator for Forex and Futures, System Trader, and Creator of Ambush Trading Method

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

To view previous published Chart Scan newsletters, please log in or click on "Join Us," shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.