Edition 612 - March 4, 2016

We hope your January through February proves to be profitable. After one more month, March, you can evaluate your quarterly trades to make adjustments. If adjustments are necessary, make sure that they align with your trading plans.

Stop-Running

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Recently I showed a student how stop-running takes place in forex trading. Most forex traders are falling for the lie that, because liquidity is so great in forex, there is very little, if any, stop-running taking place. The truth is that that there is more stop-running taking place in forex than in futures.

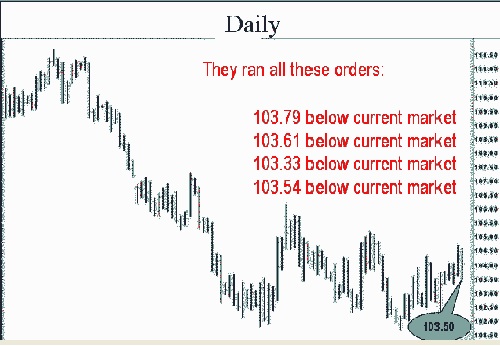

The chart below shows an example of stop-running in forex. Stops were located at the following levels the day before the last day you see on the chart. Our “Trading All Markets”, and “The Law of Charts In-Depth” recorded webinars will further explain this by teaching you how and where to place stops.

104.72 above current market

103.79 below current market

103.61 below current market

103.33 below current market

103.54 below current market

102.97 below current market

102.33 below current market

The last bar on the chart below shows The Law of Charts in action. One aspect of The Law of Charts is based on the fact that if there are stops in the market, the market movers will move prices to get as many of the stops as they possibly can.

In the case below, they were able to follow the line of least resistance, and took out the stops at the following levels:

103.79 below current market

103.61 below current market

103.33 below current market

103.54 below current market

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Waiting Patiently

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

If you are like most people, you want to make a fortune, and you want to make it now. It is a reasonable wish. Who wouldn't want to make enough money to make all their dreams come true? But such a future-oriented focus is often the undoing of many traders. Making money in the markets takes time. You have to wait for ideal market conditions, and you have to build up the requisite trading skills to take home huge profits. And if you are like many traders, it will also take time to save up enough capital to trade on a scale that can make you wealthy. If you are serious about making it in the trading business, you will have to learn to be patient.

Many people can't wait to be rewarded. Depending on your style of trading, being unable to wait patiently can be a problem. For a long-term investor, for example, it is necessary to buy-and-hold long enough for a long-term strategy to play out. There may be minor fluctuations during the waiting period, but seasoned investors have learned to wait it out. Most novice investors, in contrast, impulsively sell as the masses panic, and buy the stock back at a top, which usually results in a losing trade. If you are a long-term investor, it is necessary to be able to control your impulse to take a profit and allow the price to rise over time. Even shorter-term traders, such as swing traders, must fight the urge to sell early. Although trades are held for much shorter windows, a swing trader must know how to wait patiently for the optimal time to sell.

Impatient traders tend to show a future-oriented focus. They dream of the profits they will make in the future, but at the same time, they desperately need them right now. Getting rid of impatience requires the trader to curb this future-oriented perspective, and focus on the near future. Traders can become more patient by following a set of specific steps.

First, it's necessary to admit that you are impatient. This can be difficult to do. It's hard to admit our limitations. One of the best ways is to make it impersonal. Pretend you are watching a television show about yourself. Pretend the character on television isn't you. Watch how impatient you are. See yourself as an objective observer would see you, and then think about how you might change. Second, imagine you have two "tuning" knobs in front of you. Pretend that one of the knobs controls your focus on the future. If you turn the knob to the right, you will focus years into the future.

Don't let impatience thwart your long-term economic plans. Impatience can dash traders' hopes for economic success. Without the proper discipline, you will make losing trades that will eat away at your account balance. By trading with patience, you can build up your account balance slowly and surely, and eventually reach your economic goals.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

SPECIAL PROMOTION!

20% off "Trading Is a Business"

20% off "Life Index and Equity Evaluator"

March 4-9, 2016 only!

Enter Coupon Code Upon Checkout: tiblife20 (all lower case)

Trading Idea with Commentary

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Click on the video below to learn about a seasonal spread with a very good historical P&L statistic. Long October Sugar and short July Sugar is showing a nice seasonal up-move during the next few weeks.

Profitable trades are attainable! To find out how to manage this and other trades, and also to receive our daily detailed trading newsletter, subscribe to Traders Notebook.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading System

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

In order to succeed in trading, you will need a system or a plan. The usual way of attaining such a system is through many days of trading, hard-earned personal experience, not repeating mistakes you’ve made while analysing trades, knowledge of probability, observing other traders, trade simulation, book learning, seminars and mentoring, or any number of similar factors. Such a system will give you a correct mathematical and intuitive grasp, and once this hard-won system is in place, you should deviate from it only on rare occasions and for good reasons. Once you attain this system, it can operate almost by itself – you just do it, quite simply – almost naturally – without thought of opponents or outcome. If you don’t have a system yet, or feel unsure about the one you have, my mentoring program can help you to find the right system so that you can trade without hesitation or fear.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Where and How (Not) to Place a Stop-Loss

by Master Trader Marco Mayer

Educator for Forex and Futures, System Trader, and Creator of Ambush Trading Method

Marco talks about stop-losses in general, ways to decide on your stops that don't make much sense, and other pitfalls like using breakeven stops. Finally, he gives you some insights on his own systematic approach regarding exits, and how he likes to decide where to put a stop-loss.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

SPECIAL PROMOTION!

20% off "Trading Is a Business"

20% off "Life Index and Equity Evaluator"

March 4-9, 2016 only!

Enter Coupon Code Upon Checkout: tiblife20 (all lower case)

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.