Edition 613 - March 11, 2016

We have added a new feature to our site. Please take a few minutes to check out our blog. The "blog button" is located on the top right hand corner of this page.

Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Exchange Volatility Stop

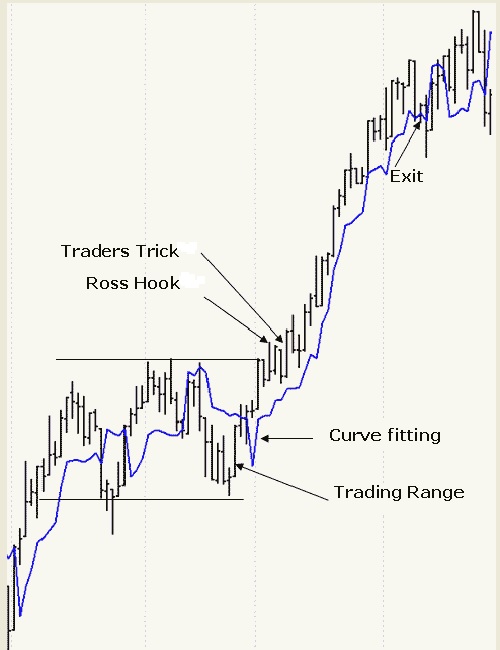

This week we are studying a 1-2-3 formation in combination with a Volatility Stop (VS). Volatility Stop can be used to track or contain a trend or a swing better than can a moving average. Since Genesis Trade Navigator has this study already programmed into it, I will use it to demonstrate how to go about setting it up.

When you see a trading range formation followed by a breakout from the consolidation area, and then a Ross Hook, you should immediately think "defined trend," and begin to also think "Volatility Stop."

What you want to do is to attempt to curve fit the Volatility Stop line around the formation including the breakout bar, so that you see containment of the formation. Then stay with the trade until prices move below the VS, or Stop Close Only below the VS, it’s your choice.

The VS has 3 parameters: a moving average, a multiplier, and an offset value. You can manipulate these three until you get containment.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Start Out Strong

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Trading is a challenging business. Not only is it tough to repeatedly pick one winning trade after another, it is also hard to control our emotions. Our emotions often get the better of us. Our expectations tend to influence how we feel as we trade, and when we doubt our abilities, we may have difficulty maintaining a winning attitude. One good approach to staying optimistic as we battle with the markets is to build up psychological momentum: start off ahead of the game, and build on that success. However, many traders set themselves up for failure. They start off making trading errors, and then dig themselves into an emotional hole from which they have trouble climbing out.

The expectations you have regarding a trade can dictate how you approach it. If you feel you are about to make a mistake, then you probably will make a trading error. As an example, you might have a perfectly good idea for a trade, but you may feel so on edge that you have trouble taking advantage of it. It often starts out innocently enough. You have a good trading plan, but you make a few little errors. Perhaps you trade under less than ideal market conditions, or you set your stop too close to your exit point and get stopped out. Maybe you don't put up enough capital to make your trading plan work.

Whatever it is, you may make a few poor decisions, end up with a losing trade, and feel disappointed. Making one bad trade isn't a big deal, but what happens when you make another losing trade, and then another losing trade, and so on? At that point, you may feel that it is hard to get out of the minor slump you are in.

How can you set yourself up to win? First, realize that trading can be much like a self-fulfilling prophecy: you secretly believe that your trading plan won't produce a profit, and then you subtly self-sabotage your plan by feeling uptight, overly exacting, and constrained. It is vital to feel relaxed and carefree when you start out the trading day. Think optimistically. Second, why not cheat a little? When you start the trading day, wait for an ideal trade, a trade you can afford to make, and which has a high probability of winning. If the first thing you do is to make a profitable trade, even a small one, you'll feel good on your first trade, and then you can start building on your solid start.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea with Commentary

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Click on the video below for Andy's detailed explanation of how he would handle this multi-leg Soybean spread.

Profitable trades are attainable! To find out how to manage this and other trades, and also to receive our daily detailed trading newsletter, subscribe to Traders Notebook.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Stop-Running or What?

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Read more on Andy's blog.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Smaller Stop = Less Risk = Better Risk: Reward?

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

Marco provides a follow-up video about stops in which he presents the concept of using smaller stops to risk less, and to achieve a better risk-reward ratio. While this is a popular concept, it unfortunately has its flaws if used in the wrong way. See for yourselves!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Draghi Day - EUR/USD: To Trade or Not to Trade?

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

Read more on Marco's Blog.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.