Edition 614 - March 18, 2016

Here's some trading humor: A few days ago I booked a lot of money on a trade with a water development company. Today a man knocked on my door and asked for a small donation towards the local swimming pool. I gave him a glass of water. Now, I’m wondering if I did the right thing.

Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Trade What You See

Trading Educators teaches traders to trade what they see, not what they think. But as a trader, you will never see anything if you fail to first look!

Fairly often a trade comes along that is extremely obvious. I'm wondering right now how many traders missed the absolutely easy-money Intermarket spread. The spread calls for going long the E-mini Nasdaq 100 and short the Mini Dow.

Simple observation was all that was needed to make the trading decision. The CBOT gives a 90% margin credit if you will trade the spread as a ratio spread. To obtain the credit, the CBOT called for entering 3 Mini Dow contracts vs 5 E-mini Nasdaq contracts (Note: The ratio can change).

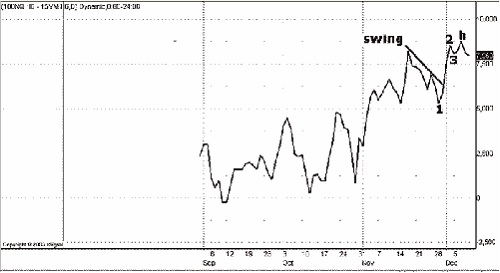

As you can see below, The Law of Charts is at work in spreads as well as in outright futures or stocks. In fact, The Law of Charts works with any kind of chart you want to use. It works with bar charts, line charts, point and figure charts, and candlestick charts. As long as a chart has a horizontal axis and a variable vertical axis, you can see The Law of Charts in action. The Law of Charts™ states that a 1-2-3 low occurs only at the end of a trend or swing. Since the low of the swing on the chart moved lower than the low of the previous retracement, the line I have drawn indicates a downswing. If you will take a look at your own charting software, you will see that the Nasdaq futures are moving sideways, while at the same time the Dow futures are moving down. This gives the reason for the spread to work.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Realistic Optimism

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Jack and John have just started a small trading business. Jack says, "I can feel it. We're going to make a fortune. By this time next year, we'll be rolling in money."

John counters, "I doubt it. That would take a miracle."

Jack says, "You're such a pessimist. Why are you so bleak?"

John argues, "I think we'll be successful. But I don't think it's going to happen overnight. It's going to take some time, and a lot of hard work!"

John is a realist. He knows they will make huge profits eventually, but he does not falsely believe that a miracle will happen. Becoming a winning trader will require that you overcome endless setbacks. It's important to be optimistic, but it is more important to be realistic. If you are overly optimistic, like Jack, you are setting yourself up for failure. You may take unnecessary risks, or be especially disappointed when you encounter the endless setbacks that are commonplace in trading.

If you want to beat the odds and become a winning trader, then you must doggedly make trade after trade, even when you face endless setbacks. It takes a rare person to be able to pick oneself up after a fall and be ready to face each setback with enthusiasm.

Optimists do better in school, win more elections, and succeed more at work than pessimists. A study of several occupational groups from top notch winning athletes to traders on the floor of the exchange, found that optimists do better. What's their secret? It is in how they explain setbacks or failures. They don't blame themselves. They don't believe that success or failure is a matter of enduring personality traits. Instead, they explain setbacks as the result of minor, controllable situations that have nothing to do with them personally. They believe that, with enough persistence, they will have a good outcome.

On the other hand, pessimism has its virtues. Pessimists may feel badly most of the time, but research studies have shown that they more accurately judge how much control they have over situational circumstances. Pessimists are more realistic in their judgments, and thus it may be beneficial to think pessimistically on occasion. Optimism may make you feel good, but pessimism helps you evaluate the feasibility of your plans, goals, or ideas. Traders, especially novices, are notoriously overly confident. Novice traders tend to over-trade, and are unrealistically optimistic. It's vital for survival to have realistic expectations when it comes to trading. Optimism helps you persist in the face of a setback, but a healthy sense of skepticism will keep you based in reality.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Implied Volatility vs Historical Volatility

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

In the video below, Andy reveals the the difference between Implied Volatility and Historical Volatility. Which volatility is important to an options trader (seller), and does one affect the other?

Profitable trades are attainable! To find out how to manage this and other trades, and also to receive our daily detailed trading newsletter, subscribe to Traders Notebook.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Do I Deserve to Win?

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

The world's most successful traders believe in themselves and their ability to win. In fact, many of them feel that they “own” the market. They are not necessarily being arrogant, but they are sure of themselves and that they are able to take profits out of the market. Most importantly, they believe that they deserve to win. They have a mindset that is conducive to winning as a trader. It's essential that you make sure you, too, have such a mindset.

Do you find yourself acting as if you don't deserve to win? Do you waiver between two opinions, declaring that you know how to take big gains out of the market one day, and doubting whether you can really do the same the next day?

Do you often make gains, and then give them back, plus a little more sometimes? How about a lot more?

Deep down inside, you may be suffering from the work ethic. You may not believe making money easily is honest work. Is it possible that these beliefs interfere with your making easy money without a lot of guilt?

There is a powerful human need to hang onto tradition. Everyone in your family worked hard, so you must work hard. Have you considered that working smart might be a better way to go? When we stray from certain social mores and traditions, we feel confused and uneasy. Therefore, it's essential that we learn who we really are, and identify which beliefs we hold that prevent us from working smart and not hard. We need a mindset that is conducive to trading.

Money is a means of exchange that provides us with circumstances and experiences we could not otherwise have. There is plenty for everyone. Let’s face it, the government can always print more money. When we acquire wealth, we are able to support our loved ones, others, and ourselves more fully. We can be an asset to family and society.

For a few minutes, think about how you feel about the profits you make. Do you believe you deserve wealth? Do you believe you are justified in accumulating more capital than you currently have? Do you believe that by winning you are taking money away from others? Such negative beliefs are not consistent with trading success, so if you hold such beliefs, you are going to have to get rid of them if you want to “win” as a trader.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Why Having a View on a Market Isn't Enough

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

Marco provides a video on YouTube. He talks about why having a view on the direction of a market isn't enough. The reason is that just having a directional view doesn't make a trade...find out why!!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.