Resources (29)

The Spiritual Side of Trading: The Need for the Correct Mind Set

Written by Denise Ross

Our trading experiences color the way we see things in the market, and influence the way we approach them. If we take a big hit in a particular market, we may decide never to trade there again. Or, when we have a great trade in a market, it produces pleasure, so we try to trade there again as soon as we can.

How do you envision the markets overall? More importantly, how do you conceive of your role in the market? Do you see the markets as potentially hazardous arenas in which you must be very, very careful? Do you see them as though everyone in them is out to take your money? Or do you view them as a place in which there is dynamic profit opportunity?

Each time you sit down in your trader workspace, do you feel uncomfortable and wish you were somewhere else? Or are you really eager to jump into your work, look over your charts, and get down to trading? Does plowing through new material feel like a lot of hard work, or does it excite you to learn new information that will add to your ability as a trader? The Bible says that whatever you undertake to do, you should do with all your might. This is what diligence is, making every effort at what you attempt to do. Scripture also says that the hand of the diligent makes him rich.

The way you envision the markets will have a powerful influence on your actions! So it's absolutely necessary for you to be very much aware of just what your perception is, and what past experiences color your perception. You need to honestly assess your vision of — and feelings towards — the markets and your role in them. It will surely be time well spent.

Here's something to think about: the longer you sit in front of your screen, the more bad experiences you are going to have. The bad habit that defeats most day traders is that of overtrading. As you continue to sit in front of your trading screen, your focus and your sensibilities become increasingly numb. The longer you sit there, the more the probabilities increase in favor of your making bad decisions and wrong trades.

Let me ask you a question that may put the entire situation into perspective for you. Have you ever seen old people in a nursing home sitting hour upon hour staring at the TV screen? If you haven't, can you picture what it would be like? Almost everyone has seen people who either by choice or circumstance, sit all day watching TV. They sit and watch the "boob tube" hour after hour. What do you suppose this is doing for their minds? Do you think they are becoming increasingly sharp? Is sitting there all day helping them to grow? What would you say is happening to their minds? Are they not going to suffer from an increasing amount of atrophy as they fail to think — as they fail to use their minds? (And also fail to exercise their bodies to help nourishment get to their minds!)

When I see a trader sitting in front of his trading screen all day long, it generates the same kind of picture for me as when I see someone watching TV all day. They are destroying their minds. At least with TV you might learn something. But what are you learning watching a cursor tick up and down hour after hour?

Trading is a terrible occupation if all you do is trade. Taking signals from a mechanical trading system is one of the most mind-numbing, emotionally crippling things anyone can do. The shorter the time frame being watched, the worse it is. Is it any wonder that 90% or more of day traders last only 3-6 months in the market?

A successful trader has two major things going for him/her: 1. Plenty of money to have an excellent life-style. 2. Plenty of time to do some good in this world. But if you sit and trade all day, what do you have to show for it in the end? What have you produced that is of benefit to anyone but yourself?

I'll let you answer that. But my suggestion to you is that you strive to trade less, not more. Learn what the good trades look like, and then trade them only when they occur. And when they do occur, focus your money — trade as many contracts on the good trades as you can. Don't trade more of the time on many trades, trade many contracts less of the time on the good trades.

Use your time and money to help those less fortunate than you. After all is said and done, it is more blessed to give than to receive. Do you know what the word "bless" means? It is a verb meaning to "make happy." Paraphrased, that old saying translates to "you will be a happier person if you 'give' than if all you do is strive to 'get.'" But if you spend all your time and energy on a 1-minute chart, working all day long to get, you're not going to be able to get much of the happiness that is available from giving.

The Spiritual Side of Trading: The Need for the Correct Mind Set

Written by Denise Ross

Our trading experiences color the way we see things in the market, and influence the way we approach them. If we take a big hit in a particular market, we may decide never to trade there again. Or, when we have a great trade in a market, it produces pleasure, so we try to trade there again as soon as we can.

How do you envision the markets overall? More importantly, how do you conceive of your role in the market? Do you see the markets as potentially hazardous arenas in which you must be very, very careful? Do you see them as though everyone in them is out to take your money? Or do you view them as a place in which there is dynamic profit opportunity?

Each time you sit down in your trader workspace, do you feel uncomfortable and wish you were somewhere else? Or are you really eager to jump into your work, look over your charts, and get down to trading? Does plowing through new material feel like a lot of hard work, or does it excite you to learn new information that will add to your ability as a trader? The Bible says that whatever you undertake to do, you should do with all your might. This is what diligence is, making every effort at what you attempt to do. Scripture also says that the hand of the diligent makes him rich.

The way you envision the markets will have a powerful influence on your actions! So it's absolutely necessary for you to be very much aware of just what your perception is, and what past experiences color your perception. You need to honestly assess your vision of — and feelings towards — the markets and your role in them. It will surely be time well spent.

Here's something to think about: the longer you sit in front of your screen, the more bad experiences you are going to have. The bad habit that defeats most day traders is that of overtrading. As you continue to sit in front of your trading screen, your focus and your sensibilities become increasingly numb. The longer you sit there, the more the probabilities increase in favor of your making bad decisions and wrong trades.

Let me ask you a question that may put the entire situation into perspective for you. Have you ever seen old people in a nursing home sitting hour upon hour staring at the TV screen? If you haven't, can you picture what it would be like? Almost everyone has seen people who either by choice or circumstance, sit all day watching TV. They sit and watch the "boob tube" hour after hour. What do you suppose this is doing for their minds? Do you think they are becoming increasingly sharp? Is sitting there all day helping them to grow? What would you say is happening to their minds? Are they not going to suffer from an increasing amount of atrophy as they fail to think — as they fail to use their minds? (And also fail to exercise their bodies to help nourishment get to their minds!)

When I see a trader sitting in front of his trading screen all day long, it generates the same kind of picture for me as when I see someone watching TV all day. They are destroying their minds. At least with TV you might learn something. But what are you learning watching a cursor tick up and down hour after hour?

Trading is a terrible occupation if all you do is trade. Taking signals from a mechanical trading system is one of the most mind-numbing, emotionally crippling things anyone can do. The shorter the time frame being watched, the worse it is. Is it any wonder that 90% or more of day traders last only 3-6 months in the market?

A successful trader has two major things going for him/her: 1. Plenty of money to have an excellent life-style. 2. Plenty of time to do some good in this world. But if you sit and trade all day, what do you have to show for it in the end? What have you produced that is of benefit to anyone but yourself?

I'll let you answer that. But my suggestion to you is that you strive to trade less, not more. Learn what the good trades look like, and then trade them only when they occur. And when they do occur, focus your money — trade as many contracts on the good trades as you can. Don't trade more of the time on many trades, trade many contracts less of the time on the good trades.

Use your time and money to help those less fortunate than you. After all is said and done, it is more blessed to give than to receive. Do you know what the word "bless" means? It is a verb meaning to "make happy." Paraphrased, that old saying translates to "you will be a happier person if you 'give' than if all you do is strive to 'get.'" But if you spend all your time and energy on a 1-minute chart, working all day long to get, you're not going to be able to get much of the happiness that is available from giving.

The Spiritual Side of Trading: The Morality of Trading

Written by Denise RossBible scripture uses the term "righteousness" for morality. Righteousness includes the way you conduct yourself, your trading, and your trading business. One aspect of morality is that of being ethical. One way to look at morality is to look at its opposite — immorality: badness, corruptness, dishonor, evil, and dishonesty. Sadly, the markets and all too many of those who live off of those who aspire to be traders, fit the definition of immorality. Equally sad to say, these parasites populate the Internet in increasing numbers, as they seek to prey off the ignorance of novice traders. All we can say to that is "Trader, beware!" These denizens of the marketplace will do anything they can to part you from your money. They are ruthless and merciless. However, in spite of them, there are those who survive and get past the ones who would separate them from their hard-earned money. Those survivors have managed to learn a great lesson: trading is a business, and must be conducted as such.

Trading is a business, but certain areas of trading, such as day trading, can be a business missing a key dimension — that dimension being that it can have little value for the development of any individual person’s contribution to society.

I want to make it perfectly clear that I am not writing about the value of markets to the economic structure of the world. Nor am I addressing the value that speculating holds for the development of an individual’s character. To the contrary, markets and those who trade in them are in a position to greatly benefit the economic and societal structures of the world, and, when properly conducted, speculating can contribute greatly to the personal attributes of discipline and self-control among those who speculate in the markets.

My comments here are not to those who truly use the markets as they were originally intended — those who are producers and users, who utilize the markets for hedging.

My comments are not to those who are knowledgeable speculators holding long-term positions providing true liquidity to the markets.

My comments are aimed at those who foolishly speculate in the markets, knowing little or nothing about true market dynamics, and even less about any purpose their speculations may have. Sadly, this includes, for the most part, those novice speculators who dabble in what has become known as “day trading.” I wish to separate true speculative trading from what I will from this point on call “get-rich-quick speculating,” and those who engage in it I will call “novices.”

I have long held that true speculating is one of the finest ways to develop personal character as a human being. Even, speculating as a day trader. Not only do speculators have to develop discipline and self-control, but real speculators, as opposed to gamblers, must also overcome many weaknesses of character that, if not overcome, invariably lead to failure in the markets.

Speculators must conquer fear and greed. Speculators cannot afford delusion; when it comes to market perception, they must be totally honest about what they see. Above all, speculators must rigorously seek the truth about the markets and those who trade in them.

The Missing Dimension

The missing dimension in speculation, as it concerns novice traders, can be seen in the fact that it is almost totally self-serving gambling. At the individual level, for those novices trading is nothing more than a selfish act.

Think about it! What service is performed via the act of short-term gambling? What product is produced that is of benefit to anyone?

The role of novice day traders today can no longer be the claim of providing liquidity to the marketplace. Leaping in and out of trades several to dozens of times a day does nothing more than churn the markets at the same time that it churns the novice’s account! Is it any wonder the brokers love these people? The type of liquidity for which the markets were originally created must take place over the entire course of the time it is needed, not just for a few minutes. A weakness of day trading is that it provides liquidity almost entirely for other day traders.

At one time it could rightfully be said that speculative traders provided liquidity to the need for hedgers to protect against wild fluctuations in price. But how does a trade held for seconds or minutes help the hedger? Let’s face it, it doesn't! When far fewer than 3% of all positions entered into result in the delivery of anything at all, how can it be said that speculation provides liquidity to those who have a need to hedge?

I am not against speculating as an occupation. Speculating is how I make my living, and teaching about speculating is why I created Trading Educators. Speculating is not wrong when it is done with knowledge and wisdom. I make my money, and still do, by having more knowledge and correctly applying that knowledge — wisdom.

It was not until I decided to reach out to help others that I found the real value of speculating — I could use the harvest I reaped from the markets to help other people.

Viewing the results of speculating is similar to viewing a field (the markets) after a vicious battle — the field is strewn with the dead, dying, and horribly wounded. Becoming a victim of the speculative battle is the sad and terrible truth for most novice “traders.” The overwhelming majority of aspiring novice traders will end up having lost most, if not all, of their money. Even greater is the loss of feelings of personal worth as the markets discover and exploit every human weakness of character in those who would become successful at speculating.

At one time, trading was a noble occupation in that speculators actually provided liquidity for those who had an economic need for it. The hedger was able to pass off the risk of excessive price fluctuation to those willing to take that risk in return for the greater anticipated reward — the speculative trader. Speculative traders did take, and still do take, risk after performing a thorough analysis of the fundamentals driving the markets in which they speculate. The true speculator makes his trading decisions based on knowledge gathered from information about: the behavior of the underlying, seasonality, historical and current trends, chart analysis, fundamentals, the market dynamics, and the understanding of those who trade in them. This is quite unlike the way in which novice traders operate.

Short-Term, Day Trading Speculation

Think! Do any of the above parameters apply to the kind of speculation found in day trading as performed by novices? The shorter the time frame traded, the less any semblance of rational trading can be applied. Where does the market analysis come into play on a 5-minute chart?

What is known about the fundamentals? What is known about the underlying, seasonality, historical and current trends? As opposed to being proactive, the novice day trader is almost completely reactive to the price action in the marketplace. I ought to know, I was once a novice.

This is not to say that it is not possible to make money by day trading. I have done that for years. But my question is: of what value other than self-seeking are the winnings from day trading by a novice day trader? What is produced that is of benefit to anyone other than the day trader? Where is the product or service? Where is the value?

The Drawbacks of Day Trading

It is common knowledge that sitting in front of a television set all day long eventually produces atrophy of the mental processes. Someone addicted to television eventually loses much of the ability to think. Television is entertainment without the benefit of participation. There is little action in watching TV.

How much more so for the novice who sits in front of a trading screen all day in the hopes of winning money. At least in watching TV there is some chance of gaining knowledge. What knowledge is gained from watching a cursor move up and down on the screen all day long? Day trading is addictive, and those who sit in front of the screen throughout the day are surely growing brain-dead over a period of time. Novices who engage in this kind of day trading are losing their ability to think, and they are losing it more quickly than the person who watches TV all day.

The novice who day trades throughout the day is subject to almost constant stress in the hopes of monetary gain. The more trading decisions a novice makes in a single day, the less effective he/she becomes. I am asserting a proven fact that is found in the old saying, “all work and no play makes {your name} a dull boy.” There is a reason school classes are on average only 45 minutes in length — the brain can absorb only as much as the seat can endure.

I have proven that the less you trade in and out during the course of a day, the more money you will make. I am telling you here that the more you trade in and out, the less effective you will be. Novice traders who survive the markets long enough to find this out know that their best trades are their initial trades, and that the longer they “play” in the markets, the more they tend to lose what they made earlier in the day.

However, this is advice contrary to what the industry will tell you. So it takes a step of faith to believe what I am saying to you. The industry wants you to trade — they want you to make many trades. The brokers are getting rich from your trading — whether you win or lose, they win. Whether you win or lose, the exchanges take their pound of flesh every time you trade.

Is Day Trading an Occupation?

Once again I ask you to think — is day trading an occupation? Certainly it occupies your time, but what value is produced from this activity? For most aspiring speculators, the product is money lost. For most, it is defeat in the markets. Day trading, even for those who succeed at it, can provide a hollow victory. The result is most often the opposite of the reasons for which a person enters the business of speculating. For most, day trading results in long tedious hours sitting in front of a computer screen — and then even more hours backtesting and fiddling with historical charts trying to figure out a better way to speculate.

People tell me that they want to become “traders” so that they no longer have to punch a time clock. They want to enter this business so they can be their own boss. They want to be independent. They want to answer only to themselves. To accomplish this, they are willing to give up their job and all of its perks. They are willing to give up their retirement program, paid vacations, health benefits, a company car, paid travel, etc. However, few indeed ever count the costs. All they see dangling in front of them is money and all the happiness they think it will bring.

Get a Life

Speculating can be a wonderfully rewarding activity if it is engaged in sensibly. Speculating, when done properly, can furnish the speculator with time and money to do those things that result in an enriched life. Enrichment comes when time and money can be used to bring happiness to others. There is much truth in the notion that the greatest happiness results from giving. The successful speculator is in an excellent position to give both time and money in the pursuit of bringing joy into the life of others.

The Spiritual Side of Trading: The Need for Wisdom

Written by Denise Ross

Apply these to your trading and your life.

“Only fools refuse to be taught. Wisdom calls out in a loud voice wanting to be heard.”

“Wisdom is supreme; so get wisdom. Though it costs you all you have, get understanding (of the markets and how they work.)”

The above proverb reflects much of how I feel about the subject of wisdom. For years I have pursued it diligently. I long ago realized that I was a fool – with that realization I began an unrelenting hunt for wisdom in my trading. The quest still goes on, and probably will as long as I live. It is one of the most important things in my life.

The following is a paraphrase of proverbs taken from various translations of scripture and set into language that makes them more easily understood in light of our purpose here, which is to bring wisdom into the trading of markets. It is my pleasure to share them with you.

Purpose

The purpose of these proverbs is to help you to attain wisdom and discipline; for understanding words of insight; for acquiring a disciplined and prudent life of doing what is right, just, and fair.

They are set forth for giving prudence to the simple-minded, and knowledge and discretion to the beginner. Let those already wise read them and add to their knowledge. Do you think that is you? You say to yourself, "I am wise!" But I can tell you that nine out of ten wannabe traders are truly simple-minded when it comes to the business of trading.

The Bible says that respecting God is the beginning of knowledge, but fools despise wisdom and discipline. So many aspiring traders think that they can somehow "make it" by acquiring knowledge. They think: "Why not? After all, isn't this how I have achieved my current position in society?"

However, knowledge is not enough. It is the right application of knowledge that will make you a successful trader. Wisdom is defined as the right application of knowledge. Without wisdom, there is no way you can exercise self-control. Wisdom is the only way to achieve discipline, and a trader needs self-discipline above all else.

Don't be enticed

Read these instructions and don’t forget these teachings. If salespeople, promoters, and hustlers try to entice you saying “Invest along with us, we’re making the hot trades, we’re eating up the markets, we’ve got the most fantastic system,” don’t go along with them. Don’t listen to them, because they will head you straight for danger. Trouble and disaster await all those who want easy wealth and to “get rich quick.”

The lips of these financial whores drip honey, and their speech is smoother than oil. Flattery is their stock in trade. But afterwards, you are left with only the taste of bitter gall as you realize that they have led you down the path to financial ruin and destruction.

Wisdom will save you from the words and enticements of these greedy fiends. Their words are perverse and crooked. They are designed to play on your greed and suck you in. What they have to say is devious and deceptive. They blaze a crooked trail and don’t even realize that they themselves are staggering down that same path, ultimately snaring themselves in the same trap in which they have entangled others.

You beginners especially, and you who are older, who may have become less nimble-minded and astute, run from these crooks. Don’t go near them, because they will feast on your wealth, and all your labors will go to enrich them. You will be left groaning, tired and sick to your stomach, having been cheated out of all your wealth, your savings, and the fruits of all your labors. Then you will say “Oh, if only I had been wise. If only I had listened.”

Benefits of wisdom

Be faithful and honest with yourself in your trading, be diligent and consistent, and it will bring you prosperity.

Anyone willing to be corrected is on the path to success. Those who refuse correction have lost their chance.

Wisdom in financial situations

If you have been foolish enough to co-sign someone else’s debt, if you have been trapped by what you have said, ensnared by the words of your mouth, then do this to free yourself, since you have fallen into their hands: Go and humble yourself; press your plea with them! Don’t even allow yourself to sleep until you free yourself from the mistake you have made.

Follow the rules and keep your financial life intact; ignoring them means financial ruin.

Steady plodding brings prosperity; hasty speculation brings poverty.

Any enterprise is built by wise planning, becomes strong through common sense, and profits wonderfully by keeping abreast of the facts.

Riches can disappear fast — so watch your business interests closely. Know the state of your investments.

Those who work their plan will prosper, but those who chase fantasies lack judgment.

Laziness

If you are lazy, learn a lesson from the ants. Learn from their ways and be wise. Because even though they have no one over them to make them work, yet they labor hard all summer gathering food for the winter.

Lazy people won’t use the tools at their disposal, but the diligent make good use of everything they find.

The lazy are full of excuses. “I can’t go to work” they say. “If I go outside I might meet a lion in the street and be killed.”

Wisdom vs. Foolishness

If you instruct the wise, they will be wiser still and will add to their learning. If you instruct fools, they will ignore you and may even insult you.

The wise in heart will accept rules and live by them, but the chattering fool will come to ruin by ignoring these rules.

The wise store up knowledge, but fools blurt out everything they know, which only leads to sorrow and trouble.

The earnings of the wise advance their purposes; fools squander their earnings on foolish things.

A fool’s pleasure is in doing stupid things; the pleasure of the wise is in being wise.

What fools dread overtakes them; what the wise desire will be granted to them.

When the storm has swept by, the foolish are gone, but the wise are still there standing firm.

The wise are guided by their honesty; fools are destroyed by their dishonesty.

The fool sometimes gets rich for the moment, but the reward of the wise is lasting.

Fools think they need no advice, but the wise listen to others.

A fool is quick-tempered; the wise man stays cool in the face of insult or adversity.

The wise ask advice from friends; the foolish plunge ahead and fall.

The wise think ahead; the fool doesn’t, and even brags about it.

The wise eat to live, while the fool never gets enough.

The wise look ahead. Fools fool themselves and won’t face facts.

The wise are cautious and avoid danger; fools plunge ahead with great confidence.

Simpletons are crowned with folly; the wise are crowned with knowledge.

The wise are praised for their wisdom; fools are despised for their folly.

Fools despise advice; the wise consider each suggestion.

The wise are hungry for the truth, while fools feed on trash.

The wise think before they speak; the foolish pour out their nonsense without even giving it a thought.

A person of few words and settled mind is wise; therefore, even a fool is thought to be wise while remaining silent. It is profitable for fools to keep their mouths shut.

The wise learn by watching ruin overtake the foolish.

The foolish will lose in the end; the wise will end up with the winnings.

The wise save up for the future, but the foolish spend whatever they get.

Wisdom is a fountain of life to those possessing it, but a fool’s folly is his burden.

Wealth vs. Poverty

The wealth of the rich is their strength, but the poverty of the poor is their curse.

Hard work brings prosperity; playing around brings poverty.

Pride vs. Humility

The proud end up losers, but the humble become wise.

Pride leads to arguments; be humble, take advice, and be wise.

Pride goes before destruction, and arrogance before a fall.

Pride ends in destruction; humility in honor.

Thought Provokers

Gossips go around spreading rumors, while the trustworthy try to quiet them.

To learn, you must want to be taught. To refuse correction is stupid.

The plans of good people are honestly thought out, but advice from the dishonest is deceitful.

Everyone admires those with good sense; but those with a warped mind are despised.

It is better to get your hands dirty and eat, than to be too proud to work and starve.

Lies will get anyone into trouble, but honesty is its own defense.

The truthful give honest testimony, but a false witness tells lies.

Some people like to make cutting remarks, but the words of the wise soothe and heal.

Truth stands the test of time; lies are soon exposed.

Wealth taken from gambling quickly disappears; wealth from diligent effort and hard work grows.

It is pleasant to see plans develop. That is why fools refuse to give them up even when they are wrong.

If you are looking for advice, stay away from fools.

Before everyone there lies a wide and pleasant road that seems right, but ends in death.

Only simpletons believe what they are told! The prudent check to see where they are going.

The quick-tempered do foolish things, and despise those who are patient.

Work brings profit; talk brings poverty.

The wise control their temper. They know that anger causes mistakes.

Mockers resent correction; they will not consult the wise.

When you are feeling gloomy, everything seems to go wrong; when you are feeling cheerful, everything seems right.

Plans go wrong with too few counselors; many counselors bring success.

Everyone enjoys giving good advice, and how wonderful it is to be able to say the right thing at the right time.

If you profit from constructive criticism, you will be elected to the "Wisdom Hall of Fame." But to reject criticism is to harm yourself and your own best interests.

Wisdom is better than gold, and understanding more valuable than silver.

Hunger is good if it makes you work to satisfy it.

A rebuke to those of common sense is more effective than a hundred lashes on the back of a rebel.

It is safer to meet a bear robbed of her cubs than fools caught in their folly.

Fools find no pleasure in understanding, but delight in airing their own opinions.

At times the rich think of their wealth as an impregnable defense, a high wall of safety. What dreamers they are!

Rumors are dainty morsels, too often consumed with great relish.

What a shame — yes how stupid! — to decide before knowing the facts.

The intelligent are always open to new ideas; in fact they look for them.

It is dangerous and stupid to rush into the unknown.

People who love wisdom love their own best interest, and will be successful.

Get all the advice that you can, and be wise all the rest of your life.

Stop listening to teaching which contradicts what you know is right.

If you won’t plow in the cold, you won’t eat at the harvest.

The intelligent person sitting as judge will weigh all the evidence carefully, distinguishing the true from the false.

If you love sleep, you will end up in poverty. Stay awake, work hard, and there will be plenty to eat.

“Utterly worthless”, say the buyers as they haggle over the price. But afterwards they brag about their bargain.

Good sense is far more valuable than gold or precious jewels.

Don’t tell your secrets to a gossip unless you want them broadcast to the entire world.

A fortune can be made from cheating, but there is a curse that goes with it.

The glory of the young is their strength; of the old, their experience.

The man who strays away from common sense will end up dead.

The wise are mightier than the strong. Wisdom is mightier than strength.

Don’t go into the battle without wise guidance; there is safety in many counselors.

A person without self-control is as defenseless as a city with broken-down walls.

In the mouth of a fool a proverb becomes as useless as a paralyzed leg.

As dogs return to their vomit, so do fools return to their folly.

There is one thing worse than a fool, and that is a person who is conceited.

Don’t brag about your plans for tomorrow — wait and see what happens.

Sensible people watch for problems ahead and prepare to meet them. Simpletons never look, and suffer the consequences.

Ambition and death are alike in this: neither is ever satisfied.

Persons who refuse to admit their mistakes can never be successful. But if they admit them and forsake them, then they get another chance.

Those who want to do right will get a rich reward. But those who want to “get rich quick” will quickly fail.

Trying to “get rich quick” is wrong and leads to poverty.

It is foolish to entirely trust yourself, but those who use God’s wisdom are safe.

One of the most beautiful pieces of scripture that any trader can take to heart is found in the eighth chapter of the book of Proverbs. I end this section with quotes from that chapter:

“Can’t you hear the voice of wisdom? She is standing at the city gates and at every fork in the road, and at the door of every house. Listen to what she says: ‘Listen men!’ She calls. ‘How foolish and naive you are! Let me give you understanding. Let me show you common sense! Listen to me! For I have important information for you. Everything I say is right and true, for I hate lies and every kind of deception. My advice is wholesome and good. There is nothing of evil in it. My words are plain and clear to anyone with half a mind — if it is only open! My instruction is far more valuable than silver or gold.’

“‘I, Wisdom, give good advice and common sense. Because of my strength, governments reign in power. I show the judges who is right and who is wrong. Rulers rule with my help. I love all who love me. Those who search for me shall surely find me. Unending riches, honor, justice and rightness are mine to distribute. My gifts are better than the purest gold or sterling silver! My paths are those of justice and right. Those who love and follow me are indeed wealthy. I fill their treasuries. The Lord formed me in the beginning, before he created anything else. From ages past, I am. I existed before the earth began. I lived before the oceans were created, before the springs bubbled forth their waters onto the earth; before the mountains and the hills were made. Yes, I was born before God made the earth and fields, and high plateaus. I was there when He established the heavens and formed the great springs in the depths of the oceans. I was there when He set the limits of the seas and gave them his instructions not to spread beyond their boundaries. I was there when He made the blueprint for the Earth and oceans. I was always at his side like a little child. I was his constant delight, laughing and playing in his presence. And how happy I was with what He created — His wide world and all His family of mankind! And so, listen to me, for how happy are all who follow my instructions.’

“‘Listen to my counsel — don’t refuse it — and be wise. Happy is the man who is so anxious to be with me that he watches for me daily at my gates, or waits for me outside my home! For whoever finds me finds life.’”

One last word: in the Biblical sense, to be wise is to seek God and learn to live in ways that please Him. The fool, in that sense, is the one who determines to get through life on his own terms, thereby never discovering the purpose for which God created him.

The Spiritual Side of Trading: Dishonesty and Lying

Written by Denise Ross

There are two aspects of dishonesty and lying with which a trader must deal: the lies that are thrown at him from some people in the field, and the lies that the trader feeds to himself.

At Trading Educators we hear many sad stories from novice traders who have been duped by dishonest liars. Scripture says to beware of "a proud look, a lying tongue, and hands that shed innocent blood." Don't allow that blood to be yours.

But the worst kind of dishonesty and lying of all is lying to yourself. It is amazing how the human mind can rationalize to the point of deception. In the book of Galatians, chapter 6, verse 3, we read: "If anyone thinks he is something when he is nothing, he deceives himself. " That goes along with what scripture has to say about pride. But we have seen traders take personal deception to extremes.

I will never forget sitting with a doctor who wanted to be a trader, and watching the ultimate self-deception. He had developed a trading system, and invited me to observe how wonderfully well it worked. He invited 3 other people as well. We were all witnesses to the absolute failure of his system. But each time the system failed, he told us: "Well, if I were trading it, I wouldn't have taken that trade!" When we pointed out to him the numerous short-comings and erroneous thinking behind his system, he simply became angry with all of us - all, that is, but one. One of the people he had invited was his broker. His broker completely agreed with him. You could almost see this broker licking his lips as he contemplated all the commissions he would make from the doctor's trading. So naturally he lied and told the doctor that the system was good. He could find nothing wrong with it. Do I have to tell you that the doctor traded his system with that broker and lost $350,000? Lying and deception can never produce anything consistently good.

So what is the truth in trading? That there are no shortcuts, no way to get around the basic need for self-control, study, and practice. And that the trader's life must be balanced and integrated into his overall physical, mental, and spiritual health and development.

The Spiritual Side of Trading: Dealing with Pride, Arrogance and Vanity

Written by Denise Ross

Scripture states: "Pride goes before destruction, and an arrogant spirit before a fall." Proverbs 16:8. I cannot tell you how many times I have seen pride destroy a trader. I can't count the times pride has cost me dearly, resulting in the opposite, which is humility. The markets can humble you so fast it makes your head (and your account) spin.

Yet we see it all the time among novices, especially on forums and news groups. Invariably there will be traders on these venues who have to tell everyone how well they are doing. They have to brag about their trading prowess, and crow about their success, whether real or imagined.

When pride enters the picture, you can be certain that disaster is just ahead. When you put your ego on the line, get ready to have it smashed. Interestingly, scripture has some pertinent things to say about pride. In the book of Proverbs, chapter 8, verse 13, God is quoted as saying: "...I hate pride and arrogance..." A little further on, in chapter 11, verse 2, it says: "When pride comes, then comes disgrace, but with humility comes wisdom."

"A man's pride brings him low," according to Proverbs 29:23. Scripture mentions the word "pride" no less than 46 times; the word "proud" is mentioned 47 times, and there is never anything good said for those who are proud or have pride. We are told that the pride of your heart will deceive you.

The markets have certain attributes that are true. As far as a trader is concerned, the markets are all-powerful and all-knowing. Markets are like the 600-pound gorilla - they go wherever they want to go. Additionally, all knowledge about the underlying is in the market. Any information that is not generally known is not in the market, and so the trader has no need to be concerned about it. But he needs to take care that he never gets "cocky" (crows like a rooster) or vain or careless when he's standing in the path of the market!

My friends, I could go on and on quoting from what the Bible has to say about pride, arrogance and vanity. But suffice it to say that none of it is in favor of any of them. If you find that pride is a problem with your trading, then you need to confront it, deal with it, and get rid of it.

Also, learn to keep your mouth shut about your trading. Keep quiet about your investments. The less said about your financial life, the better. I have seen traders get up at seminars and tell everyone else there how they are cleverly beating the tax man. But agents of the Internal Revenue Service (IRS) often secretly sign up for such seminars. They take notes and names. I know this for a fact because it happened at one of my seminars.

Do not brag about your trading on forums or any other public venue. You never know who is listening in. When you tell about the great trade you made, whether or not it is true, don't be amazed when you get a phone call or a letter from the IRS!

The Spiritual Side of Trading: Selfishness and Discontent

Written by Denise Ross

The selfish trader wants it all for himself. The sad part is that he believes he can get all. The selfish trader is most apt to fall for marketing hype telling him he can know exactly when and where prices will change direction (turning points.) The selfish trader is blind to the fact that those who proclaim they can predict market turning points are not able to predict with any certainty where the next tick will be. Selfish traders are akin to, though somewhat different from greedy traders. The Bible has a lot to say about greed. Notice:

"A greedy man brings trouble to his own house." Proverbs 15:27 Here's another one: "They are like greedy dogs...everyone is for his own gain." Isaiah 56:11

I don't know about you, but I hope that I will never be viewed as being like a "greedy dog," out only for my own gain.

The apostle Paul warned against being greedy for money (1 Timothy 3:3), but that is what we have witnessed among so many traders. I recall one trader who was so greedy that he repeatedly gave back substantial profits in his lust for even more. His trading records time and again showed profits of $1,500, $1,800, $2,000 and even more, yet on every one of those trades he ended up losing money. He simply could not bring himself to take the money when it was there. So he hung onto trades, hoping for even more. When the market turned, he kept telling himself prices would once again move his way. But they didn't, and he sat and watched his unrealized profits vanish into thin air; he watched them turn into losses and, when he no longer could stand the pain, he gave up and exited the trade. To ease his pain, he simply turned off the screen so he didn't have to watch. In doing that he added self-deception to his problem with greed.

Greed and selfishness are nothing more than human lust. It's interesting to see what God inspired the apostle John to say about it. You'll find it in the book of 1 John 2:16: "For everything in the world - the cravings of man, the lust of his eyes and the boasting of what he has and does - comes not from the Father (God) but from the world." We live in this world, and it takes great effort to overcome the pulls and temptations that are a part of society. In our greed and selfishness we want more and more. We want every toy and device we can get our hands on. But the more we get, the more we want. There is no satisfying greed. Greed is an appetite that can never be filled.

One of the wisest traders ever is quoted as saying he was content with getting his piece out of the middle of a move. Content is an important word in trading. It is the opposite of discontent, and discontent is the twin brother of greed. Unless you can be content with your piece of the market, you will continue to strive for more. In trying to get more, you will lose what you have. It's like Aesop's fable about the dog and the bone. The dog looks down into the water and sees his reflection: a dog with a bone. He opens his mouth to grab the bone in the reflection and loses the bone he actually has. We have seen many traders who are like that. They are selfish like the dog, they are not content with what they have, and they are greedy for more!

The Spiritual Side of Trading: Virtues for Successful Trading

Written by Denise Ross

In the book of the Bible called 2nd Peter, beginning in verse 5, we find the following words written by the apostle Peter:

"... Make every effort (be diligent) to add to your faith, goodness; and to goodness, knowledge." Elsewhere in the Bible, we find that "the hand of the diligent makes him rich."

How can we apply this to our trading? What do faith and diligence have to do with trading?

When you are trading, you must have faith in two things:

- Yourself.

- Your knowledge of what you are doing.

You acquire this faith, this confidence in what you are doing, through diligence, by making every effort to acquire knowledge. But keep in mind that you must be diligent to acquire the right knowledge. It is all too easy to be fooled by marketing hype into acquiring worthless knowledge, information that will not succeed in helping you to become a better trader. So goodness must also enter the picture.

Once you have faith in yourself and your methodology, add good information to what you have already learned.

But the apostle Peter, through the inspiration of God, had a lot more to say. In verse 6, we are told to add self-control to our knowledge, and to self-control add perseverance.

Would you agree that self-control is critical to successful trading, and that the only way you can develop self-control is to persevere - stick with it until you have it? Peter then finishes that verse, writing "...and add to perseverance, godliness."

What in the world can he mean by godliness? How can we apply that to trading? The word translated "godliness" is the Greek word "eusebeia." It also means "respect." Do you respect the power of the market? You should. The market goes where it goes without asking for your permission. Respect for market dynamics must be included in your trading plans. So to perseverance, we must add respect.

Next, the apostle Peter tells us to "add to respect, brotherly kindness," i.e., good will. You know that as a trader you have to deal with others. A prominent person in this regard is your broker. There comes a time when you need to call the broker, even if you are an electronic trader. Trading is not 100% devoid of human contact. So part of trading is learning to be nice to people. It's just good business.

This brings to mind the selfish trader, the one who wants to have it all. The selfish trader is not a practitioner of good will. This is the trader who will try to know in advance where market turning points will be. This is the trader who lacks the knowledge that no human can tell you with absolute certainty where the next tick will be, let alone where prices will turn in the market.

Peter has yet more to say that we can apply to our trading. In verse 8 he says, "if you possess these qualities (the virtues we've been looking at) in increasing measure, they will keep you from being ineffective and unproductive." He also says, in verse 9, that "if anyone does not have them, he is short-sighted and blind."

Can anyone disagree with a trader's need to be diligent, and knowledgeable? Can you disagree that it is important to persevere and develop self-control? Would you argue that it doesn't pay to be nice to people, to show respect to others and to the markets?

God's words are also revealed through the apostle Paul, and they apply to us as traders. Some of these virtues are supportive of what the apostle Peter had to say, and all of them are virtues that cannot hurt any trader, they can only be helpful. We find God's inspired words to us in the New Testament of the Bible in the book of Galatians, Chapter 5, beginning with verse 22:

Paul begins by telling us we must have love. This is the same word that was used by Peter which I told you means good will. But it also has other meanings, one of them is affection. You really must have an affection for trading and the markets if you are to succeed in them. This love or affection for what you do is essential for persevering in the marketplace. As we will see later, perfect love, according to scripture, drives out fear. We will discuss that when we come to the topic of fear.

Paul tells us we must have joy. The word used here also means gladness. Are you a happy, joyful trader, glad for the opportunities presented by the market? Or do you trade uptight, fearful, and with great trepidation? It is truly difficult to trade if every trade is, for you, a traumatic event.

Paul tells us next that we should be at peace when we trade. We should be relaxed, at rest, quiet, exempt from rage. When we trade we should be in step with the market. The word used here also mean to be in harmony with the market, because peace and harmony make and keep things safe, and the results of our efforts will be prosperity. Being at peace means we should be assured of the outcome of our trading. Did you ever think you would find such things in the Bible?

But Paul is not done yet. He tells us that we must be patient, constant, and steadfast. Paul called this "longsuffering" in some translations of the Bible. Is that you when you trade? Are you patient, constant, and steadfast? Do you stick with what you know? Do you follow your plan?

Next, Paul tells us to be gentle, good, and to have faith. Let's look at what those things mean in the original Greek so that we can apply them to our trading.

Gentleness is talking about morality, moral goodness, and integrity. Do you see anything wrong with applying integrity to your trading? We're going to talk about the morality of our trading in another section, so I will leave the depth of that discussion for later. The word good as used by Paul in this instance has to do with uprightness of heart and life, certainly virtues to be sought after, and which are part and parcel with morality. Paul also tells us to have faith, i.e., assurance, belief in what you are doing. This is where courage of conviction enters the picture. Do you believe in the truth of the knowledge you have of trading and of the market? If not, how can you possibly trade with any assurance that your trading will produce your desired results? Faith is conviction. Faith is trust in your ability to trade successfully.

Continuing, Paul says: You should be meek and temperate. By the word meek, Paul means to be mild, calm, and at ease. And this is the way you should be when you are trading. By temperate he means under control; self-disciplined and self-controlled. I suppose there have been plenty of books written about that in conjunction with profitable trading.

Then Paul concludes with a rather interesting statement. He says, "Against these, there is no law." Can you agree with that? Has anyone ever passed a law that says you cannot be happy, joyful, in love with your work, believing that what you are doing will bring you success? Is there a law against being a nice person, a humble person, an ethical person, or a person who practices moderation? All of these virtues can only enhance your trading as well as your whole life.

Introduction

All traders, sooner or later, begin to realize that there is something more to trading than learning to read a chart, following an indicator or a trading system, or discovering a method or setup that will work a high percentage of the time.

If you didn’t fail early in your trading business, then you have probably been around long enough to realize that many of the problems you encounter as a trader are those that derive from your own individuality. Such problems are common among traders and, in fact, common among all human beings.

However, it is the nature and dynamic of this business to bring your human frailties and weaknesses to the front and center of your life. Trading brings you into a head-on confrontation with who you are, the deep-down "real" you.

At that point of confrontation, there are a number of choices you must make. I will list four that come to mind:

1. Admit defeat and give up trading.

2. Seek to overcome your human nature through deep introspection, using the strength of your own resources to confront and deal with who and what you are.

3. Seek the help of a professional, someone skilled in matters of trading psychology.

4. Seek spiritual help from a power much greater than your own.

Seeking spiritual help from a power much greater than your own is the area I address in "The Spiritual Side of Trading."

At this point I want to make clear that as an individual and as a professional trader, author, and educator, I believe with all my heart that the creator God exists. If you would like to see some of how I proved that to my own satisfaction, click on this link: Show me proof that God exists.

Also, after much thought and study, I believe that the book commonly known as the Bible is the "manufacturer's instruction book" that God has provided for us:

- to show us how to live the highest possible quality of life;

- to show us things we cannot discover or figure out by ourselves - information we cannot learn except by its being revealed to us.

There are many proofs that the Bible is the actual and inspired word of the creator God in written form. If you are interested in seeing some of the proofs that convinced me in my own belief, follow this link: Show me proof that the Bible is the written word of God.

You can spend a lot of money on trading systems and books on how to trade. You can spend even more money getting psychological help, buying books on trading psychology, and additional books on how to succeed, how to be a better person, how to think, how to become wealthy, etc. But because I was not charged for the spiritual information I received, I am passing it on to you in the same way.

Can anything free be of any value? Most surely the answer is "Yes." The word of God is freely given to anyone who is willing to receive it. I cannot charge you for the wisdom and truths revealed in the Bible. They are not mine to sell. The only requirement is that you seek to discover them. The Bible says: "Seek and you will find, knock and the door will be opened for you."

Traders' Problems

There are many problems that plague traders. Some of these problems are fairly easily identified, and you may already be aware of them. You probably know that, relative to your trading career, you may experience any of the following:

- Fear and/or Feelings of Inadequacy - Lack of Courage or Self-confidence

- Selfishness and/or Greed

- Pride and Vanity

- Dishonesty and Lying

- Lack of/need for Wisdom

- Lack of/need for Virtues that foster Successful Trading

- Questions about the Morality of Trading

- Need for the Correct Mind set

- An Identity Crisis

Any one, or any combination of the above can result in a poor self image, which in turn affects the outcome of your trading efforts. I will mention only in passing that all of the negative characteristics of human nature derive from the spirit world; the spirit world the Bible labels as evil. All of the above are merely symptoms brought about by problems that run much deeper within your mind and spirit than you might care to believe. These problems, and others as well, are manifestations of spiritual problems that you are probably not consciously aware of.

There are problems that plague your human spirit that remain hidden. They reside deep in your memory, but you may have pushed them into the recesses of your mind. They are problems that come from bad things that happened to you even as early as the time you were inside your mother’s womb. They are problems that stem from events you want to forget. They are problems caused by real or perceived mistreatment of you by others. It can be something as simple as abuse from a family member, a label hung on you by a classmate, teasing, or a name you were called. The abuse may have been physical or verbal. It may have come from someone you loved and trusted. Whatever it was, because it hurt you, you have buried it deep in your memory and covered it over. Nevertheless, who you are and what you are from your own point of view - your self-image - has been tainted by those events and experiences that are hidden. They are indelibly etched in the deepest parts of your mind, and they will plague you as a trader until you dig them out, confront them, and deal with them.

Earlier I wrote that one purpose of the Bible is to reveal to us things that we might otherwise not know. The Bible is a book of revelations. It reveals to us that there is a God. If it didn’t tell us there is a God, how would we know that there is one? It reveals to us a law - a simple set of rules that we should live by. If everyone lived by the simple rules revealed in the Bible, life on Earth would be paradise even now.

There are many revelations written within the pages of the Bible - the fact that they are there is a very strong proof that the concepts revealed in the Bible come from a mind that is far greater than any human mind.

There is one piece of information revealed in the Bible that I have not found revealed in any place other than from those who have also discovered it in the Bible. It is: "There is a spirit in man." Please read that again: There is a spirit in man!

What is this spirit in man? What is the Bible trying to tell us when it reveals that there is a spirit in man?

It is the spirit in man that gives man his superiority over the rest of the animal kingdom. The spirit in man imparts to him his intellect. It gives man his ability to reason, to imagine, to plan, to organize, to invent, to devise, to make choices, and much more.

The Bible reveals that anything man can imagine to do, he can eventually do! That in itself is a startling piece of news, but the truth of it is to be found everywhere. Man has learned how to fly through the air, to comfortably remain underwater for lengthy periods of time, to control the temperature of his environment, to move at speeds impossible for any other form of earthly life. Man has even figured out how to reach the stars. That’s pretty impressive. But do you know what man has so far not figured out how to do? He has not figured out how to live in peace, harmony, and contentment with other men or with the rest of creation. In some cases, he has not even figured out how to live in harmony with himself!

What is it that keeps him from finding the way to peace, contentment, and true happiness? The answer to that is also in the Bible. It is the nature of man coupled with influence from the evil sector of the spirit world.

The things that have happened to you, the experiences and events of your life that hurt you, are wounds to that part of you we call the mind. Those wounds can be ferreted out and healed. The rest of this manual is dedicated to showing you God’s way to successful trading. It is set forth to teach you the spiritual side of trading.

"For as a person thinks in his heart, so is he…"

Before anyone starts to plan his career as a trader - or anything else for that matter - he or she should realize the truth of the Biblical statement above. It is the best answer I have for where to begin. It tells all of us where we have to start, and how to continue our journey. It tells us how to start developing our values and vision, where we have to look closest in order to see the farthest and clearest. We begin by looking at how we think. We begin by having the right mind set. We begin by having the right thoughts. From the point of view of the human spirit, we are what we think we are. We are who we think we are. If our self-image has been damaged, that damage will be reflected in the results we get from trading. Additionally, the markets themselves can influence us as to who and what we think we are. Markets punish us when we make mistakes. Markets are unforgiving. Trading in markets and losing can do serious damage to our self-image.

Of course, the real truth is that we are who and what God says we are, but that is a topic for those who would like to have a much deeper spiritual experience than that which I am going to present here. (However, in due time, I will point the way for those who do want to pursue the deeper way.)

The markets offer us a gingerbread house of potential goodies. Break off some of the cake. Stuff yourself with as much as you want - and there is much you do want, so you step up to the gingerbread offering of the markets. You can probably make a list of dozens, if not hundreds, of things you want, and the gingerbread house with all its good appearance holds out the promise of satisfying your quest for the material things of this world. But within that gingerbread house exists something evil - individuals who want to satisfy their own desires at your expense.

Let’s face it, the markets are made up of nothing more than many human beings seeking to satisfy their own needs and desires.

What is currently contained on this website is an open book. Periodically new thoughts, ideas, and links will be added. Appropriate observations from others are invited, but we reserve the right of final judgment as to whether or not they will be included.

It’s time now to see what the Bible has to say about the virtues needed to become a successful trader as well as various aspects of human nature.

More...

Selected Report Activity Cause and Effect

The effect of various reports on price market action

Unit Move Table

Created by Master Trader Joe Ross to fill a gap in the information available for the value of a full-point move and a minimum tick fluctuation.

Spiritual Side of Trading

If you didn't fail early in your trading business, then you have probably been around long enough to realize that many of the problems you encounter as a trader are those that derive from your own individuality. Such problems are common among traders and, in fact, common among all human beings. Seeking spiritual help from a power much greater than your own is the area I address in the "Spiritual Side of Trading".

Charting and Trading Software (alphabetical order)

![]() For more than thirty years, we've developed new technologies, offering real-time and historical data integrated with graphics and technical analysis tools. CQG's innovations have become industry standards. Our analytic tools and order-routing ISV services are the industry's best performing. Traders rely on our data's quality, accuracy, and reliability. CQG was the first vendor to insert real-time exchange corrections. We monitor a worldwide network 24 hours a day, ensuring that clean data is always available. Our customer support is backed by product development staff in four countries, our product specialists, and our data quality and operations teams, which are deployed globally to ensure the quality and performance of our hosted market data and electronic trading networks.

For more than thirty years, we've developed new technologies, offering real-time and historical data integrated with graphics and technical analysis tools. CQG's innovations have become industry standards. Our analytic tools and order-routing ISV services are the industry's best performing. Traders rely on our data's quality, accuracy, and reliability. CQG was the first vendor to insert real-time exchange corrections. We monitor a worldwide network 24 hours a day, ensuring that clean data is always available. Our customer support is backed by product development staff in four countries, our product specialists, and our data quality and operations teams, which are deployed globally to ensure the quality and performance of our hosted market data and electronic trading networks.

Genesis Financial Technologies and our flagship product, Trade Navigator, is here today in large part because we've created a culture of finding ways to say YES. We believe in the power of YES. Genesis gained a reputation with professional traders for offering clean data in an easy to use application. Over the years, I’ve had the great pleasure of meeting and working with some of the world's greatest traders. Often the conversation began with a trader saying "hey wouldn’t it be great if ..." and with very few exceptions, my response has always been, "Yes, we can do that!"

Margin Requirements

Find out the margin requirements directly from the exchange.

► Minneapolis Grain Exchange Margins

Forex Warning

Discover when not to trade the forex. Find the Truth you are not being told.

Agricultural news, including pre-open calls, mid-day reports, and after hours wrap-up

Agricultural Reports

Trading Calendars

Stock Disciplines

Strategies, Free Tutorials, stop-loss tool, stock alerts, signals, The Valuator, systems, price surges, volume changes, reversals, breakouts, stock scanner, setups, watch list, strongest 50 ETFs.

Securities Exam Preparation, Inc.

Established in 1972, is a consulting organization specializing in self-study test preparation for FINRA, NASAA, and futures industry exams -- and in registration services for Investment Advisers, Broker Dealers, Commodity Trading Advisers, and Introducing Brokers. Assistance is also provided for registration of ForEx (foreign exchange) merchants and IBs.

Norman Hallett, Trader's Coach

Give Me Just One Minute and...

I’ll Show You How to Eliminate Your Big Trading Losses and Increase Your Profits

Adrienne Toghraie, Trader's Coach

Adrienne Toghraie, Trader's Coach

“My mission is to assist you in improving all areas of your life.”

Adrienne coaches traders and investors to their next level of success by helping them overcome their self-imposed limitations. Keynote speaker since 1989 and author of 13 books.

Terms of Use

Terms of Service

Privacy Policy

"AMBUSH" A MARKET OF YOUR CHOICE

Ambush many stock index futures, commodity futures, currency futures, forex pairs, or CFDs markets

Systematic Trader Marco Mayer, our in-house quant-trader has come up with a safer and easier way to trade a large variety of markets, with the potential of locking in a steady stream of profits.

The Ambush Trading Method™ was launched in 2009. It's proven itself in many different market conditions since then, not only in backtests, but also in forward-testing.

Ambush supports a variety of markets, including:

- Futures: Stock Index, Commodity, Currency, and Interest Rates

- Spot Forex Markets

- CFDs on any of the supported markets (results may vary, depending on your broker's quotes)

Ambush is based on Daily charts, so there is no need to sit in front of a screen to watch all day. When the market you want to trade opens, you place your limit entry order and your protective stop, and you go on about your business. You will always close your position on the same day you entered the market. This means there's no overnight risk, and depending on your broker, this can make a huge difference in relation to margin requirements.

"Of the many ways to trade I’ve seen over the years, I have never seen a more stable way to take profitable gains from the market."

Master Trader Joe Ross

Understanding the Ambush Method

The idea of Ambush is actually quite simple. As markets became more and more difficult to trade on a breakout-basis using a daily chart, Marco started to look for a way to exploit that reality. The problem was how to get into a market when many traders are "trapped" in their trades, and how to profit when they lose. This sounds tough, but these are often some of the best trades you can get into.

In other words, you'll "ambush" those traders who're buying or selling when it's statistically a very bad idea to do so, at least on a short-term basis. Odds are their trade will fail, and when it does they'll have to quickly get out, or even reverse their trades, which will drive prices strongly into our direction.

This means Ambush is a counter-trend method on a short-term basis. It doesn't necessarily go against the long-term trend of a market that has been trending for weeks, but it does go against trying to get into the market during short-term trends when the odds favor an intraday-reversal. Still it's based on daily charts and you don't need to watch the markets during the day, which makes it a quite unique method. It actually allows you to profit from significant short-term intraday-moves without being tied to the screen!

Simple Rules

Ambush is not a black-box system. Instead, we give you the complete trading rules which allow you to become really comfortable with the method.

- This method uses simple, clear rules. They tell you exactly:

- At what price to place your limit entry order.

- At what price to place your protective stop-loss.

- When to get out of a trade.

- The exit-rules used by Ambush are very simple. There's no profit target involved, and the stop-loss is only a catastrophic stop-loss. This means that one of the biggest issues of method-development, which is overoptimizing the exits, doesn't apply for Ambush.

- You will become a member of a private section where we post the latest set of market suggestions and specific parameters for fine-tuning the method to each market. The fine-tuning is done in a way that avoids over-optimizing the method, and targets robustness instead of performance. This gives us an additional edge in each of very different markets, while applying the same basic method.

- Since markets change, we continue to look 2-3 times each year for new markets to add to our list of suggested markets.

Ambush Trading Example

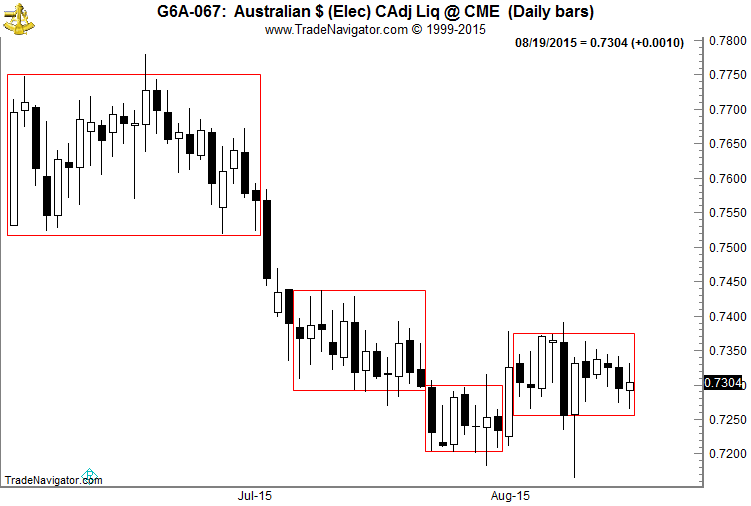

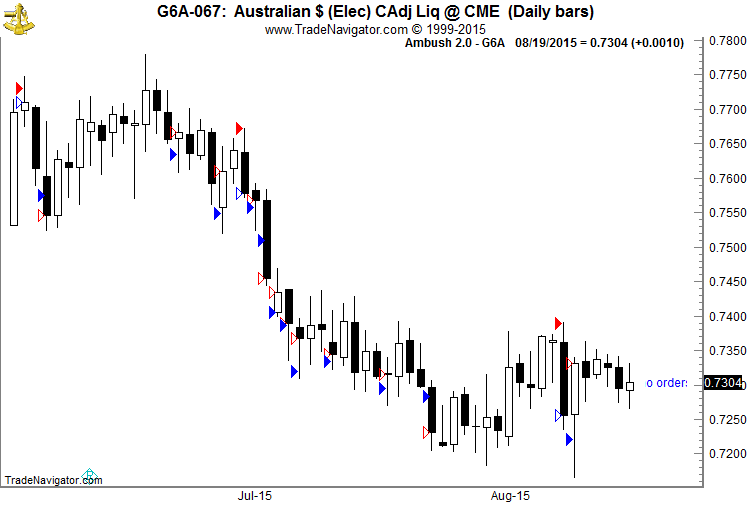

Below is an idea of what an Ambush trade actually looks like.

In looking at the chart below, ask yourself

"Is it possible to successfully trade in such choppy market conditions?"

Daily chart of the Australian Dollar Future (6A, traded at the CME):

The answer is YES, Ambush can.

This example clearly shows how well the concept of Ambush works in a real market. Notice on how many trades we get in around the high/low of the day, and how strongly prices reverse from there.

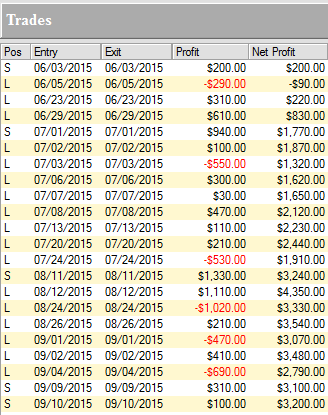

Check out the results of those trades (without commissions):

As you can see, Ambush managed to make a total of $3,200 profits.

Don't sit and watch prices intraday all day long in order to make these trades.

Simply place your orders at the beginning of each new trading day,

place your stop, and walk away.

$1,799.00

Ambush Trading Method™ eBook

Performance Reports for the Ambush Trading Method™

The above Australian Dollar Futures example shown represents just a small sample of trades in only one market. It was a very good period for Ambush in that market, and as you know, it is not always like that. While this gives you an idea of what Ambush trades looks like plotted on a chart, it doesn't tell you anything about the actual long-term performance of the method overall.

And while you can trade Ambush in just one market, it's actually better to trade it in multiple markets at the same time. This way your trading will diversify nicely, and give you more robust results and smaller drawdowns long-term.

Look at our detailed reports for each of the markets. Whether you're interested in Futures or Forex.

What you need

All you need to use with Ambush is daily-charting software of the market you want to trade.

Ambush also uses two indicators which can be found in most charting software programs:

- ATR (Average True Range)

- RSI (Relative Strength Index)

Contact us with quetions regarding Ambush, don't hesitate to get in touch with us!

"I have been trading using the Ambush method since August 2014. I have mainly been trading the 3 currencies - 6A Australian Dollar, 6C Canadian Dollar and 6E the Euro. For the last 5 months of 2014 I was making consistent profits on a monthly basis. Trading only 1 lot I averaged a profit of about $2500 a month! In 2015 due to the euro-crisis and other events Ambush so far has been in a drawdown in two of the three currencies I'm trading but I'm confident that once the markets calm down again, Ambush will perform like it did last year. But being the conservative trader that I am, and knowing that drawdowns are normal trading any method, I decided to stay on the sidelines for now to protect my capital...still overall for me the profits so far by far exceed the losses I experienced during the drawdown!" ~ Clive, South Africa

"I like the ambush trading method, it controls the draw downs which I have experienced with it, while also regaining the loses and making money." ~ R.A., U.S.

"The method looks like it is a great one! Is the first time during my 4 years trading experience that I actually made some money!! The only important issue is that it needs to be done everyday in my experience, or to put it better, the order needs to be there everyday, because missing an important big money trade in the month can make the difference with the Ambush; this is what happened to me, when i started putting the orders daily, my account began growing slowly!" ~ Alberto, Italy

$1,799.00

Ambush Trading Method™ eBook

Orders Filled Within 24 Hours*

All Sales Final on Digital Products

*IMPORTANT: Your order will be fulfilled within 24-hours during our regular business hours. If you have not received instructions via email by that time, please contact us, so we can resend it to you. Be sure to check your junk/spam folder before you contact us. All sales are final.

With Ambush Signals, you can now easily follow the Ambush System on a subscription basis for educational purposes.

CROSS PRODUCT PROMOTION

Combine the Ambush Trading Method™ with Stealth Trader™ and receive 20% off your purchase of Ambush-Stealth-Combo!