Displaying items by tag: trade market

Trading Strategies with Ambush and Stealth Combined

Save 20% instantly with the Ambush & Stealth Trading Methods Combined!

Enjoy the flexibility of trading during any market condition by combining the trading education of the Ambush and Stealth Trading Methods! These products follow completely different trading approaches:

Ambush Trading Method™ is a counter-trend method and Stealth Trader™ is a trend-trading method.

- Ambush Trading Method™ is fading the trend and stays in the market for only one day

- Stealth Trader™ catches the trend and holds on to the trade as long as possible.

- Both trading methods support many different trade markets, including commodity trading, so you'll be diversified in markets and methods!

You no longer have to decide in what market conditions you are trading. Trade both methods at the same time, and let the trading methods do their job.

The Ambush and Stealth Combo Includes:

- Ambush Trading Method™ eBook by Marco Mayer

- Stealth Trader™ eBook by Andy Jordan

- 20% Instant Savings for purchasing the combo

- Personal email support provided by both traders

Orders filled via email within 24 hours and all sales of digital products are final.

$2,196.80 (20% Instant Savings!)

IMPORTANT: Your order will be fulfilled within 24-hours during our regular business hours. If you have not received instructions via email by that time, please contact us, so we can resend it to you. Be sure to check your junk/spam folder before you contact us. All sales are final.

Stealth Trader™

Learn How To Profit from Trading Volatility Breakouts!

Stealth Trader is a complete trend-trading method which holds on to the trend as long as it is productive.

Professional Trader Andy Jordan, creator, uses this method in many U.S. futures markets, and it also works in Forex and some ETFs. You will love the simplicity of this method. When you purchase our Stealth Trader eBook, you'll be entitled to receive personal attention directly from Andy.

History

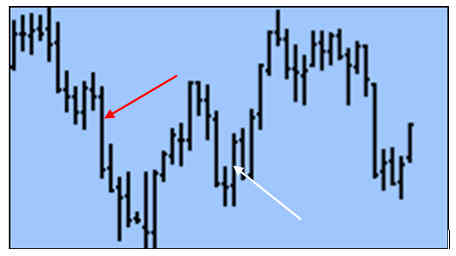

As we study charts, we see that a typical behavior of many markets is to go from "action" into "flat," and then, after some time, back into “action” again, as shown on the chart below. A market can, of course, trend for a long time or go sideways for a couple of weeks, but more often we will see the typical "action – sideways – action – sideways" behavior.

The questions that came to mind were: "Are there any indicators that can show us 'action' and 'flat' in the markets?" and "How good are they at showing us when to enter or when to leave the trade alone?"

As you will discover in the eBook, there are indicators resolving the problems explained above, and they work very well.

The next question was, "Is there any entry technique we can combine with our indicator?" After running a few tests, it ended up with a surprisingly simple entry strategy that you will find in the eBook.

Because testing the methods by hand in various markets is very time-consuming, we started to program the method using a simple stop strategy (you will learn several stop strategies in the eBook). We were amazed to see that the method worked in so many different markets. Please click on "Stealth Performance" on the right menu (Stealth Menu) to see some statistics for over 24 U.S. Futures Markets tested over the last six years.

Important Facts

Total Net Profit: $1,483,803 (Average Yearly Profit in USD $134,615) with a Profit Factor of 1.39. A $5 round turn commissions & 1/2 tick slippage for each stop-markt or market on close order included. No compounding used, trading same number of contracts all the time.

The way the method is programmed is very basic. It simply uses the low (when long) or the high (when short) of the previous bar as the stop loss, no adjustments during the trading day, simply using End of Day charts. Important: You do not need any specific software you can program. Stealth Trader is using a few standard indicators you can find in any other software as well! You will be able to influence the trading results dramatically by using various exit strategies. In the eBook you will find more detail about several ways of managing the trades.

Another important fact is that it stays VERY stable in regard to the variables implemented in the method. We have seen many other methods that require continual adjustment of the variables. When programmed into our software, we had a good idea about the values we wanted to use for the variables. When tested the method with different values, the results stayed very stable. That's an important fact! You do not want to see a method performing very differently only because you changed a few variables. What you want to see is that the performance stays stable even if you slightly change the numbers of your parameters.

$947.00

Stealth Trader™

eBook

Orders Filled Within 24 Hours*

All Sales Final on Digital Products

*IMPORTANT: Your order will be fulfilled within 24-hours during our regular business hours. If you have not received instructions via email by that time, please contact us, so we can resend it to you. Be sure to check your junk/spam folder before you contact us. All sales are final.

CROSS PRODUCT PROMOTION

Combine Stealth Trader™ with the Ambush Trading Method™ and receive 20% off your purchase of Ambush-Stealth-Combo!

Ambush Trading Method™

"AMBUSH" A MARKET OF YOUR CHOICE

Ambush many stock index futures, commodity futures, currency futures, forex pairs, or CFDs markets

Systematic Trader Marco Mayer, our in-house quant-trader has come up with a safer and easier way to trade a large variety of markets, with the potential of locking in a steady stream of profits.

The Ambush Trading Method™ was launched in 2009. It's proven itself in many different market conditions since then, not only in backtests, but also in forward-testing.

Ambush supports a variety of markets, including:

- Futures: Stock Index, Commodity, Currency, and Interest Rates

- Spot Forex Markets

- CFDs on any of the supported markets (results may vary, depending on your broker's quotes)

Ambush is based on Daily charts, so there is no need to sit in front of a screen to watch all day. When the market you want to trade opens, you place your limit entry order and your protective stop, and you go on about your business. You will always close your position on the same day you entered the market. This means there's no overnight risk, and depending on your broker, this can make a huge difference in relation to margin requirements.

"Of the many ways to trade I’ve seen over the years, I have never seen a more stable way to take profitable gains from the market."

Master Trader Joe Ross

Understanding the Ambush Method

The idea of Ambush is actually quite simple. As markets became more and more difficult to trade on a breakout-basis using a daily chart, Marco started to look for a way to exploit that reality. The problem was how to get into a market when many traders are "trapped" in their trades, and how to profit when they lose. This sounds tough, but these are often some of the best trades you can get into.

In other words, you'll "ambush" those traders who're buying or selling when it's statistically a very bad idea to do so, at least on a short-term basis. Odds are their trade will fail, and when it does they'll have to quickly get out, or even reverse their trades, which will drive prices strongly into our direction.

This means Ambush is a counter-trend method on a short-term basis. It doesn't necessarily go against the long-term trend of a market that has been trending for weeks, but it does go against trying to get into the market during short-term trends when the odds favor an intraday-reversal. Still it's based on daily charts and you don't need to watch the markets during the day, which makes it a quite unique method. It actually allows you to profit from significant short-term intraday-moves without being tied to the screen!

Simple Rules

Ambush is not a black-box system. Instead, we give you the complete trading rules which allow you to become really comfortable with the method.

- This method uses simple, clear rules. They tell you exactly:

- At what price to place your limit entry order.

- At what price to place your protective stop-loss.

- When to get out of a trade.

- The exit-rules used by Ambush are very simple. There's no profit target involved, and the stop-loss is only a catastrophic stop-loss. This means that one of the biggest issues of method-development, which is overoptimizing the exits, doesn't apply for Ambush.

- You will become a member of a private section where we post the latest set of market suggestions and specific parameters for fine-tuning the method to each market. The fine-tuning is done in a way that avoids over-optimizing the method, and targets robustness instead of performance. This gives us an additional edge in each of very different markets, while applying the same basic method.

- Since markets change, we continue to look 2-3 times each year for new markets to add to our list of suggested markets.

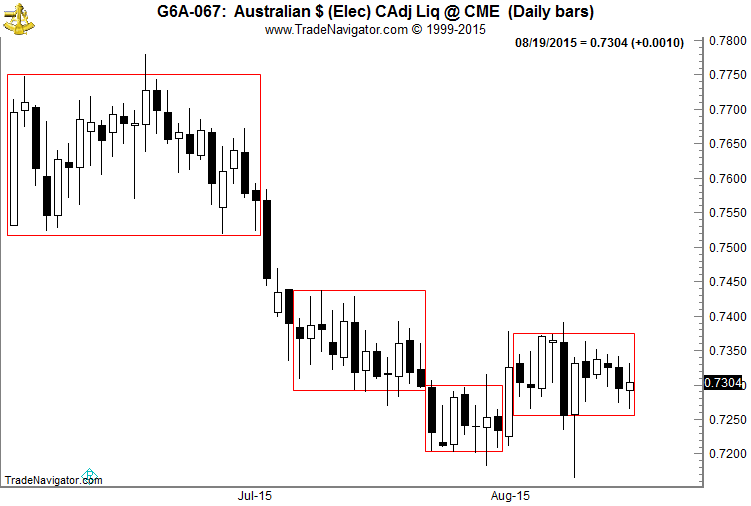

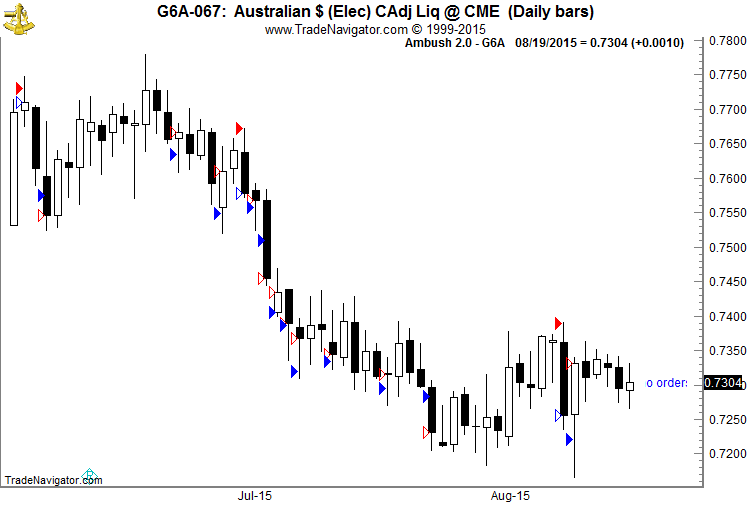

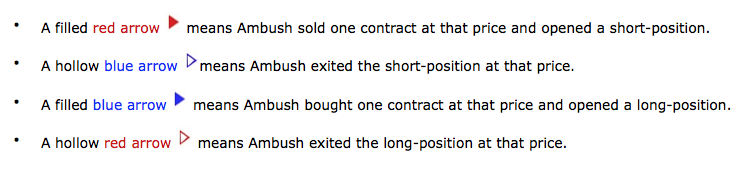

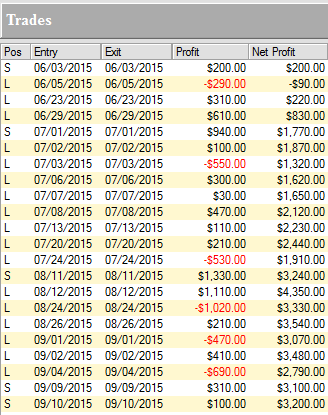

Ambush Trading Example

Below is an idea of what an Ambush trade actually looks like.

In looking at the chart below, ask yourself

"Is it possible to successfully trade in such choppy market conditions?"

Daily chart of the Australian Dollar Future (6A, traded at the CME):

The answer is YES, Ambush can.

This example clearly shows how well the concept of Ambush works in a real market. Notice on how many trades we get in around the high/low of the day, and how strongly prices reverse from there.

Check out the results of those trades (without commissions):

As you can see, Ambush managed to make a total of $3,200 profits.

Don't sit and watch prices intraday all day long in order to make these trades.

Simply place your orders at the beginning of each new trading day,

place your stop, and walk away.

$1,799.00

Ambush Trading Method™ eBook

Performance Reports for the Ambush Trading Method™

The above Australian Dollar Futures example shown represents just a small sample of trades in only one market. It was a very good period for Ambush in that market, and as you know, it is not always like that. While this gives you an idea of what Ambush trades looks like plotted on a chart, it doesn't tell you anything about the actual long-term performance of the method overall.

And while you can trade Ambush in just one market, it's actually better to trade it in multiple markets at the same time. This way your trading will diversify nicely, and give you more robust results and smaller drawdowns long-term.

Look at our detailed reports for each of the markets. Whether you're interested in Futures or Forex.

What you need

All you need to use with Ambush is daily-charting software of the market you want to trade.

Ambush also uses two indicators which can be found in most charting software programs:

- ATR (Average True Range)

- RSI (Relative Strength Index)

Contact us with quetions regarding Ambush, don't hesitate to get in touch with us!

"I have been trading using the Ambush method since August 2014. I have mainly been trading the 3 currencies - 6A Australian Dollar, 6C Canadian Dollar and 6E the Euro. For the last 5 months of 2014 I was making consistent profits on a monthly basis. Trading only 1 lot I averaged a profit of about $2500 a month! In 2015 due to the euro-crisis and other events Ambush so far has been in a drawdown in two of the three currencies I'm trading but I'm confident that once the markets calm down again, Ambush will perform like it did last year. But being the conservative trader that I am, and knowing that drawdowns are normal trading any method, I decided to stay on the sidelines for now to protect my capital...still overall for me the profits so far by far exceed the losses I experienced during the drawdown!" ~ Clive, South Africa

"I like the ambush trading method, it controls the draw downs which I have experienced with it, while also regaining the loses and making money." ~ R.A., U.S.

"The method looks like it is a great one! Is the first time during my 4 years trading experience that I actually made some money!! The only important issue is that it needs to be done everyday in my experience, or to put it better, the order needs to be there everyday, because missing an important big money trade in the month can make the difference with the Ambush; this is what happened to me, when i started putting the orders daily, my account began growing slowly!" ~ Alberto, Italy

$1,799.00

Ambush Trading Method™ eBook

Orders Filled Within 24 Hours*

All Sales Final on Digital Products

*IMPORTANT: Your order will be fulfilled within 24-hours during our regular business hours. If you have not received instructions via email by that time, please contact us, so we can resend it to you. Be sure to check your junk/spam folder before you contact us. All sales are final.

With Ambush Signals, you can now easily follow the Ambush System on a subscription basis for educational purposes.

CROSS PRODUCT PROMOTION

Combine the Ambush Trading Method™ with Stealth Trader™ and receive 20% off your purchase of Ambush-Stealth-Combo!

Day Trading Forex

Master Trader Joe Ross shows you how he does it!

"I hate to see so many aspiring Forex traders losing their money. Why do they have to make everything so complicated when, in fact, it’s not at all hard to win? In this eBook I show you trips and traps of Forex day trading. You need to know them in order to avoid the fate of so many other traders." ~ Joe Ross

Message from Joe Ross

I’ve been trading Forex for many years, even before there was such a thing as retail Forex, and before more and more people decided to become Forex traders. Trading Forex is heavily marketed and popular, but it is also deadly. The correspondence I receive attest to the fact that most people who attempt to day trade Forex are losing their money. The turnover rate is atrocious. Because of the pain I’ve seen, I decided that I will show you how I day trade the currency pairs.

Learn where to find more safety in your trading, and where the greatest Forex profits are made. The Day Trading Forex eBook gives you detailed answers to vital questions, such as knowing which currency pairs to trade, which time frame to use, and where to set your profit-taking objectives and your protective stop.

Day Trading Forex Highlights and What You Can Learn:

Chart Reading – The Law of Charts

You will learn to identify the basic formations of The Law of Charts: what they are, what they mean, and how to trade them in the Forex market. You will see how I trade the Ross Hooks and consolidations. I reveal a fantastic way to implement The Law of Charts (TLOC), namely the Traders Trick Entry (TTE), together with simple ways of using it in your trading.

I always like to remind traders that "a chart, is a chart", and Forex charts are no different from any other kind of chart. Forex charts show you human emotional reaction to the movement of prices. It’s the same as with stocks or futures charts. As they say, "a picture is worth a thousand words." On that basis, you are going to find many thousands of words in this eBook. It will truly help you to understand and implement The Law of Charts in your trading.

Identifying Consolidations and Finding Trends

Are you aware that currencies trade sideways 85% of the time? Do you know how to make money when they are doing just that? Please take a look at the chart below: do you know what it means when prices have formed as between the two red lines below?

You will find the answer to that question, and many more. It is vital to recognize congestions at the earliest possible time. In fact, you'll see how to identify sideways markets before anyone else realizes they are beginning to consolidate. In order to do that, the book has been "loaded" with graphic examples.

Your Own Trading Plan

Please look at the chart below: do you know why someone sold at the red arrow and someone bought at the white arrow? You will find out why in a fascinating way, through the help of a single graphic representation. You will discover precisely where to have your entry order, what your initial objective should be, and where to best place your protective stop.

You will learn to set up your own trading plan simply by using price charts, and with almost no indicators. The ones used will greatly help you in filtering and managing your trades, but your main focus will be on the price action as seen on the chart. Charts will also help you figure out which pair to trade, and which time frame best fits your comfort zone.

Trade Management and the Costs of Running your Trading Business

It is not only risk management that you need to know about in order to successfully day trade Forex. You will learn other aspects of management, things that most traders ignorantly ignore. For example, you will learn how business management, risk management, trade management, and personal management are all part of the picture, not just money management. This information alone will save you thousands of dollars. You need to know the concepts and the realities of how a "bucket shop" operates, about the leaning and skewing of prices, as well as the myths of "free streaming data" and the "guaranteed fills". It’s all true, as will be explained to you. You will also see that Forex trading is not without heavy overhead in the form of the spread you pay to trade. You will discover the most important things you need to know about Forex regulation and brokers.

Commonly Asked Question

What's the difference between the Day Trading Hardback Book, the Day Trading E-Mini S&P 500 eBook, and the Day Trading Forex eBook? The Day Trading book is a full-sized textbook that is loaded with lessons, examples taken from real trades, and reveals many concepts to succeed at trading. The Day Trading E-Mini S&P 500 eBook teaches you how to day trade in almost any market, along with some concepts that go beyond what is in the Day Trading book, and focuses specifically on the E-Mini S&P 500. The Day Trading Forex eBook teaches concepts that are not in the other two products; it can be used in a variety of markets, but focuses on Forex.

"Joe's Day Trading Forex book has been an invaluable source of information about the most traded market in the world. I got not only the proper way to trade this market with plenty of example and clear explanations but also how to create good habits to become a profitable trader. Truth is together with this book and Daytrading Joe's book I have been trading smarting and my account has benn growing since then slowly but surely." ~ Johnny A., USA

"I have been following the Joe Ross method for years. At one time I owned my own day trading firm and taught his method to my traders. Many used it successfully, others used their own method. The EBbook is very detailed and when followed gives you a direct, set of plans that you can write down and consistantly use." ~ Michael H., USA

"EXCELLENT practical outline of trading forex using the raw mechanics of the market (price action, order / flow, participant overview) coupled with proactive analysis, trade management, entry and exit techniques). Most notably, it works!" ~ George P., Australia

"I feel confident with the material because of Joe's age and experience in the market. I also feel his material is very simple to remember and apply in my daily reading of the market." ~ Steen N., Denmark

"As usual, another great work about markets, in this case Forex. Joe discovers new ways to trade Forex market, to manage risk and stablish profits." ~ Carlos L., Spain

"Joe as usual has great insights about the trading process. They're different from other run of the mill trading products or services." ~ Eugene T., Singapore

$127.00

Day Trading Forex

eBook

Orders Filled Within 24-Hours*

All Sales Final on Digital Products

*IMPORTANT: After your order has been verified, an email will be sent within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.