Displaying items by tag: futures trading

Trading Spreads and Seasonals

Discover One of the Best Kept Trading Secrets in the Markets

EBOOK VERSION COMING SOON!

"In trading, you're not paid for analyzing charts. You're not paid for calling in the order. What you are paid for is successfully managing the position while it's on." ~ Marshall Sass

Message from Joe Ross

"In Trading Spreads and Seasonals, it is my purpose to teach you everything I can about the wonderful trading vehicles created by seasonality. I hope to go beyond anything you may have encountered in the past. This course is organized according to degree of risk rather than order of complexity. The first part of the course deals with seasonal spreads, the second part with outright seasonal trades in futures. You will discover the trading secrets many full-time traders use on a daily basis to exploit the markets for their own financial gain, at the expense of the "little guys." In my opinion, spreads, when traded properly, carry considerably less risk than do other forms of trading."

Spread trading is quietly kept secret. Why? Because spread trading completely eliminates stop running. Do you think the insiders want you to know that? What would they do if they didn't have your stops to run?

Spreads and seasonal trading are like "insider trading" because that's what traders in-the-know do! What I'm talking about is a different kind of "insider trading" – trading based on the knowledge, experience, and expertise of successful traders who know the inside story of how markets work, and how to get the best out of them. They've done exactly that - time and time again.

Highlights and Benefits

Avoiding the worst nightmare of all traders, and landing in a trading paradise

Did you know that you can considerably minimize the risk of a position so that you might hold it overnight? What about the luxury of being able to avoid the worst nightmare of all traders - stop loss running?

You will learn how to achieve both of these results, and more than that, how to do it using as little as one-tenth the margin required for outright futures trades. You will also learn how to trade during periods of extreme volatility, and be much less concerned with liquidity, by using spreads. You can trade spreads in markets where you dare not go in outright futures.

By learning how to trade spreads, you will feel as if you have landed in a "trading paradise" because you will not be worried at all about the direction of prices. And if you do care about the direction of prices, you will find out that spreads trend more often, more steeply, and much longer than do outright futures.

How to select and filter seasonal spread trades

Seasonal spreads are among the best possible trades for those who are willing to wait for these excellent opportunities to come along. And, they come along often. Many spread trades work 100% of the time, for periods spanning 15 years or more. You will learn that over the years, spreads have a huge advantage of a very high degree of reliability.

You will also learn how to filter seasonal spreads in order to obtain the very best results. A lot of money can be lost by blindly taking these trades based upon computer-generated dates for entry and exit. Seasonal spreads can be heavy losers in those years when they fail to work as predicted by computer-generated studies. However, you will filter your trades so that you get the ones that work 80% or more of the time.

Using technical indicators to trade spreads

Not all traders enjoy trading based only on chart patterns. That’s why Joe shows you how to use technical indicators that are able to help you see forces in the market that are unlikely to be clear without some sort of visual aid. You will learn how to use technical indicators that Joe has found useful in trading spreads, whether they are seasonal or non-seasonal in nature.

You will be able to graphically display certain market properties not otherwise easily seen. You will see how to use these indicators, how to select, and keep them simple, and how to make sure you use no more than two that represent different aspects of the market.

Why and how to trade seasonal futures

In their anxiety to get rich quickly, most traders ignore seasonality in trading futures. Few have the patience to wait for seasonal windows to benefit from an enhanced opportunity for success. Joe teaches you the advantages of seasonal trading deriving straight from the battle of the giants: the commercials and the producers.

You will learn who has power, and how these forces can affect seasonality in various commodity markets. You will see how you can benefit from producer cartels that attempt to control prices. You will see how to offset the effects of commercial domination. As a wise trader in the market, you will be aware of seasonal tendencies, and trade accordingly.

Reality trading

Trading is not a problem for most of the participants in the market. You will find out that it is not your lack of knowledge about trading that keeps you from succeeding in the markets. You will be given a realistic look at the spreads and seasonal concept of "how to trade the trade."

You will understand why entry technique is all well and good, but it is only a small part of trading. A much more important aspect of trading is that of having a strategy, and then deploying the tactics that will fulfill the intent of that strategy.

You will learn the answer to "What do I do next?" Once you’re in the trade, you have to know what to do next. You will be amazed about what can be discerned from careful inspection of a chart as the trade progresses. You will find out the problems you might run into during the course of a seasonal trade. Finally you will learn when and how to bend a few rules, or even throw a few out, because in real trading rules don’t always work.

Seasonal trend and seasonal spread trading have been around for many years, and are wonderful ways to trade in today’s frantic markets. The art of using these trades has recently disappeared from the public eye. Amazingly, this knowledge is just as valid in today’s markets as it has ever been, and can be quite profitable for the trader who is willing to pursue it.

Trading Spreads and Seasonals is a truly complete trading guide

"Spreads and Seasonals are simple but require a skill set and knowledge to maximize profits and minimize losses. This book outlines to the point on when to enter a trade, how to manage and exit. Risk control and market assessment is there in easy to understand language throughout. You would be a foolish trader to ignore these set ups and even more foolish if you fail to apply them! Risk is one thing but this book isn't a risk to your pocket."

~ DK

"Joe defines spreads, describes their various types, points out in which markets they are most viable, and discusses their advantages and disadvantages. This book is not a theoretical, conceptual treatise, however. It takes a hands-on how-to approach in not illustrating only those spreads which succumb to his theories. He wants to educate readers for real-time trading – how to find spreads, filter them, analyze them, and place orders. He also shows how just a couple of well-known technical indicators can further filter and enhance entry and exit."

~ Jerry Toepke, Editor Moore Research Center, Inc.

"The book gives a very clear, step by step explanation of spread trading. Plenty of examples and a huge quantity of wisdom."

~ Marc d.M., Netherlands

EBOOK VERSION COMING SOON!

- managing positions

- spreads

- spread trading strategies

- spread trading

- trading seasonals

- seasonal spreads

- trading secrets

- financial gain

- spreads less risk

- eliminate stop running

- futures trading

- technical indicators

- seasonal futures

- commodity markets

- entry technique

- maximize profits

- minimize losses

- Long Term Trading

- futures

- commodity futures

- ETFs

- stocks

Trading is a Business

A Life-Changing Book for Traders

"WARNING: This is a nasty book. It will take you apart at the seams, point out your weaknesses as a trader, and then attempt to resurrect you as a successful, self-disciplined person who can control his trading in a businesslike manner. If you cannot stand constructive criticism, or if you do not wish to succeed as a futures trader, I suggest you lay this aside now and ignore it."

~ Joe Ross

eBOOK VERSION COMING SOON!

Joe Ross named this book Trading Is a Business because, in teaching traders and would-be traders, he found that there are few indeed who realize they must take a self-controlled, business-like approach to trading. Virtually all new traders abandon the solid principles of sound personal management that make for successful careers in the business and professional world. For most traders, trading is a "fantasy land."

Eighty percent of traders are on the right side of the market when they enter a trade, yet overall, ninety percent of them lose money in the markets. Why? Because no one shows them how to properly manage what takes place after they get in, either in the markets or within themselves!

In this book, you will discover the real problem in the market. The realization of the Truth that Joe reveals will forever change your perception of the markets, enabling you to concentrate on the only action that you can take to become a winner.

Joe teaches you how to run your trading life just as a successful businessman does with his own business. The book is structured in two big parts: the first part shows you how to develop the mindset of a successful trader; in the second part you learn outstanding trading techniques, and how to build your own trading plan.

Highlights and Benefits

Most Traders Know How to Trade

Trading is not a problem for most of the participants in the market. You will find that it is not your lack of knowledge about trading that keeps you from succeeding in the markets. Joe goes into the details of the most fundamental personality skills that are known to man in the area of self-discipline. In addition, he helps you to really understand the nature of many management areas related to trading, some of which you have probably never considered.

If eighty percent are on the right side of the trade when they enter the market, then where do they go wrong? You will be amazed by the answers to this question. They are manifold, and in this part of the book Joe addresses many psychological reasons that keep traders from the success they seek.

Mental Gridlocks

By now you know you cannot change the markets. Joe shows you that the only way to successfully trade them is to change your behavior in relation to them. Because the mental, emotional, and even spiritual aspects of your life can be part of the stakes involved, trading cannot be played as a game.

Human beings excel at pattern recognition, and they have the ability to use patterns together with rules and procedures. However, you will learn that at times you must challenge and change these rules. Joe teaches you how to do that, and then shows you a great truth: it is traders’ perception of what is happening that causes both the actions and movement of price.

Joe demonstrates that trading less leads you to making more money. You will also understand why trading based on opinions is a sure way to a “death sentence” in the markets. In addition, Joe helps you identify, handle, and deal with the many hang-ups that cause traders to lose in the markets.

Self Examination

What Joe shows in this section is far beyond what you can find in the best self-development books ever written, and it relates 100% to your trading. If you are to succeed in any aspect of life, you must develop traits that consistently strengthen, and keep you on the right side of what you’re doing.

Joe tells you how to be resourceful, diligent, flexible, and knowledgeable in your trading. He also lightens your learning path, and shows you how to avoid overtrading, expecting too much from a trade, thinking trading is an investment, or simply looking for the Holy Grail where there is none.

Making Profits in the Markets

This book is not about how to trade, but about how to make money trading. In this section, Joe shows you how to manage your revenue (winning trades) and your costs (losing trades, commissions, slippages, etc.) in the trading business, just as any owner must run his business to become and stay successful.

You will learn two distinct ways to take profits, ways to use the size of your account margin to your advantage, and to scale your trading. Here you will also discover Joe’s famous “Patterns for Success” entry signals, and the Traders Trick Entry.

What does Management in Trading really mean?

Just about any manager knows what business management means. But really, how do its functions translate to trading? What are planning, organizing, delegating, directing, and controlling when it comes to trading? Let Joe explain them to you, if you are serious about making a business out of trading. He is speaking from his experience of over 5 decades of trading the markets.

You will find a ton of books out there, all talking about magic indicators, and about how to enter the market - but what are you supposed to do once you get in? They rattle on about money management, telling you that all you have to do is keep losses small and let your profits run, but by now you know it isn't all that easy. Just exactly how do you keep losses small and let your profits run? You will find the answers to all these questions, and many more, in this book.

At Trading Educators we talk about money management too, but we also talk about self-management, trade management, risk management, and business management. Truthfully, without personal management and self-control, money management just won't cut it. Joe gets into the details of each of these important aspects of management, and how they affect your trading.

The Real Problem in the Market

You will find out what the real problem in the market is, and your realization of what Joe reveals to you will change your entire approach to markets. It will enable you to focus on the only thing you can do become a winner. Whether you do that thing methodically, systematically, or haphazardly may affect the degree of success you can have, but is of no consequence to the truth you’ll discover.

Message from Joe Ross

My main objective in this book is to help you build the right character and have the correct mindset to be a successful trader. I'll show you how to manage not only the trade, but most important of all, how to manage yourself! You will learn a self-controlled, business-like approach to trading.

Trading Is a Business teaches you how to run your trading as a business

"Hi Joe, I received your books, and reading Trading Is a Business, I realized it takes a lot of courage to write that. Congratulations. Because it tells the truth, and truth always hurts. Maybe because we compare reality with our imagination. Surely our fantasy world is a lot nicer. Well, I think I got the message, so I'll re-read the other five. Then I hope I'll be ready to meet you, I saw you travel to Europe sometimes."

~Dr. Kirschbaum

"Hi Joe,I can relate to making most of the mistakes you list in your book Trading Is a Business. The ones that hit home the most have been being dishonesty with myself, trading what I think and not understanding risk and losing. Hey what a package! I do believe all of these traits can be eliminated though education and discipline."

~James R.

"If you feel that you have the skill to trade, then you must read "Trading Is a Business". Joe outlines the rules, techniques, and discipline needed to succeed in the market. Every trader should read and re-read this book."

~Keith Ellis

eBOOK VERSION COMING SOON!

Day Trading Forex

Master Trader Joe Ross shows you how he does it!

"I hate to see so many aspiring Forex traders losing their money. Why do they have to make everything so complicated when, in fact, it’s not at all hard to win? In this eBook I show you trips and traps of Forex day trading. You need to know them in order to avoid the fate of so many other traders." ~ Joe Ross

Message from Joe Ross

I’ve been trading Forex for many years, even before there was such a thing as retail Forex, and before more and more people decided to become Forex traders. Trading Forex is heavily marketed and popular, but it is also deadly. The correspondence I receive attest to the fact that most people who attempt to day trade Forex are losing their money. The turnover rate is atrocious. Because of the pain I’ve seen, I decided that I will show you how I day trade the currency pairs.

Learn where to find more safety in your trading, and where the greatest Forex profits are made. The Day Trading Forex eBook gives you detailed answers to vital questions, such as knowing which currency pairs to trade, which time frame to use, and where to set your profit-taking objectives and your protective stop.

Day Trading Forex Highlights and What You Can Learn:

Chart Reading – The Law of Charts

You will learn to identify the basic formations of The Law of Charts: what they are, what they mean, and how to trade them in the Forex market. You will see how I trade the Ross Hooks and consolidations. I reveal a fantastic way to implement The Law of Charts (TLOC), namely the Traders Trick Entry (TTE), together with simple ways of using it in your trading.

I always like to remind traders that "a chart, is a chart", and Forex charts are no different from any other kind of chart. Forex charts show you human emotional reaction to the movement of prices. It’s the same as with stocks or futures charts. As they say, "a picture is worth a thousand words." On that basis, you are going to find many thousands of words in this eBook. It will truly help you to understand and implement The Law of Charts in your trading.

Identifying Consolidations and Finding Trends

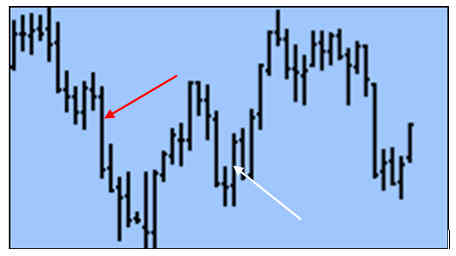

Are you aware that currencies trade sideways 85% of the time? Do you know how to make money when they are doing just that? Please take a look at the chart below: do you know what it means when prices have formed as between the two red lines below?

You will find the answer to that question, and many more. It is vital to recognize congestions at the earliest possible time. In fact, you'll see how to identify sideways markets before anyone else realizes they are beginning to consolidate. In order to do that, the book has been "loaded" with graphic examples.

Your Own Trading Plan

Please look at the chart below: do you know why someone sold at the red arrow and someone bought at the white arrow? You will find out why in a fascinating way, through the help of a single graphic representation. You will discover precisely where to have your entry order, what your initial objective should be, and where to best place your protective stop.

You will learn to set up your own trading plan simply by using price charts, and with almost no indicators. The ones used will greatly help you in filtering and managing your trades, but your main focus will be on the price action as seen on the chart. Charts will also help you figure out which pair to trade, and which time frame best fits your comfort zone.

Trade Management and the Costs of Running your Trading Business

It is not only risk management that you need to know about in order to successfully day trade Forex. You will learn other aspects of management, things that most traders ignorantly ignore. For example, you will learn how business management, risk management, trade management, and personal management are all part of the picture, not just money management. This information alone will save you thousands of dollars. You need to know the concepts and the realities of how a "bucket shop" operates, about the leaning and skewing of prices, as well as the myths of "free streaming data" and the "guaranteed fills". It’s all true, as will be explained to you. You will also see that Forex trading is not without heavy overhead in the form of the spread you pay to trade. You will discover the most important things you need to know about Forex regulation and brokers.

Commonly Asked Question

What's the difference between the Day Trading Hardback Book, the Day Trading E-Mini S&P 500 eBook, and the Day Trading Forex eBook? The Day Trading book is a full-sized textbook that is loaded with lessons, examples taken from real trades, and reveals many concepts to succeed at trading. The Day Trading E-Mini S&P 500 eBook teaches you how to day trade in almost any market, along with some concepts that go beyond what is in the Day Trading book, and focuses specifically on the E-Mini S&P 500. The Day Trading Forex eBook teaches concepts that are not in the other two products; it can be used in a variety of markets, but focuses on Forex.

"Joe's Day Trading Forex book has been an invaluable source of information about the most traded market in the world. I got not only the proper way to trade this market with plenty of example and clear explanations but also how to create good habits to become a profitable trader. Truth is together with this book and Daytrading Joe's book I have been trading smarting and my account has benn growing since then slowly but surely." ~ Johnny A., USA

"I have been following the Joe Ross method for years. At one time I owned my own day trading firm and taught his method to my traders. Many used it successfully, others used their own method. The EBbook is very detailed and when followed gives you a direct, set of plans that you can write down and consistantly use." ~ Michael H., USA

"EXCELLENT practical outline of trading forex using the raw mechanics of the market (price action, order / flow, participant overview) coupled with proactive analysis, trade management, entry and exit techniques). Most notably, it works!" ~ George P., Australia

"I feel confident with the material because of Joe's age and experience in the market. I also feel his material is very simple to remember and apply in my daily reading of the market." ~ Steen N., Denmark

"As usual, another great work about markets, in this case Forex. Joe discovers new ways to trade Forex market, to manage risk and stablish profits." ~ Carlos L., Spain

"Joe as usual has great insights about the trading process. They're different from other run of the mill trading products or services." ~ Eugene T., Singapore

$127.00

Day Trading Forex

eBook

Orders Filled Within 24-Hours*

All Sales Final on Digital Products

*IMPORTANT: After your order has been verified, an email will be sent within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.