Displaying items by tag: Long Term Trading

Money Master™

How to Retire with Considerable Wealth

Market: Stocks

"This eBook presents a progression of thought and techniques in using the stock market that causes your money to work for you. If the content of this book were taught in schools, there could be an end to poverty for millions of people." ~ Joe Ross

Message from Joe Ross

The knowledge contained in Money Master, belongs in every home. It should be taught in schools around the world. It belongs to both the worlds of trading and of investing. Anybody can easily find the way to consistent profits by applying the strategies revealed in this eBook.

The beauty of these strategies is that your money will work for you, as the best worldwide businesses make your money grow and compound. There is also little risk in using the strategies in this eBook - so little, in fact, that you will often not even think about risk. The strategies allow you to be as passive or as aggressive as you wish. After the eBook, continue to expand your learning with the Money Master Advanced Strategies™ Recorded Webinar.

Highlights of What You Will Learn

Building the Foundation

Joe Ross wants you to think about this statement, "When I decide I want to own something, I try to buy the best quality for my money." This should also be true for you.

In Money Master, you will discover how to identify the best companies in the world, what their characteristics are, and how to apply the strategies using these great companies to make your money grow and compound.

A Different Mindset

To employ and enjoy the strategies explained in Money Master, you might have to do a complete mental turnaround. Why? Having been a day trader for many years, he used to quickly respond to the movements seen on price charts. However, with the methods you’ll see here, you’ll have lots of time to think, and to plan, as well as to act.

Joe Ross says it best. "When I bought anything as a trader, my profits were based on my expectation that prices would move higher. If prices fell, my heart, along with my hopes, fell with it. Conversely, if I sold something my anticipation was for falling prices. If prices rose, I would suffer a loss. My hope of selling high and buying back at a lower price was shattered, as was a piece of my ego."

However, with the strategies in this eBook, instead of a market meltdown causing you to panic, you won’t mind it at all. Huge market swings will no longer be a problem. You’ll be in for the longer term, and enjoy the situation both when prices rise and when they fall. You’ll have the best of both worlds while your money will be growing and compounding.

Three-Way Collecting

You will learn an amazing way to collect money from different "sources" with little effort. Have you ever collected rent from a house that you owned, even though the house was not occupied? How about a situation in which you could collect rent from a house that you didn't own? You will learn how to do the equivalent of that in the world of investing, and how to put your money to work for you.

The Options Secret

You will learn the options secret, an easy way to trade options so that you profit, by understanding the single most important and surest thing that always works in your favor. It is the opposite of what you hear from brokers and exchanges, and that should not surprise you at all!

By applying what you find in Money Master, you will profit if the market is flat, moves away, or even if it moves slightly against you. Because of that, you will not have to be precise in determining market direction. You will learn to do the opposite of what the public usually does, and you will be profitable.

Being Part of the Best Opportunities Worldwide

If someone comes along and says, "I have a business that makes billions, and I'm willing to let you in on it," shouldn’t you want to get in on it? You’ll see, through several case studies, how you can passively own great businesses, or how you can be a bit more aggressive in doing so. Either way, your money will earn money for you. By applying what you learn, you'll be able to use the strategies to develop your own personal trading and investing style, and your money will compound and grow. All you have to do is to take action now!

Continue Building Trading Knowledge with Money Master Advanced Strategies™ Recorded Webinar

Let Money Master Help You Retire with Considerable Wealth!

"Excellent. I have read the book, and I must say, it is a real eye opener as to the many ways to be successful in the market, and make your money work for you. Methods that I would never have thought of on my own. Looking forward to implementing some of them soon. Joe is down to earth, no hype, the products I have received from you are excellent, and I am a much better trader for them. Thanks Joe, for sharing your knowledge." ~ G.M Travers, USA

"Very interesting and useful to build wealth using income generating strategies combined with the power of "compounding on compounding." ~ M. Dietsch, Germany

"A very concise book about building wealth through the purchase of dividend paying stocks." ~ Joel B., USA

"The contents provided a new perspective with which to put one's money to work. This has been a life changing knowledge and experience for me as I carefully implement the strategies outlined along with the results that I'm seeing. Please keep enlightening us and thank you for sharing Mr. Joe Ross. All of Joe Ross's books that i have purchased in the past have guided me in my quest to become a more successful trader and I was convinced this new e-book will be filled execellent insights into one can master money in order to be wealthy. Thx Joe Ross!!" ~ O. Kunle, Canada

"I enjoyed to read a hands on information. No doubt has been one of the best information about investing, I look forward putting into practice what I´ve leand and look forward learning more about this aproach as well." ~ Edgar C., Mexico

$229.00

Money Master™

eBook

Orders Filled Within 24 Hours*

All Sales Final on Digital Products

*IMPORTANT: After your order has been verified, an email will be sent within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.

The Stop Placement that Makes Sense

"The question I am most consistently asked is "Where do I put the stop?" Therefore, this eBook is about stop placement. Most trading books and articles you read concentrate on entry. This book concentrates on exit. Knowing when to get out of a trade is vastly more important than is getting into a trade." ~ Joe Ross

If you place your stop a certain number of ticks or pips distant from your entry point, or a certain distance from your entry using a percentage basis, you probably are placing your stop in the wrong place. If you place your stop a certain dollar amount from your entry, below "support," above "resistance," or based on a chart pattern, we know you are upside-down in stop placement. Please believe us, there are much better ways! Joe Ross wrote this eBook "Stopped Out" in order to show you four specialized ways for stop placement. Every single one of them is based on reality. Your stops will rarely be where everyone else puts theirs. Your stops will be unique to you, based on your personal risk tolerance, in conjunction with the risk in the market.

One very important thing: the techniques contained in this eBook apply to all markets — stocks, futures, forex, bonds, contracts for difference, spread-betting, and derivatives, regardless of where they are traded, or by which means they are traded. Like everything else we offer, this material is top quality and is profusely illustrated with charts in order to save thousands of words.

Highlights

Exit Stops that Make No Sense

You don’t need to become angry if you have used a kind of stop placement method that makes no sense, just avoid using it in the future! We demonstrate with charts why nonsensical stops will only get you into trouble.

Famous trading advisories tell traders to use a 25% stop loss. Others tell traders to use a 15% stop loss. Why? We‘ve heard traders say something like the following: "I always place my stop 15 units away from my entry." But why? Other traders say "I will risk $300 on a trade." But really, why $300? Yet other traders place their stops above resistance, or beneath support. Have you ever seen prices drop through support like a steel ball in a vacuum? Haven‘t you ever seen prices shoot up through resistance like a rocket on its way to the moon?

Stop placement must take into consideration the realities of the markets. It also has to take into consideration your financial tolerance for loss. In this book, discover ways to allow the market itself to tell you where to place the stop. More than that, the market itself can give you an amount that fits your financial tolerance for loss.

Sensible Exit Stops

You will learn about three specialized exit stops which can be used for your initial stop loss as well as for trailing stops. They all take into consideration the dynamics of the markets. You will also be introduced to a stop technique that enables you to stay in a long-term trend much longer than most traders dare stay in.

We'll show you a wonderful and accurate method for stop placement that can be used from as little as a one-minute chart to a monthly chart, and every conceivable time frame in between. You will learn a stop technique that enables you to successfully stay in medium-term trends and swings. It is a truly powerful stop placement method which is fully adjustable to your personal risk tolerance.

A Method for Staying with a Long-Term Trend

This chapter goes into a method for staying with a long-term trend even during the time of a major retracement. How long? It can be 1 month, 6 months, or up to ten years. How many traders do you know who have ridden a trend for 10 years?

One of the great lessons of trading is that you "can‘t have your cake and eat it, too". If you want to be a long-term trader using this tool, you accept the trade-off that, by keeping you in a trade for a longer time than most traders would normally endure, you give up being able to exit closer to the extreme level of the move that prices make. You learn the lesson of giving up the first and last 10% of a major move, and being happy with the rest of the 80%.

A Unique Method to Optimize Taking the Available Profits

The idea of exiting a winning trade in a timely manner is basic to success. After all, if you can't take the money off the table while it is there, you cannot succeed at trading. However, not all traders have the mental and emotional discipline to exit a trade on time, so this method offers a technically based method for stop placement.

A Method that Uses Volatility to Your Greatest Advantage

There will be no more guessing with this tool, because you will know exactly which time frame to be in. It will even tell when you shouldn’t trade at all. It keeps you out of markets and time frames you should avoid.

You’ll discover the settings Joe uses for this pure volatility indicator, but you are free to choose your own. With this stop placement technique, you will be able to personalize both your risk and your objective for every trade. That’s true! Imagine yourself being able to not only fine-tune your stops, but being able to fine-tune your objectives as well.

A Comprehensive Stop Placement / Trade Management Device - "The proof is in the pudding"

You will discover the most comprehensive stop placement/trade management device you have ever seen. It was created for our own use. Before trading, wouldn't you like to know exactly what your chances of winning?

You learn how to create your very own worksheet with which you can see how your own trading implementations are working. Once you get the feel of the work done to produce the worksheet, your understanding of how to manage risk, stop placement, and objectives will skyrocket.

We give you full exposure to how we use this trade management worksheet to trade 46 real trades in the euro. You will see how he sets up and organizes the necessary data, and then we'll show you what you should include in yours.

$167.00

Stopped Out!

eBook

Orders Filled Within 24-Hours*

All Sales Final on Digital Products

*IMPORTANT: Your order will be fulfilled within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.

Day Trading Forex

Master Trader Joe Ross shows you how he does it!

"I hate to see so many aspiring Forex traders losing their money. Why do they have to make everything so complicated when, in fact, it’s not at all hard to win? In this eBook I show you trips and traps of Forex day trading. You need to know them in order to avoid the fate of so many other traders." ~ Joe Ross

Message from Joe Ross

I’ve been trading Forex for many years, even before there was such a thing as retail Forex, and before more and more people decided to become Forex traders. Trading Forex is heavily marketed and popular, but it is also deadly. The correspondence I receive attest to the fact that most people who attempt to day trade Forex are losing their money. The turnover rate is atrocious. Because of the pain I’ve seen, I decided that I will show you how I day trade the currency pairs.

Learn where to find more safety in your trading, and where the greatest Forex profits are made. The Day Trading Forex eBook gives you detailed answers to vital questions, such as knowing which currency pairs to trade, which time frame to use, and where to set your profit-taking objectives and your protective stop.

Day Trading Forex Highlights and What You Can Learn:

Chart Reading – The Law of Charts

You will learn to identify the basic formations of The Law of Charts: what they are, what they mean, and how to trade them in the Forex market. You will see how I trade the Ross Hooks and consolidations. I reveal a fantastic way to implement The Law of Charts (TLOC), namely the Traders Trick Entry (TTE), together with simple ways of using it in your trading.

I always like to remind traders that "a chart, is a chart", and Forex charts are no different from any other kind of chart. Forex charts show you human emotional reaction to the movement of prices. It’s the same as with stocks or futures charts. As they say, "a picture is worth a thousand words." On that basis, you are going to find many thousands of words in this eBook. It will truly help you to understand and implement The Law of Charts in your trading.

Identifying Consolidations and Finding Trends

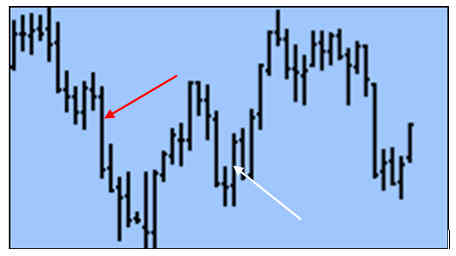

Are you aware that currencies trade sideways 85% of the time? Do you know how to make money when they are doing just that? Please take a look at the chart below: do you know what it means when prices have formed as between the two red lines below?

You will find the answer to that question, and many more. It is vital to recognize congestions at the earliest possible time. In fact, you'll see how to identify sideways markets before anyone else realizes they are beginning to consolidate. In order to do that, the book has been "loaded" with graphic examples.

Your Own Trading Plan

Please look at the chart below: do you know why someone sold at the red arrow and someone bought at the white arrow? You will find out why in a fascinating way, through the help of a single graphic representation. You will discover precisely where to have your entry order, what your initial objective should be, and where to best place your protective stop.

You will learn to set up your own trading plan simply by using price charts, and with almost no indicators. The ones used will greatly help you in filtering and managing your trades, but your main focus will be on the price action as seen on the chart. Charts will also help you figure out which pair to trade, and which time frame best fits your comfort zone.

Trade Management and the Costs of Running your Trading Business

It is not only risk management that you need to know about in order to successfully day trade Forex. You will learn other aspects of management, things that most traders ignorantly ignore. For example, you will learn how business management, risk management, trade management, and personal management are all part of the picture, not just money management. This information alone will save you thousands of dollars. You need to know the concepts and the realities of how a "bucket shop" operates, about the leaning and skewing of prices, as well as the myths of "free streaming data" and the "guaranteed fills". It’s all true, as will be explained to you. You will also see that Forex trading is not without heavy overhead in the form of the spread you pay to trade. You will discover the most important things you need to know about Forex regulation and brokers.

Commonly Asked Question

What's the difference between the Day Trading Hardback Book, the Day Trading E-Mini S&P 500 eBook, and the Day Trading Forex eBook? The Day Trading book is a full-sized textbook that is loaded with lessons, examples taken from real trades, and reveals many concepts to succeed at trading. The Day Trading E-Mini S&P 500 eBook teaches you how to day trade in almost any market, along with some concepts that go beyond what is in the Day Trading book, and focuses specifically on the E-Mini S&P 500. The Day Trading Forex eBook teaches concepts that are not in the other two products; it can be used in a variety of markets, but focuses on Forex.

"Joe's Day Trading Forex book has been an invaluable source of information about the most traded market in the world. I got not only the proper way to trade this market with plenty of example and clear explanations but also how to create good habits to become a profitable trader. Truth is together with this book and Daytrading Joe's book I have been trading smarting and my account has benn growing since then slowly but surely." ~ Johnny A., USA

"I have been following the Joe Ross method for years. At one time I owned my own day trading firm and taught his method to my traders. Many used it successfully, others used their own method. The EBbook is very detailed and when followed gives you a direct, set of plans that you can write down and consistantly use." ~ Michael H., USA

"EXCELLENT practical outline of trading forex using the raw mechanics of the market (price action, order / flow, participant overview) coupled with proactive analysis, trade management, entry and exit techniques). Most notably, it works!" ~ George P., Australia

"I feel confident with the material because of Joe's age and experience in the market. I also feel his material is very simple to remember and apply in my daily reading of the market." ~ Steen N., Denmark

"As usual, another great work about markets, in this case Forex. Joe discovers new ways to trade Forex market, to manage risk and stablish profits." ~ Carlos L., Spain

"Joe as usual has great insights about the trading process. They're different from other run of the mill trading products or services." ~ Eugene T., Singapore

$127.00

Day Trading Forex

eBook

Orders Filled Within 24-Hours*

All Sales Final on Digital Products

*IMPORTANT: After your order has been verified, an email will be sent within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.

Day Trading Strategy with E-Mini S&P 500 eBook

"Day trading the E-Mini can be a full-time career for any trader; if you are going to day trade, you may need nothing more than the E-Mini. In this eBook, Joe Ross shows you a better, most sensible approach to day trading the E-Mini, based on my own trading experience." ~ Joe Ross

The E-Mini has become the premier market for day trading by retail traders and can be a full-time career for any trader. Day Trading the E-Mini S&P 500™ eBook introduces techniques and methods for day trading the E-Mini S&P 500 futures developed by Joe Ross. After you absorb these lessons additional trading education is available via books, webinars and private tutoring to become a profitable E-Mini day trader!

What do you need to get started with E-Mini trading? For the most part, all you need is a set of charts. No technical studies for trading this market are needed. By the third or fourth bar inclusive of and following the opening, you can sit back to enjoy the fantastic trading patterns made by the E-Mini as it marches towards its session close. Find these secrets in the Day Trading the E-Mini S&P 500™ eBook.

The Day Trading the E-Mini S&P 500™ eBook will teach you:

- Preparation – plan for success

- Steps to prepare each day for when the market opens.

- What considerations to look for early.

- How to think like a “market mover” and see through the charts.

- Set healthy expectations and use sound trade management.

- Expectations – the right mindset is crucial

- Learn to understand market situations.

- Learn to form healthy expectations from each day and situation.

- Learn when to trade and when to stay away.

- Tools of the trade – execute trades successfully

- Chart reading – learn how to read charts and understand reasons prices are moving.

- Trade selection – review the trading session and entry signals. Successful day trading strategy relies largely on trade selection.

- Trade management - learn how to set objectives and how to set protective stops, including how to know when to exit immediately.

- Timing – is everything

- Morning – learn when to leverage E-Mini trading in the morning.

- Afternoon – learn when to leverage E-Mini trading in the afternoon.

- Slow Times – learn what to do when markets become slow.

- Trading without indicators – is entirely possible

- Learn to trade with or without indicators on charts.

Take a Sneak Peek at topics included in Day Trading the E-Mini S&P 500™ eBook with the Table of Contents.

"Joe, I'm very glad that you spent the time to write a new actualized book on how to day trade the E-Mini. It reveals new insights on how to analyze that market and especially important on how to manage the trade properly. In my opinion it's a very helpful supplement to your hardbound Day Trading Book you wrote some years ago. I read all your books you wrote in the past regarding trading futures and I never regretted it. In fact, I learned so much from it I'd never had learned anywhere else. So, your eBook is no exception - great insights and extremely useful for becoming a successful trader. That eBook isn't for the shelve but really for the daily use on my trading desk!" ~ Stefan N., Germany

"Joe's approach is simple, straightforward and, most of all, it works. I've taken the same approach and applied it to forex and it works! I've purchased all of Joe's trading books and have never regretted a single purchase." ~ Chris H., Japan

"It’s good solid information...just as you would expect from Joe." ~ Alan B., France

"Just fabulous! Thank you so much Joe. After 3 years of trading, I'm finally coming out of the wilderness. I now understand exactly where I was going wrong. SO simple, but yet so difficult to see without Joe's help." ~ Eloise G., Australia

$127.00

Day Trading the E-Mini S&P 500™ eBook

Orders Filled Within 24-Hours*

All Sales Final on Digital Products

*IMPORTANT: After your order has been verified, an email will be sent within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.