Edition 607 - January 29, 2016

The first month of the new year has almost ended, with hopes of trading successes during this volatile market coming to fruition. Trading Educators is here to help plant information which ensures deep roots for solid and steady growth.

A reminder that our Trader Survey is still available until February 5, 2016. The link is located at the top of our newsletter. Feel free to participate - we value your input. Thank you. Click here to participate, it takes about five minutes, and receive a 30% off coupon and an entry into a drawing for one-hour mentoring.

Aggressive/Conservative

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

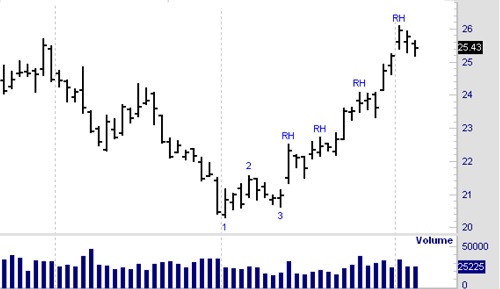

Prices were moving down. We see an end to selling, which was the low at point 1. As prices started to rise, shorts began to cover in order to take profits. Their buying, aided and abetted by the entry of longs who thought this was the bottom, caused prices to rise to the number 2 point. Some longs, looking for a quick profit, began to sell. They were joined by traders who felt that what they were seeing was a minor market rally. Prices headed back down to the number 3 point.

However, there was not enough supply at those low prices to warrant continued selling, so demand took the market higher. As prices rose, selling came into the market as longs liquidated all or part of their position, creating a Ross Hook (RH). Prices then violated the high of the Ross Hook, and a new uptrend was established.

Prices were moving up, and several corrections took place. These corrections were caused by longs taking profits. They sold in order to cover their positions, thereby causing the market to correct. The corrections left behind a minor or intermediate high which we call the point of the Ross Hook.

Aggressive traders might have wanted to go long 25.67 using the Traders Trick Entry (TTE).

Conservative traders might have wanted to wait for prices to break above the Ross Hook at 26.11 before establishing a long position in Bean Oil.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea with Commentary

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

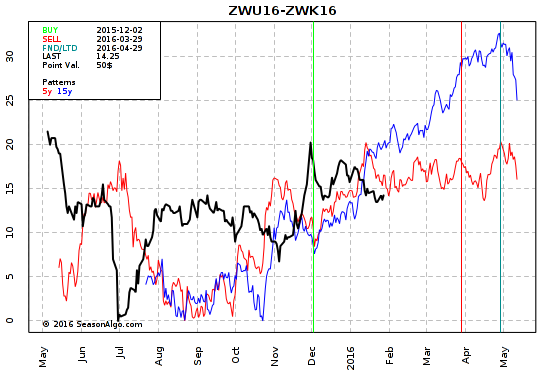

We are looking into a Wheat calendar spread ZWU16-ZWK16: long the September 2016 and short the May 2016 Chicago Wheat. Andy, in his video, explains precisely how he would manage the entry and the risk.

As an added value for our customers, Andy Jordan has provided a 3-minute video that delves deeper into understanding what is on the chart above.

Profitable trades are attainable! To find out how to manage this and other trades, and also to receive our daily detailed trading newsletter, subscribe to Traders Notebook.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article

by Master Trader Marco Mayer

Educator for Forex and Futures, System Trader, and Creator of Ambush Trading Method

Hi Marco, I’ve read that what really matters in trading are exits, not entries. The book stated that even random entries can make money with the right exits. Is this true?

Ah, another often-repeated misconception in the world of trading! I really like to get these questions from traders in order to correct their misinformation. In past articles I’ve answered questions from traders such as "is the right psychology/mindset all I need to be successful?" and "is careful money-management all I need to succeed?" Now there’s usually some truth in those statements, but they always go a bit too far in the other direction. Balance and common sense are ultimately what’s going to make things work. Traders have found my writings to be helpful in becoming a successful trader, so including this question, at some point I’ll have enough of these to publish a book.

Let’s get back to the question at hand. Which one is more important, how to enter or how to exit a trade? In my experience, both are equally important, and actually impossible to separate. There are good and bad exits for different kinds of entries.

Just think about it logically. Let’s say we have three strategies.

- A long-term trend-following strategy in which we try to capture moves that last weeks to months. Naturally, we don’t want to set profit targets here, since we know it’s the huge winners who will make this work long-term. For that, we’re willing to give back huge parts of open profits.

- A short-term breakout strategy in which we want to capture a possible breakout lasting for a few days, trying to not give too much back.

- A short-term mean-reversion strategy in which we’re unsure as to when the market will reverse. We want to give it some room, but as soon as it does bounce, we want to take profits quickly.

Could we use the same exit for each of these strategies? Will a trailing-stop exit be helpful with the mean-reversion strategy? Is a profit target going to help us with the trend-following strategy? Does it make sense to give the breakout-trades a lot of room to develop, and use a very wide stop-loss?

To all of these questions the answer is no. There are exit strategies that make sense for each of these strategies, but if you mix them up, they’ll no longer work. Which to me proves my point, that both entries and exits need to be compatible with each other, and are therefore equally important.

And no, you probably won’t make money with random entries. Well, in the short run maybe you do if you’re lucky, but in the long run, reality will prove you wrong. I’ve seen some articles that state otherwise, showing pseudo-random entries that haven’t been random at all (that for example enter at a specific time each day) or where the exit-strategy was actually part of the entry (for example using stop and reverse exits/entries).

Now, should you find a exit strategy that’s not curve-fit for a specific market and timespan, that does provide an edge with really random entries, please send me an email. I’d be very happy to hear about it, since so far I’ve failed to discover such a thing.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trader Survey

Complete it on or before February 5, 2016 to receive a 30% off coupon

and an entry into a drawing for one-hour mentoring.

To view previous published Chart Scan newsletters, please log in or click on "Join Us," shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.