Trading Educators Blog

Trade the Trend

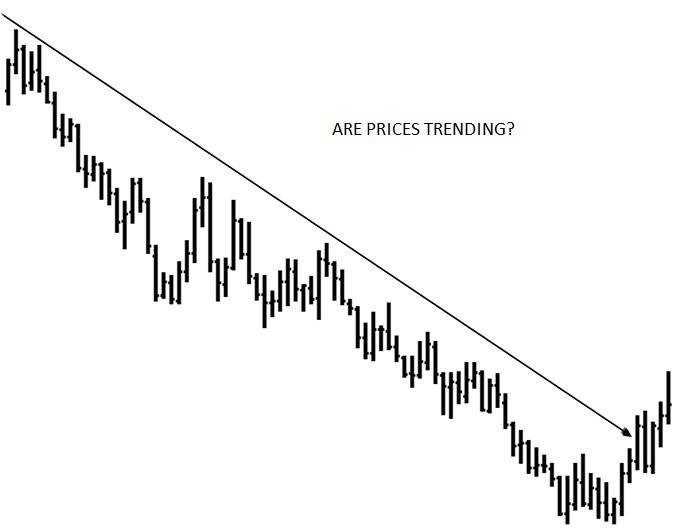

Trend Trading is a trading strategy that attempts to capture gains through an analysis of the momentum of prices in a particular direction. Trend traders enter into a long position when a security is trending upward (e.g. successively higher highs) and/or enter a short position when a security is trending lower (e.g. successively lower highs).

Higher highs and lower lows is about as basic a definition of trend as you can get. However, there is a lot more to trends and trading them than that simple definition. For example, how long to prices have to have successive higher highs or lower lows before it can be said that prices are trending?

What is the difference between a swing and a trend? I'm not sure! If prices are overall rising or falling, but are doing so by stair-stepping, is it still considered to be a trend? SAME CHART ABOVE AND BELOW.

There are no set answers to these questions. Much of what could be called "trend" is in the eye of the beholder.

Prices can be seen to trend on a monthly chart but are going sideways on a daily chart. I can take an intraday chart that is moving sideways based on passage of time, and cause it to appear to be trending based on the number of ticks contained in each price bar or candle.