Trading Educators Blog

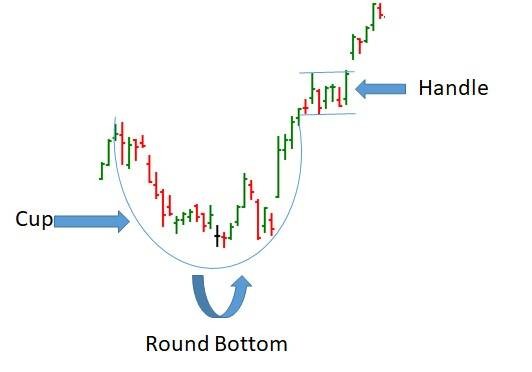

The cup and handle is a great trading pattern that works well with different time frames and with most markets like stocks, futures, commodities and foreign currency markets. Here's what it means, how to trade it, and tips to use it for potentially bigger profits. The Cup and Handle pattern is a bullish continuation pattern that begins with a consolidation period followed by a breakout. The patter...

When it comes to trading, you've got to unlearn what you've learned your whole life. It isn't all about you; it may just be the odds working against you. In other fields, probability plays little if any role. You put in effort, make sure you meet the expectations of the folks who pay you, and you're a success. In the traditional work environment, it makes sense to put a little ego and pride into y...

The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to analyze overbought or oversold conditions. It is primarily used to attempt to identify overbought or oversold conditions in the trading of an asset. Traditional interpretation and usage of the RSI is that RSI values of 70 or above indicate that a security is becoming overbought or overv...

Even if I do not want to generalize the following for each trader, there are some "general problems" in day trading. Here is a short list of why I personally think day trading is much more difficult than position or spread trading. - Fast decisions: You have to make very fast decisions when you day trade, especially when you day trade very short time frames like 5-, 3-, or 1-minute charts. When yo...

The Squeeze is the central concept of Bollinger Bands. When the bands come close together, constricting the moving average, it is called a squeeze. A squeeze signals a period of low volatility and is considered by traders to be a potential sign of future increased volatility and possible trading opportunities. Conversely, the wider apart the bands move, the more likely the chance of a decrease in ...

Most options expire worthless, so lots of traders are interested in selling options. I certainly agree with that thinking. Options are a wasting asset. All things being equal, an option will lose part of its value day after day until finally, the option expires worthless. As time passes, the option seller earns premium from time decay. The risk to the option seller is that of a large move against ...

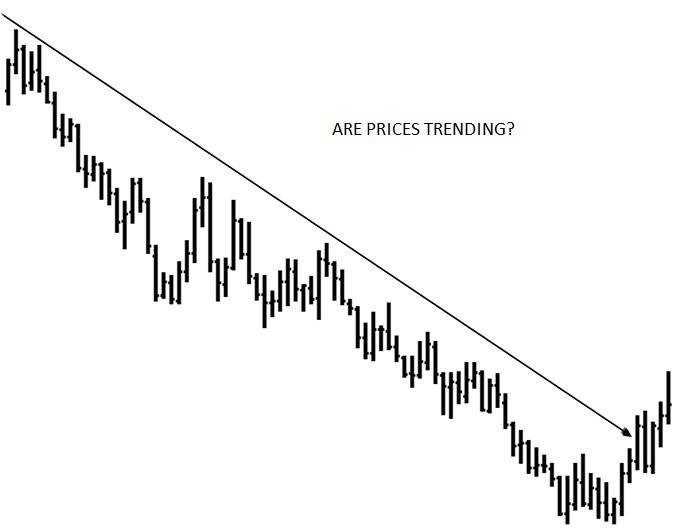

Trend Trading is a trading strategy that attempts to capture gains through an analysis of the momentum of prices in a particular direction. Trend traders enter into a long position when a security is trending upward (e.g. successively higher highs) and/or enter a short position when a security is trending lower (e.g. successively lower highs). Higher highs and lower lows is about as basic a defini...

Volume is the number of contracts or shares bought and sold each day in any given financial, commodity, index or currency instrument. High volume suggests that there is a heightened interest in the financial instrument, and if it is combined with a move higher in share price, then it is often used as a signal of strong upward momentum. Keeping an eye on volume will ensure that you are on the right...

Because some markets are very "expensive" and do not offer a mini or micro contract, many traders have to stick to a single contract once in a while. In this case, you might trade a single-lot strategy. Finding the right target for a single-lot strategy is tricky and depend on your general trading strategy. You have to study your results to see what target gives you the best performance. You need ...

"Hey Joe! I'm pretty new at this. Can you tell me the rules for buy and sell stops?" When the market trades above a buy stop price order, it becomes a market order. The first down tick after the market order price is activated determines the highest price at which the buy stop order may be filled. The rule to remember placing stops is this, "Buy above and sell below." Buy stops are placed above th...

Trading is a stressful business. When you are in a trade, your money is at risk, and you repeatedly face the possibility of losing substantial amounts of trading capital. If you are a novice trader, the stress is even greater, since you have not yet learned to trade consistently, and losing significant amounts of trading capital is the norm, not the exception. Managing stress is a key to trading s...

Question from a subscriber: "Hey Joe, I just want to be prepared for the next legal holiday. I've been basically a Dow investor for years and now I've begun trading the Dow futures. Do you have any information about the Dow Industrial Average relative to legal holidays in the U.S?" Thanks to Yale Hirsch's excellent "Stock Traders Almanac" for the following: "The Dow closes higher before one day ho...

You alone determine whether you will succeed or fail at trading. You alone are in control; take responsibility for your performance and your life. There are always tremendous opportunities in the markets. It is not what happens, it is what you do with what happens that makes the difference between profit and loss. You cannot marry a market or a single trading style. You have to look. Look at a var...

Figures show that 90% of traders who ever trade lose their account and that 10% actually go bankrupt. Those are scary numbers, I'm sure you'd agree. Traders are not stupid people; most traders have an above average IQ and are above average in most categories such as education and income. I think they don't make a success out of trading because they lack proper education and mentoring. By education...

Sometimes I write an article that elicits a good response from our readers. One of those articles is written below in blue italics. I blended together the gist of what some of you wrote back to me, and many thanks to those of you who did. "Why are losses such a big deal? I can tell you why. In your book Trading is a Business , you said that once we enter the market, we are the market. And you also...

1. Focus on trading vehicles, strategies, and time horizons that suit your personality. 2. Identify non-random price behavior. 3. Absolutely prove to yourself that what you have found is statistically valid. 4. Set up trading rules. 5. Follow the rules. 6. Don't be afraid to abandon a rule that is no longer working. In a nutshell, it all comes down to: do your own thing (independence); trade what ...

Historical Volatility Also referred to as statistical volatility. Historical volatility gauges the fluctuations of underlying securities by measuring price changes over predetermined periods of time. This calculation may be based on intraday changes but most often measures movements based on the change from one closing price to the next. Not everyone agrees on how to calculate historical volatilit...

Mr. Ross can you tell me exactly what is meant by "Bullish Divergence?" It's really very simple. A Bullish Divergence occurs when prices fall to a new low while a technical indicator fails to reach a new low. This situation demonstrates that bears are losing power, and that bulls are ready to control the market again—often, but not always, a bullish divergence marks the end of a downtrend. The tec...

One of the great lies that all traders tell themselves, is that we need to make a lot of money in order to consider ourselves successful. That there's a dollar value on "success." That is absolutely false. The goal isn't to double your account or trade for a living. The goal is to be profitable. At Trading Educators, we hear from many successful traders — traders we ourselves helped in their train...

Hey Joe! Which indicators work for real trading tactics? Have you ever noticed that my entries and exits are based on price levels—actual price bars? I use actual price data to determine most of my entries and exits. There is no better technical indicator than price itself. Think about it for a minute. You are making a mistake if you use indicators for entries and exits because every indicator is ...