Edition 605 - January 15, 2016

We encourage you to stay strong during these volatile times, and to choose your trades carefully. Stick with your planned strategies. Asking for help could save you time and money. If you're headed down the wrong trading path, you won't know it until it's too late. Don't be afraid to get advice. It's worth the investment to have one of our master traders review your plan today!

May Corn

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

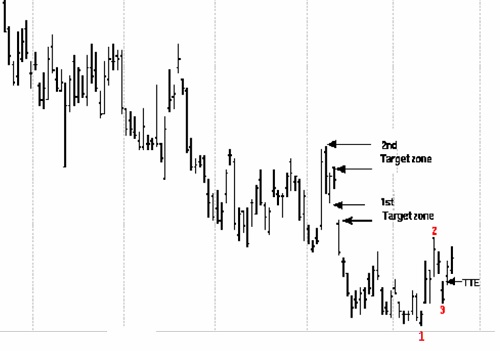

Corn formed a base at the end of a trend, and then formed a 1-2-3 low. Prices thrust above the #3 point, but due to the gap opening, I personally did not take the trade. I do not trade gap openings as a matter of preference. Actually, the choice is one of 50% - half the time it is the right choice, and half the time it is wrong, and better to enter on backfilling. Traders who entered on backfilling did enter such trades, and were then ahead.

If prices had broken beyond #2, there would have been two immediate target zones. The first one was the gap that formed when prices moved down to squeeze out the last of the bulls. The second one was that of previous fair value. Corn prices were steady in the area of the previous trading range, but a move into that area would generally see a test of the highs.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Is Trading Really a Business Like Other Businesses?

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

The importance of how you learn the business of trading cannot be minimized because of the factors that determine your success or failure. Learning the business of trading is basically no different from learning any other business. Winning means learning major guidelines and concepts that you repeat so often in your own behavior that they become good habits. These good habits then become automatic behavior patterns, which are formed as brain pathways by the rewards you get for trading well, and the punishment you receive from trading poorly. When you associate yourself with other traders, try to associate with those who are building their personal net worth, not just talking about it. True success is silent. Try not to do something just because everyone else is doing it. Successful traders are rare. If the crowd is doing it, watch out! By subscribing to Traders Notebook, you have correctly chosen to associate yourself with the winners.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Spread Scan with Commentary

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

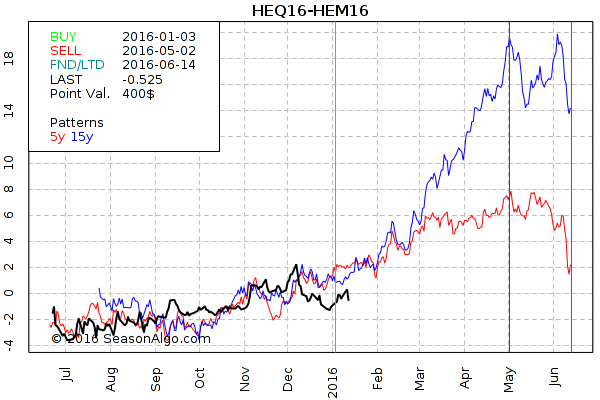

This week we're looking at HEQ16 – HEM16: long August 2016 and short June 2016 Lean Hogs (CME on Globex).

Today we consider a Lean Hogs calendar spread: long August 2016 and short June 2016 Lean Hogs (elec. symbols: HEQ16 – HEM16). After making a high in December 2015, the spread has retraced to below 0. The seasonal time window is very wide, with a statistical entry on 01/03 and an exit on 05/02. This spread has performed positively over the last 15 years. Traders might want to use the current Ross Hook as an entry signal.

Profitable trades are attainable! To find out how to manage this and other trades, and also to receive our daily detailed trading newsletter, subscribe to Traders Notebook.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Ambush Method Trade and Performance Report

by Master Trader Marco Mayer

Educator for Forex and Futures, System Trader, and Creator of Ambush Trading Method

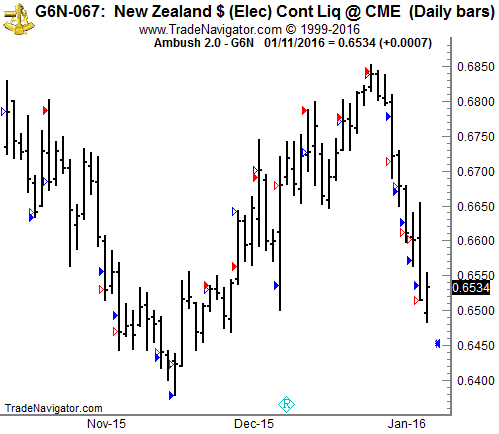

It’s been a few months since we looked at the New Zealand Dollar Futures (or NZD/USD spot forex market). Here is an update on Ambush in this market.

The NZD has really been a quite volatile and bit crazy market lately. Notice the recent strong move down all the way from 0.6850 to 0.6500 without any noticeable corrections!

All the while, basically nothing happened. The market is stuck in a huge range between 0.6400 and 0.6850, and right now it looks like it will continue to trade in this range for a while. How to approach this? I think Ambush is going to continue to perform well in this environment. A possible suggestion might be to look for buy setups around 0.6450, such as a 1-2-3 low.

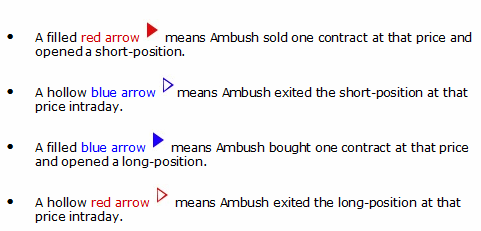

On the chart above are four different kinds of arrows:

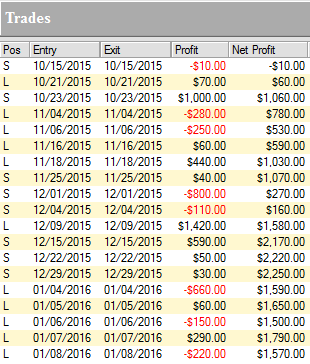

Let's examine the results of those trades (including $10 for commissions and slippage round-turn) trading just one New Zealand Dollar Futures (6N) contract:

As you can see, Ambush managed to make a total of $1,570 profit (including $10 for commissions and slippage round-turn) trading just one contract, without keeping any positions overnight!

Click on the link below and look at the menu on the right to see the long-term performance of the New Zealand Dollar Futures (6N) and all other markets supported by Ambush:

View The Reports Now

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

To view previous published Chart Scan newsletters, please log in or click on "Join Us," shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.