Edition 608 - February 5, 2016

Trader Survey deadline is today, February 5, 2016 and it expires at 11:30 p.m. US CST. Don't miss out! Click here to participate, it takes about five minutes, and receive a 30% off coupon and an entry into a drawing for one-hour mentoring. We thank all of you who have already completed it.

Simple Chart

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

There are some things I want to point out on this simple chart. I entered long at the price where you see the arrow ($9.26), one tick above a Thursday high. I made this entry based on a Traders Trick, which called for entry at that price due to the fact that Thursday’s high was only the second bar of correction to the Ross hook (three or four correcting bars are allowed), and prices were moving strongly in an uptrend.

My thought was to take some profits on Monday, and move my position to breakeven as soon as possible. But notice also that every Ross hook is also the potential #1 point of a 1-2-3 formation in the opposite direction. In this case, the #1 and #2 points of a 1-2-3 high are made evident through Friday’s prices making a higher high. Notice also that Thursday’s prices made the necessary higher low that defines the formation.

Now, let’s look at some other factors to consider with regard to this trade. The Law of Charts teaches that when prices move from trending in a straight line to becoming parabolic, a correction is near. We don’t know exactly when it will occur, but we know that nothing goes up steeply for an indefinite amount of time. So, caution must be taken with this trade, and profits in some amount must be taken quickly at the first opportunity.

A second thing to look at is the fact that prices have already made the #1 and #2 points of what could well turn out to be a 1-2-3 high formation. The Law of Charts teaches that if this were to happen, the #2 point would then become a reverse Ross hook (RRh). RRhs and how to trade them are covered in my book Trading the Ross Hook. There is a way to filter RRhs so that most of the time you will trade them profitably.

Trading is, in large part, management. Anyone can get into a trade, but not everyone gets out profitably. I entered this trade with two possible strikes against me: the parabolic trend line and the potential 1-2-3 high. But with proper management and taking some money off the table quickly, there was no need to fear what lay ahead. I was able to take the Traders Trick boldly, knowing that if I managed the trade properly, I would come out ahead.

Start trading profitably today! Learn more about "The Law of Charts" to receive many tips and tricks that make it easy for you to use it in your trading.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea with Commentary

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Click on the video below to learn about the September – May 2016 Coffee calendar spread (KCU16-KCK16).

Profitable trades are attainable! To find out how to manage this and other trades, and also to receive our daily detailed trading newsletter, subscribe to Traders Notebook.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Planning for Contingencies

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

No one likes to think about the worst-case scenario, or to make a detailed plan to recover should it happen. It's just one strategy for learning how to trade in a relaxed but focused way so that should you ever face a severe financial setback, you can recover from it. Trading requires intense concentration and focus, and it's difficult to maintain this posture when the pressure to perform is on you. Therefore, you have to do whatever you can to minimize any expected psychological pressure.

The most obvious ways to relieve such pressure is to think in terms of probabilities, and carefully manage risk. By that I mean avoid overtrading, fast markets, exceptional tick size, and be careful just ahead of reports that might drastically affect price movement. Avoid illiquid markets, and avoid adding new risk when it appears a trend might be nearing its end.

It's useful to remember that you may not win on any single trade, but after a series of trades you will have enough winners to make a profit in the long run. It's also important to manage your risk. Determine your risk up-front, and risk only a small amount of trading capital on a single trade. By doing that you will ease a lot of the pressure, allowing you to be more open to see the opportunities that the market offers. Don't break under the pressure of a potentially fatal loss. Think about the possibility, and be ready to recover from it.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Ambush Method Trade and Performance Report

by Master Trader Marco Mayer

Educator for Forex and Futures, System Trader, and Creator of Ambush Trading Method

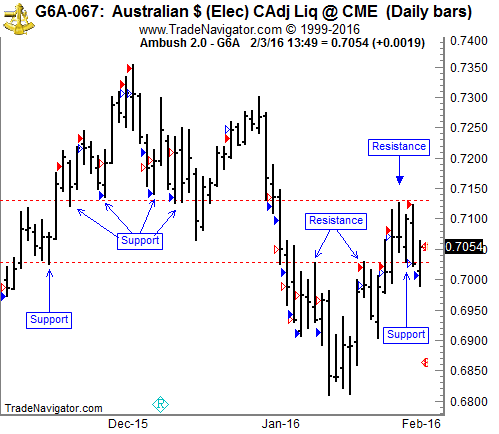

To refresh your memory, we reviewed the Australian Dollar Futures (6A, AUD/USD Spot Forex) in December, 2015. This market had been trading above a significant support level.

Because it has failed to trade through that support level, it is now trading below it. This makes for an interesting chart, while giving me an opportunity to also give you an update on Ambush in that market, so let’s have a look!

Right now the Aussie is trading between two interesting price levels, 0.7030 and 0.7130. As usual with these levels, they’re more to be seen as price-zones than exact price levels, but I guess you can get the idea by looking at the chart. The question is to which side the market might finally break out, and to be honest, I have no idea.

The good news is that I really don’t need to know, and I don’t even care about it. We’re not fortune tellers, we’re traders, right?! As traders, we make money by trading an edge, not by making guesses about the future.

As I’m writing this (Wednesday afternoon) we’re long the Aussie, trading Ambush, with an entry at 0.7006 (LIMIT Entry that we put in yesterday, no need to watch the markets during the day). Right now the market is trading at 0.7054 and we’re up about $500 on the trade, so it looks as if that support did hold again, and we’ve seen a "false breakout" tonight. But, of course, there are still about 8 hours of trading left…

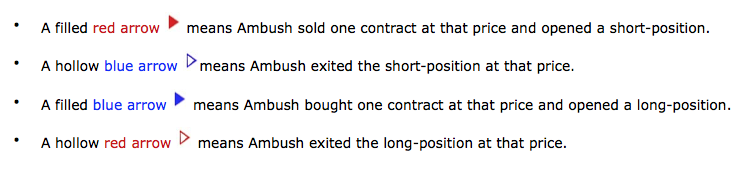

On the chart above are four different kinds of arrows:

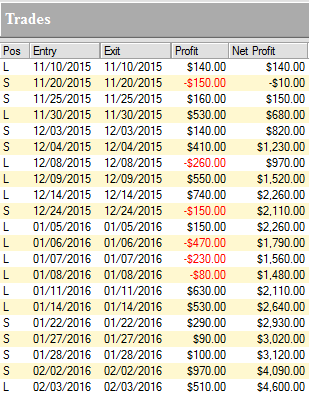

Let's examine the results of those trades (including $10 for commissions and slippage round-turn) trading just one Australian Dollar Futures (6A) contract:

As you can see, Ambush managed to make a total of $4,600 profit (including $10 for commissions and slippage round-turn) trading just one contract, without keeping any positions overnight!

Click on the link below and look at the menu on the right to see the long-term performance of the Australian Dollar Futures (6A) and all other markets supported by Ambush:

View The Reports Now

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trader Survey

Survey expires tonight, February 5, 2016 at 11:30 p.m. US CST!

Receive a 30% off coupon and an entry into a drawing for one-hour mentoring.

To view previous published Chart Scan newsletters, please log in or click on "Join Us," shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.