Edition 615 - March 25, 2016

Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Old Style Chart Reading Still Works

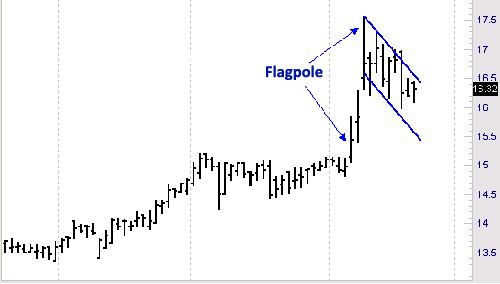

The Law of Charts is to a large extent about chart reading, and chart reading incorporates some of the observations made by traders over 100 years ago. While these kinds of observations do not follow the strict rules of the Law of Charts (TLOC), they are interesting, and it is exciting to see them work. Of course we know that nothing works all the time, but it might be interesting to learn from the chart below.

The "wisdom of the ages" states that following a breakout from consolidation, if prices shoot up creating what looks like a "flagpole," and are then followed by a flag or pennant formation such as you see on the chart, when prices resume rising, they will rise again by the height of the flagpole. The flagpole begins its ascent at 15.20, which is a violation of the high of the consolidation. Prices then rise to a high of 17.56, so the total height of the flagpole is 2.36.

The low of the pennant formation is 15.98. Therefore, the projection is that prices will rise to at least 18.34.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Confirmation Bias

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Whether you are a long-term investor or a short-term trader, you might be looking through reams of information, such as charts, analyst commentaries, and financial statements, to arrive at a wise decision. You may have to sift through it all, weigh it appropriately, and use your intuition to make the most informed decision possible.

In the end, it's usually an educated guess. Traders are hardly objective, logical processors of information. They suffer from what decision-making theorists call confirmation bias. When devising a trading plan, there is strong pressure to reach a decision and implement a plan. The consequences of a wrong decision can be financially disastrous. The added pressure can get to us. Rather than look at each piece of information objectively, we tend to pay closer attention to information that confirms our initial decision, while ignoring contrary information.

If you want to make sound trading decisions, you must fight the urge to seek out information that supports your initial expectations. As a basic rule of thumb, when trying to arrive at a sound decision, you should spend more of your time looking for information that goes against your initial hunches than information that confirms them.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading From the Beach

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Because of the short week ahead of us, I've decided to head for the beach for a few days (until Sunday). Of course, I will take my "trading stuff" with me (Laptop, Smartphone) to watch and manage my open trading positions. Visit Andy's blog post to read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trend Following Is Not Yet Dead - Part I

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

In his latest video, Marco gives you some insights on his journey into the world of traditional trend following. He talks about how trend following works, what to consider, and if it's a trading style for the average trader to consider. This is Part 1 of a 2-Part series. In his next video, Marco will go into the details of his backtests.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.