Edition 617 - April 8, 2016

Yesterday, was a very special day for someone with Trading Educators who has dedicated most of their life to learning all the "ins and outs" of trading, and sharing that knowledge with thousands of followers. That someone special is Joe Ross! Joe, we hope you had a very "Happy Birthday" and wishing you good health, happiness, and many more birthdays to come. Traders, feel free to send This email address is being protected from spambots. You need JavaScript enabled to view it. your birthday well-wishes - we know he'd love to hear from you.

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Euro FX

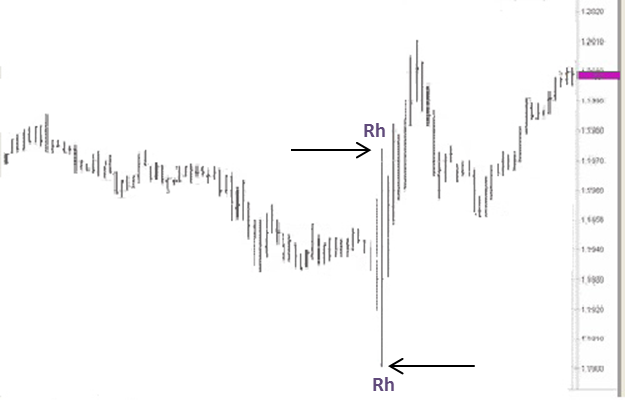

This week we are looking at an unusual chart sent to us by one of our subscribers. It is a chart of the Euro FX. I know you cannot see much detail, but for the sake of this explanation the main point is that the very long bar contains two Ross hooks.

You would think this pattern would show up more often, but it is rather rare. After a trading range is established, there is a bar that breaks out of both sides of the trading range.

The bar with the two Ross Hooks is the first bar to break out above the trading range, but it is the second bar to break out below the trading range.

The next bar is an inside bar, the first failure to go higher and lower after the breakout. So the breakout bar has two Ross Hooks.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Conquering Regret

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

One of the most powerful emotions that influences decisions of investors and traders is regret. People probably wouldn't mind making a bad trading decision if they knew there was absolutely no possibility of regretting it later. Of course, people differ in terms of how often and intensely they experience regret. If you have an obsessive-compulsive disorder, you might never make a trading decision without over-thinking it or becoming overwhelmed as you incessantly worry about what might go wrong. That being said, many normal people put off making trading decisions just to avoid later feeling regret and self-reproach.

Regret is common among many traders and investors. They can't stop thinking of how they wished they had taken a different course of action. They repeatedly mull over the consequences of the regretted decision. They can't seem to get it out of their mind. It can be so debilitating that they put off making a future trading decision for fear that again they may have to face extreme regret. How can you conquer regret and trade more freely and creatively? Psychologist Dr. Van K. Tharp offers some simple steps towards a solution:

First, acknowledge your feelings of regret. Dr. Tharp suggests metaphorically stepping out of your body and looking at yourself more objectively. Look at yourself while feeling regret, and imagine feeling differently. Examine how you feel out of control due to your debilitating feelings of regret.

Secondly, remember the times when you made a good decision, felt no regret, and were in complete control. When you remember how you took control in the past, you will immediately feel empowered rather than stuck in feelings of past regrets.

Third, look at the adaptive nature of regret. People feel regret when they make a mistake. Regret protects them from making the same mistake again. By realizing that your feelings of regret have an adaptive function, you'll start to feel better.

Fourth, feel resourceful and powerful. Think about how you can avoid making regrettable mistakes in the future. Make a specific plan of action for avoiding the same mistake twice.

Fifth, remember the times when you made successful trades.

Conquering regret takes practice, so these steps should be repeated as needed to help you feel more secure in your future trading decisions.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

A 3-leg spread combining meats and grains - it might be a spread you have never seen before.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Visit Andy's Blog for his latest post

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

This week's blog post in Andy's enhancement trading series discusses stop management.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Greetings from Port de Soller, Mallorca

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

Hi traders, I'm on vacation this week and wanted to share a picture from one of my hiking excursions. Have a good weekend.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.