Edition 618 - April 15, 2016

We love feedback from our traders! Proven success from one of Joe's books is highlighted in our Forum and goes into detail. Our top priority is educating our traders, and staying true to our philosophy, "Teach our students the truth in trading - teach them how to trade!"

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

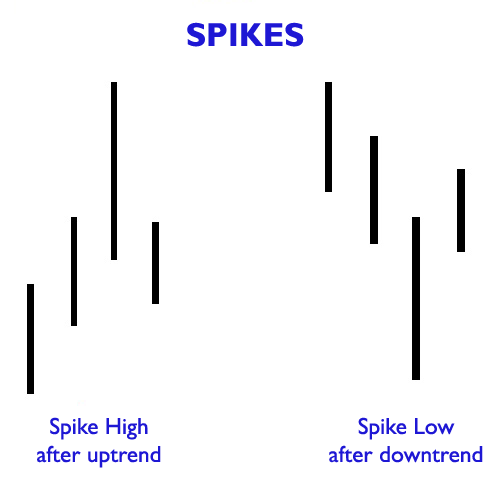

Spike Reversals

Let’s look at a 1-2-3 formation in combination with a Spike Reversal. The Spike Reversal is often a price bar that becomes the #1 point of a 1-2-3 formation. It looks as follows:

Spike Reversal

A Spike Low has:

- a low sharply below those of the days on either side,

- a close near the day’s high,

- and must be preceded by a strong decline.

Keeping in mind that every #1 point is also a Ross Hook for the continuation of a trend, nevertheless probabilities dictate that the Spike Reversal is more often than not the beginning of a move in the opposite direction to the previous trend or swing. It may turn out to be nothing more than a retracement correction of a few bars, but there are two things I prefer to do when I see one:

- Bring my trailing stop within 1-tick of the extreme of the reversal bar.

- Take my money and run - standing aside until either the trend continues or the Spike Reversal does indeed result in the formation of a 1-2-3 high or low.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Action Plan

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

In our everyday lives we are used to doing things reflexively, on the spur of the moment. That is because throughout our lives we have acquired certain skills. For example, we don't consciously think about stepping on the brakes or the accelerator as we drive, we just do it automatically.

Despite their experience learning various skills throughout their lives, wannabe traders often think they can trade on the spur of the moment. They don't carefully plan a trade or follow a trading plan when it is time to execute it. But detailed trading plans are an essential ingredient for success.

When you first start out trading, it is difficult to trade on the spur of the moment. There are too many issues to attend to, and without a wealth of experience, you are bound to make mistakes. Making a specific action plan while trading has clear benefits. Knowing when, where, and how helps you to perform effortlessly and gracefully. Specific plans help us respond quickly and automatically when it is necessary. When we make a plan beforehand, we can follow it, acting swiftly and efficiently.

Planning allows traders to more easily remember specifically what to do. They don't waste time trying to recall what it is they are going to do. They have decided what to do and when, beforehand, and have little trouble doing what they have planned. Second, research has shown that traders respond quickly when they have a plan to follow. If you have a clearly defined plan, you are ready to respond more efficiently when optimal market conditions arise. Third, when traders have a plan, they can more easily ignore interruptions and distractions. They are able to more easily focus on the task at hand, maintaining self-control. Action plans are especially useful when trying to respond during high stress situations, such as during a day when the market action is hard to pin down. Trading the markets on an especially chaotic day can be stressful. A series of necessary decisions are best made from a detailed trading plan.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

What!? No trading idea this week? Don't worry, it'll be back in next week's edition.

Visit Andy's Blog for his latest post

This week's blog post in his enhancement trading series addresses some very important tools and without these, it will be difficult to make it in the market.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Q&A Series

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

This is the first episode of a new series where Marco will answer any of your trading related questions. So whatever is on your mind that you want to ask a professional trader, go ahead and send an This email address is being protected from spambots. You need JavaScript enabled to view it., post it in our Blog or Forum.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

.png)