Edition 620 - April 29, 2016

As we spring into May, for many of you, this time of the year is when you start to make plans for the summer, declutter areas in your house, and enjoy the recent plush growth and blooms from your garden. For traders, this is also a great time to re-evaluate your trading plan, straighten up your office, and add one healthy habit to your trading routine. You are encouraged to use the upcoming month for reflection and to make positive improvements to your trading.

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

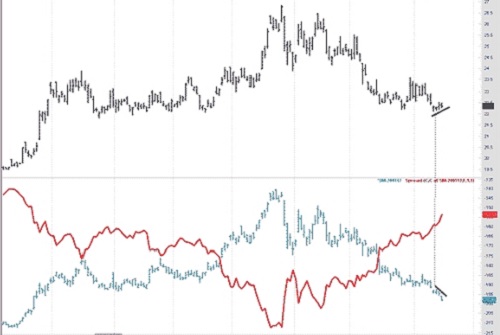

Spread Trading

I can't help but show you one of the easiest trades I ever made. I was browsing through my charts using Genesis Trade Navigator, and what I call an "observation trade" leaped off the screen.

Sometimes when you are looking at charts, something hits you as a "can't lose" trade. Such was the long Bean Oil, and short Soy Meal trade shown in this article. Bean Oil had virtually no direction, and Soy Meal, along with Soybeans, were heading down. This is a natural trade. There is no need for seasonality, correlation, backwardation, or chart pattern. Simple observation is all that is needed for this kind of easy money. Let’s look - Upper Graph (Bean Oil) and Lower Graph (Soy Meal):

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Right Timing

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Over the three-day weekend, trader Bill received a call from his friend Jack. "Hi Bill, did you take a look at the market last week?" Bill replied, "It was a rough week for my short positions. I didn't anticipate the buying surge and it hurt me a little. No, I didn't look closely at the market. I was caught up trading my own positions." Excitedly, Jack says, "Well, on Monday I bought at 345 and sold at 370 on Friday. I made almost $4,000 on that one trade alone."

Have you ever received a call from a friend in the trading business bragging about a great trade that he or she made? If you aren't doing as well, and cannot also bask in the glory of success, it's hard to avoid feeling a little resentful, envious, and somewhat disappointed in yourself. You may think, "It's just a matter of being at the right place at the right time, and unfortunately, I was at the wrong place at the wrong time."

Trading can indeed be a matter of luck. When events aren't going your way, you can get thrown off and become overly consumed with how poorly you are doing to the point that you can't think clearly. Trading the markets skillfully requires a clear, focused mindset. You can't get thrown off. But when your money is on the line, it's hard to think clearly.

There's a powerful human need to trade with perfection. You want to be at the right place at the right time, and make a huge win. One of the worst fears of many traders is missing out on a significant trading opportunity. It's natural to want to search for a once-in-a-lifetime trade, and make a year's worth of profits in a day. But constantly searching for such trades can be distracting. You spend the majority of your time searching for the ultimate trade setup, and when you do that, you start placing demands on yourself that you just can't reach. You think illogically. You lose focus, and you can no longer think clearly and wisely.

Ironically, if you become overly consumed with being at the right place at the right time, you will probably be at the wrong place at the wrong time. You won't think freely and creatively, and you will miss the potentially profitable opportunities right in front of you. From a bird's eye view, they may not be the absolute best opportunities out there, but they may be good enough to profit from. If you devote all your effort to trading them, you will make profits. Remind yourself that you don't have to be perfect. You don't have to trade the best opportunities at all times. You just need to trade the best way you know how with the resources and opportunities you have available to you. You need to trade freely, rather than stagnating under the pressure of trading to perfection.

Trading can be a matter of probabilities. Sometimes you'll be at the right place at the right time; at other times you won't. That's all right. If you are consumed with perfection and finding the ultimate trading opportunity, you will often miss the trades that are right in front of your nose.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog Post

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Read Andy's latest blog post which addresses a tough question, "Can I really make it as a trader?"

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Andy's Trading Plan Series - Part 2

This is the second part of the Trading Plan series that provides answers for the following questions: "Who needs a trading plan?" and "What will a trading plan do for you?"

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Q&A Series

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

In this Trading Basics video, Marco shares his knowledge to get into position sizing. Topics include the Range, Avg. Range, True Range, and Average True Range (ATR) indicator, as well as the concept of Initial Risk (R). If you have any questions, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., post it in our Blog or Forum.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Ambush Method Trade and Performance Report

by Master Trader Marco Mayer

Specialist in Forex, Futures, Systematic Trading, and Creator of Ambush Trading Method

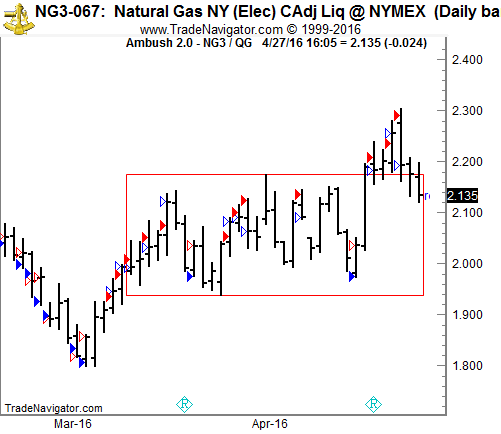

Ambush had a really good run during the last couple of months! This week is an excellent example with the Henry Hub Natural Gas Futures (NG) traded at the NYMEX.

The market has been moving in a small range between 1.95 and 2.20 (red box) for weeks and finally last week, it broke out of the range and managed to move up to 2.30. As you can see on the chart below, that’s where Ambush traders sold NG and ambushed all the breakout-traders who still wanted to get in after the break out. Today it’s moving within the range again, and I wouldn’t be surprised to see NG moving back down towards 2.00.

On the chart above are four different kinds of arrows:

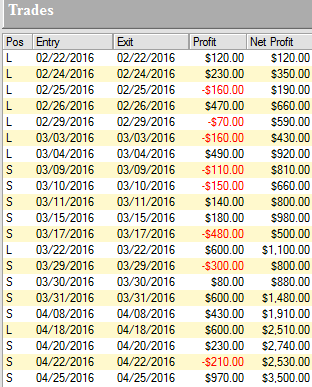

Let's examine the results of those trades (including $10 for commissions and slippage round-turn) trading one Henry Hub Natural Gas Futures (NG) contract:

As you can see, Ambush managed to make a total of $3,500.00 profit (including $10 for commissions and slippage round-turn) trading just one contract without keeping any positions overnight!

Click on the link below to see the long-term performance of the Henry Hub Natural Gas Futures (NG) and all other markets supported by Ambush:

View The Reports Now

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.