Edition 621 - May 5, 2016

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Long Term Trading

Some years ago I was tutoring a trader who would be trading a $1 billion managed money account, moving up from trading a $15 million account. He had been trading in a single market, but found that the amount of money being managed was simply too big for a single market, which he traded in his own country. The need to diversify brought him to the U.S. to learn about the U.S. markets.

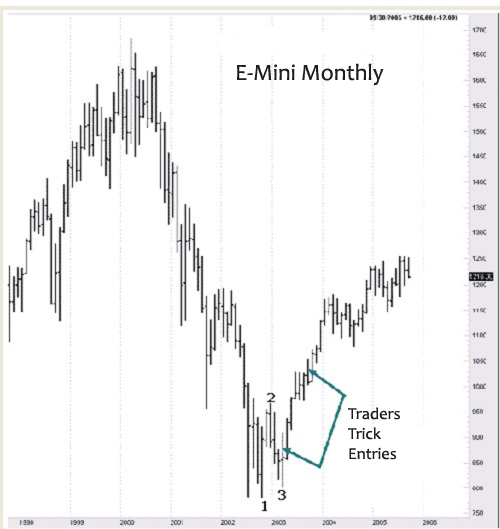

With a trading account of that size, he feels there is no way to engage in short-term day trading, and I agree. It's pretty hard to diversify when your entire focus is on a 5-minute E-mini chart. So this week, I want to show you something about the long-lost art of position trading long-term charts using monthly and weekly charts in markets with which most of you are already familiar - the E-mini S&P 500 and the Mini Dow.

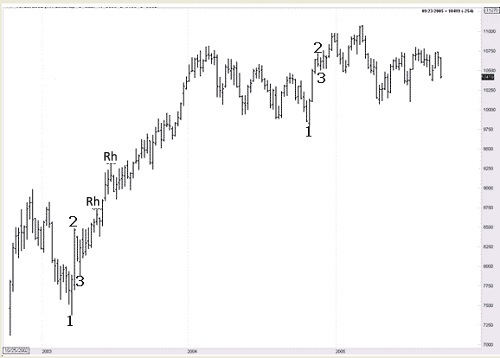

It seems that these days few traders are interested in trading long-term. The monthly and weekly charts remain relatively unnoticed. Traders are so busy looking at anything and everything from 60 minutes down to 1 minute, that they let beautiful trades slip right by them in the very markets where they are trying so desperately to make a buck. Since monthly and weekly charts of the E-mini S&P and Mini DJ show only a few bars, I am going to have to use a continuous chart to show you what I mean. The prices may not be correct historically, but the relationship between bars will be exactly as they happened, so don't despair about the fact of continuity. Please keep in mind that the moves you will be seeing are huge on the monthly and weekly charts; and if they last for only a few bars, that is many times better than the moves you are getting on intraday charts.

The weekly chart of the Mini Dow below is loaded with Ross Hooks (Rh), too many for me to mark them all. Each one has a Traders Trick. Please examine these charts on your own, and remember the moves are big. A Ross hook is the first and subsequent failures of prices to continue in the direction they were moving after the breakout of a 1-2-3 formation, a ledge, or any form of consolidation. If you need more help, please study "The Law of Charts" which was a free EBook sent to you via email. If you need another copy, please This email address is being protected from spambots. You need JavaScript enabled to view it. to request it.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Maintaining Discipline

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Traders and investors have difficulty "letting their profits run." When you see your position increase in value, it's hard to avoid selling early to lock in profits. But not every trade goes your way, so when you come upon a trade that does produce a profit, it's vital for your long-term success to maximize the profits for that particular trade. You must make more profits on your winning trades than you lose on your losing trades, but this is difficult to do if you consistently sell prematurely. Waiting for your price objective takes self-control. You must fight the urge to sell early if it fits in with your testing and trading experience.

A thinking strategy that may help you increase your ability to maintain self-control when you need to consists of viewing trading decisions as "linked" in that the decisions you make on earlier trading choices influence the decisions you make on later trading choices.

How do you approach discipline when you trade? Do you think, "I'll sell early on this trade, but on future trades, I'll let my profits run. What's the harm?" It may set a bad precedent. What you do early on may influence what you do later: If you sell early on some trades, you may tend to sell early on other trades. The truth is that initial choices are good predictors of future choices. The choices you make deciding on a smaller reward upfront, or waiting for a larger reward later, are important. For example, a person might decide between one piece of pizza now and two pieces of pizza in a week. It's quite similar to taking a smaller profit early rather than patiently waiting to take a larger profit later. Nevertheless, you must make such decisions based on experience and testing. If you are more comfortable taking smaller profits at both ends of the trade, then doing so becomes your trading style. If that is how you trade profitably, then stick with it.

If you want to trade with discipline, it is essential that you maintain discipline at all times. Don't sell early, and think, "I'll hold on next time." The mind doesn't seem to work that way. You must show self-control early, and on all decisions. So when you are about to sell early, stop! Remind yourself that the long term consequence of taking profits prematurely is that it might set a bad precedent. You won't be able to show self-control and restraint when you really need to. And in the long run, it will severely cut into your overall profits.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Today I'm looking into Silver and will explain a trading idea using options.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Method

I'll explain how to read the equity chart of a trading method or system to better understand the characteristic of a trading method.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Q&A Series

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

In my new Q&A Episode, I'll answer questions about the usefulness of demo-trading, trading 123 formations, and why I developed my own python-based backtesting platform.. If you have any questions, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., post it in our Blog or Forum.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.