Edition 622 - May 13, 2016

Stay tuned while Mayer Marco puts on the finishing touches to: AlgoStrats.com.

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Trading Concept

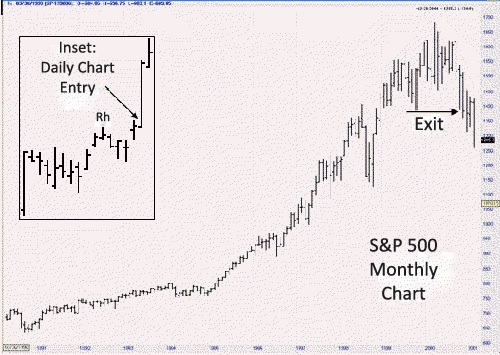

One of the concepts we teach at Trading Educators is that at times, it is worth taking entry signals from the larger time frame chart and then, once in the trade, managing from a lesser time frame. For example: taking an entry signal from a 60-minute chart, then managing on a 30-minute chart once you get a fill. Or taking entry from a weekly chart, and managing on the daily chart. The reason for doing this is to enable you to micro-manage the trade.

However, in the case of the greatest trade I have ever personally seen, the management was done in just the opposite manner. It was done by a long-term trader, and the trade lasted from 1991 to 2000.

The trader entered the S&P 500 in early December, 1991, and exited in 2000, by first entering from a daily chart, using a trailing stop for protection. When he felt he had accumulated sufficient profits, he began trailing his stop on the weekly chart, and then finally on the monthly chart, where he kept his stop two support levels (below two retracements) back. The trade ended up making $16 million.

Going from "micro" managing to "macro" managing is a perfectly logical way in which to stay longer in a trade. There was a Ross hook on the daily chart following a breakout from congestion. However, because of the gap opening on the bar prior to the one where I showed the entry, he chose to enter the following day. This is not exactly how I would have preferred to enter, but who am I to argue with $16 million?

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

The Lottery Mindset

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Do you ever dream about winning the lottery? There are actually people who have such good luck that they repeatedly enter contests and win. They win so often that if they wanted, they could count on winning, even though they are essentially trying to capitalize on chance. They develop a "lottery mindset" in that they approach life by counting on rare chance events. The rest of us aren't so lucky, and we don't live our lives counting on a fluke like winning the lottery. We work hard, master a profession, and work steadily to make a living. In many ways, top-notch traders approach their profession in the same diligent way. They don't view trading as recreational gambling, counting on a fluke to make a profit.

That said, many people do experience key life-changing events. We have all heard of people who needed a lucky break and got it. You often hear of actors who, with their last 50 bucks went for an audition, landed a job, and ended up as a star of a hit sit-com.

You probably know of friends who were desperately searching for a job for months, and needed a job fast! With only a week's worth of resources left, they found a job. It can also happen in sports. Olympic athletes may practice their entire life for "one moment in time" when they can perform at their best. But there is some luck involved. A family member may pass away, or they may become ill, and it may throw them off their game. Sure, they have rare talents, but the Gold Medal winners are also lucky enough to have everything go their way. There are times when life can come down to a few key moments. It's a little like playing Lotto, and hoping that you'll win.

Even though profitable traders don't approach trading as if they were playing the lottery, they almost all have at least one big winning trade in their careers. In a series of exclusive interviews, we asked traders to describe their biggest winning trades. Jesse described how he invested in Juno Online: "I bought about 3000 shares, and the stock went up 20 points in two days. It went up fast, and there was really no reason for it. I had a feeling it was just hype and euphoria, so I sold out and made $60,000." Andy described how he used to trade currencies: "One day I was trading Yen, and made around $18,000 in just that day." Don's biggest trade was in the heyday of the dot-com boom. "A European auction company was upgraded one morning. It was touted as the next eBay. CNBC was playing it up. The stock had just split, and they got the price target a little bit wrong. They quoted an ungodly high amount. This was merely a single digit stock. That morning it had traded up over 100. I shorted it as it fell.”

Do people make huge profits capitalizing on a once-in-a-lifetime trade? Sure they do, but the question you need to ask yourself is, "Do I want to trade hoping to make all my profits on a fluke?" Do you want to approach trading with a lottery mindset? If you do, you'll always be on edge, and you will have difficulty trading with discipline. You'll tend to take big chances, and you may end up losing big. It's better to trade more prudently. That doesn't mean never taking a risk or pushing yourself to invest a little more capital when you hit upon a winning streak. What it does mean, though, is controlling over-confidence. Don't seek out those one or two trades a year that will make up for all you've lost. There's an advantage to using a more methodical approach: continue to search for solid, high probability trade setups, outline detailed trading plans, and trade prudently with unwavering discipline.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog - Thoughts about being an option buyer

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Read Andy's blog about why we sell options instead of buying them in Traders Notebook along with a TN special offer.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Position Sizing Part II

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

In the first part of the Position Sizing series, Marco explains the basic indicators that are useful for position sizing. In Part II, Marco gives you a simple approach to determine your position size based on market volatility.

If you have any questions, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., post it in our Blog or Forum.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.