Edition 623 - May 20, 2016

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Forex Trade

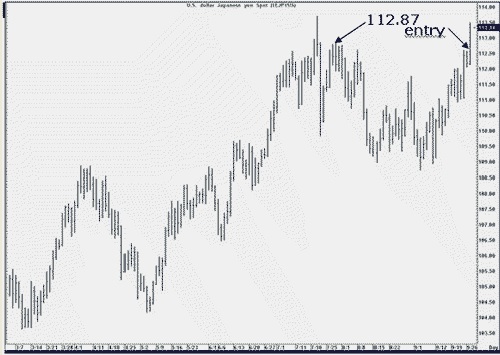

We’re referencing an older dollar-yen forex pair at a time that the Yen was making strong moves. There is a lesson to be learned from this older chart.

The move began with a 1-2-3 low formation. The number 2 point was violated, and then followed by three Ross hooks - two of them being the double-high kind. The Law of Charts states that following the breakout of the #2 point of a 1-2-3 low, every failure by prices to move higher constitutes a Ross hook.

On Monday, the 26th of September, prices failed to move higher, thereby giving us a Ross hook. The question then was: should we take a Traders Trick Entry with only a 2-tick difference between the highs of Friday the 23rd and Monday the 26th? I can only tell you what my own decision was, and why I decided to take the Traders Trick with only 2-tick’s clearance between Friday's high and Monday's high.

As I looked to the left of the chart, I saw that traders probably have stops just above 112.87. Contrary to the popular belief that there is no stop-running in forex, the truth is exactly the opposite: there is plenty of stop-running - but that's a story for another day. I figured if they took out Monday's high of 112.59, there was a good chance they would take a shot at 112.87, giving me enough pips on a day trade to take in the money I wanted to achieve from the trade. As you can see, they more than met my expectations, taking prices all the way to 113.51. I have often said that every trader needs to have rules, but there are times when common sense tells you to break those rules. That's what I did on Tuesday, September 27.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Can exchanges change the rules any time they want to?

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Yes, they certainly can, and do. In 2015-16 NASDAQ eliminated all types of orders other than limit orders. Following shortly after, NYSE did the same thing. The thought of not being able to place a stop-loss order in the market was mentally devastating to many traders. The same was true for eliminating “Good 'til Canceled” orders (GTC). This action by the exchanges threatened to seriously reduce trading volume, and to force traders into becoming day traders, having to sit in front of a screen all day long simply to monitor their positions. The only other choice would have been to trade stocks only through mutual funds and exchange-traded funds.

Fortunately, most, if not all, stock brokers changed their software to handle these, and even more kinds of orders than the exchanges had ever allowed.

In 1980, few who were trading at the COMEX at the time the Hunt brothers tried to corner the silver market, will ever forget that the exchange forbid the Hunt's from buying silver futures.

Federal commodities regulators introduced special rules to prevent any more long-position contracts from being written or sold for silver futures. This stopped the Hunts from increasing their positions by temporarily suspending the fundamental rules of the commodities markets.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

This week Andy is looking at a Crude Oil calendar spread going long the December and short the July Crude Oil.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Error: Stop Trading At the Worst Time

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

Marco talks about one of the most common mistakes traders do: stopping following their strategy just at the worst time possible. He also gives you some insights on why that is, and why methods have drawdowns at all. With this understanding you can learn to better deal with drawdowns which are simply part of the trading business. If you have any questions, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., post it in our Blog or Forum.

( Stay tuned while Mayer Marco puts on the finishing touches to: AlgoStrats.com. )

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Don't miss out! Sale ends this Sunday for Andy Jordan's Traders Notebook. Click Here for more details, and watch Andy's video that gives you a sneak peek to the Traders Notebook Campus.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.