Edition 626 - June 10, 2016

Joe Ross sent out a letter earlier this week. In case you missed it, you can read it on his blog and have an opportunity to sign up for his "Money Master Plus" webinar on June 25th (take advantage of the early bird special).

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

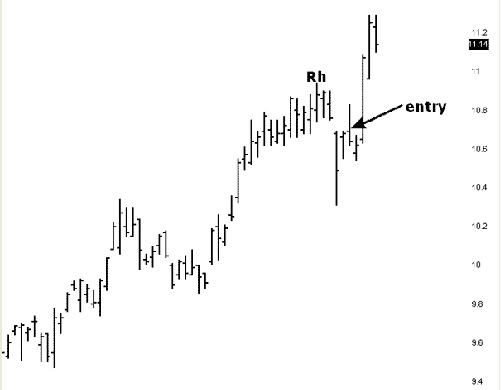

Sugar Trade

This week we look at a daily sugar chart. We need to learn something here about the Traders Trick Entry (TTE). March Sugar prices reached a high of 10.94 and then retraced for two days. Those two days made identical highs [at 10.90]. Prices then dropped again, and again we had two identical highs [at 10.69]. The TTE rules say that after 4-bars of correction you are no longer to enter a trade based on the TTE. However, the rules also state that when expecting a continuation towards the upside, equal highs count as only one bar of correction (retracement). So, although we have 4-bars in the correction, because of the equal highs we count this as only two bars of correction. Now you can see why we made an entry 1-tick above 10.69. What happened afterwards is of no consequence to the rule I am showing you here. In accordance with your money and trade management, you made a little, or took a loss, or made a lot on this trade. I will tell you only that we made a little. ;-)

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Seeking Out Protection

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Making a profit in the trading world is hardly a sure thing. How you deal with this fact of trading, though, depends on your personality. Some people take risks in stride, while others obsess over them. Which type of person are you - a natural born risk taker, or an obsessive, fearful seeker of safety?

Life is a matter of taking risks, but some people embrace it while others superstitiously try to avoid it. For example, have you ever seen an extremely ineffective car theft device called "The Club?" You are fooled into believing that by putting a massive metal bar on your car's steering wheel, you are protected. It seems it would work, until you realize it takes merely a few minutes to cut the steering wheel with a hacksaw to pull it off. Similarly, why do car stereos have removable faceplates? Do you think thieves are actually unaware that there isn't an expensive stereo beneath a removed faceplate?

These kinds of "protective" devices make us feel better, at least until we realize that they don't work. At that point, we think, "How could I have been so stupid?" That said, feeling protected helps take the edge off. Even if it is just superstitious behavior, like wearing your lucky shirt on the day of a big trade, you feel better when you do it. There's a psychological benefit to it.

We can alleviate some of the uneasiness of taking risks through risk control. By risking a small percentage of your trading capital on a single trade, and looking at the big picture, you will feel more at ease. From a psychological viewpoint, it is to your advantage to make a potential trading loss so insignificant that you may start thinking "Why am I even bothering making this trade?" There is no universal rule for how to limit risk. Some experts suggest risking merely 2% of your capital, while others suggest 5%, and still others suggest using past market action to determine the amount of loss you can afford to take (for example, if the market is bullish with many opportunities for profit, then you can take a little more risk.)

The best way to control risk is to set a protective stop, but whether or not you set a stop loss or how you do it depends on your personality and attitude toward risk. If you are a natural born risk taker, you may not set a formal stop loss at all. You may keep an informal stop loss point in mind, and close your position when the stock price reaches that point. At the other extreme, the obsessive-compulsive worrier trader may set the stop loss too close to the entry price, and end up getting stopped out too early. The middle ground seems to be reasonable for most traders. Again, it depends on your personality, but if you are afraid to take a loss, a stop loss can help. If you don't have a stop loss and hate taking a loss, you may not close out a position when the price falls hard. You may be prone to hope against hope that the trade will turn around, and watch your losses mount as you fail to take action. The stop loss order, however, guarantees that you will be out of the trade should prices move against you.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

This week, Andy is looking into a Natural Gas calendar spread going long the April and short the March 2017 Natural Gas.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Andy's Blog Post - The Best Trader in the World

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

If you had to describe the best trader in the world, who would that person be? What qualities would he have? Take a moment to envision him. This is important because this is the person you want to be, so you need to have an exact picture of him and what his qualities are. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Forex vs. Futures

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com.

In his new video, Marco talks about the major differences between trading Futures and Forex from his point of view. Find out what the advantages and disadvantages of both trading instruments are! If you have any questions, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., or post it in our Blog or Forum.

Marco's new site is now live!

AlgoStrats.com

(Be sure to also follow Marco on Facebook and Twitter)

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.