Edition 627 - June 17, 2016

Joe Ross' "Money Master Plus" webinar is scheduled for June 25th at 10:00 a.m. to 1:00 p.m., US CST. This informative, wealth building, and motivating three hour webinar is led by a master trader who has gained invaluable knowledge and techniques by trading over 50 years within all markets. Become a "Master" of your money and learn a way to trade with no losses. Let us put you on a money making path that will greatly change your life. Don't wait another minute and sign up today!

Marco Mayer, Systematic and Forex Expert, is proud to announce that his newest development is live and ready for you to experience it. Traders, we invite you to visit AlgoStrats.com. AlgoStrats:FX Free Trials will start soon in early July, stay tuned!

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Market Manipulation

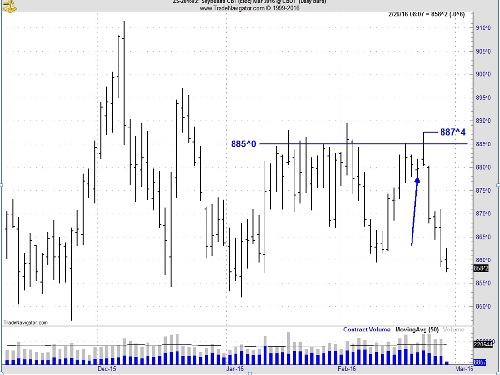

The chart below was sent in by one of our students. It showed a manipulation in March Soybeans.

March Soybeans had been struggling to get above the $8.85 level for quite some time, so it is reasonable to assume that a fair number of buy stops had accumulated just above that level. The day marked with an arrow, was options expiration day. When the market closed that day, there were eight thousand 880 puts that expired 1 ¾ cents in the money. This probably wasn’t nearly enough to recover the premium that was paid for them, and the person that wrote them had been working his tail off to make sure of it. The put owner decided to just let them expire instead of exercising his right to sell the position at 880. The Trade took notice, and took this as a very bullish sign, as can be seen by the gap open the following Monday. With all of the buy orders accumulated up above, both traders were easily able to liquidate their longs at a higher price and get short for the subsequent move down. Did they plan this move together, or was it mere chance that both sides were able to profit? Always remember that there are people out there with the ability to push the market around, and they will do so at every opportunity.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Staying on Target

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

After carefully studying the fundamentals of a tech stock, Jack decided to buy 1,000 shares at $60 a share. After a recent product announcement it traded at $64. Although it was higher than he had preferred, he felt it was still a good investment and figured he might as well buy at the higher price before it went even higher.

As is often the case after a product announcement jump in prices, prices fell to $60 a share a few days later. Jack started to kick himself, "Why couldn't I wait. I knew it would fall. I should have waited. I could have saved $4,000." Jack plans to hold the position for six months and he still thinks the stock has the potential to hit $70, but he can't seem to stop berating himself for buying too soon and spending an extra $4,000. His feelings are understandable, but it's distractions like these that often throw traders off target. It's vital to continue to focus on your trading plan and not be stifled by self-reproach.

Depending on your personality, you may be prone to kick yourself for making trading mistakes. In Jack's case, he may have bought a stock at a higher price than he had hoped, but it isn't a disaster. According to his trading plan, he can reach his objective of selling at $70 in six months, and making $6,000 as he had anticipated. Many traders have a tendency to be perfectionists. They can't stop obsessing about how they could have entered and exited a trade more skillfully.

Striving for high ideals is noble, but when it distracts you from focusing on your ongoing experience, it can be detrimental. For example, if Jack continues to berate himself for buying too high on this trade, he may not be able to focus on studying the next trade and developing a sound, new trading plan. He may also feel less spontaneous and creative. His mind may become filled with self-doubt and his thinking may become clouded. Striving for perfection can be much more of a distraction than a benefit in the long term.

At times of self-reproach, it's essential to talk yourself out of it. It's necessary to move from a mental state that concerns obsessing about errors to a calm, focused mindset concerned with thinking creatively. Although they may sound trite, repeating a few common sayings about trading the markets may be quite helpful: "I'm going to trade my plan and stick with it." "I'm going to go where the markets take me." "I'm a mere mortal; I can't control the markets." "I need to accept the fact that I'm human and may make mistakes."

You don't have to trade perfectly. You just have to trade profitably. Put a single trade in perspective. It's just one trade of the many trades you will make in your lifetime. You may lose or you may win, but the outcome of a single trade does not matter. What matters are your overall profits across a series of trades, not just a single trade. Rather than beat yourself up for minor mistakes, stay on target. You may make a mistake here and there, but it's all right. All traders make mistakes.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

This week, Andy is looking into a Cotton butterfly spread and explains why the butterfly looks good at the beginning, but might be difficult to trade.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Andy's Blog Post - Ego-less Trading

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

The majority of traders might think it would be impossible to trade in an "ego-less state", but this is not the case. To trade in an ego-less state means simply to not let the ego and emotions get involved. While trading in an ego-less state, winning or losing on a single trade become almost meaningless when the focus lies only on the whole picture. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Manual Backtesting Pitfalls

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com

In his new video, Marco talks about some of the most common pitfalls when doing manual backtesting. So if you ever wondered why your actual trading results don't match with the manual backtest you did, this is for you! If you have any questions, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., or post it in our Blog or Forum.

Marco's new site is now live!

AlgoStrats.com

(Be sure to also follow Marco on Facebook and Twitter)

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.