Edition 631 - July 15, 2016

Who doesn't want extra income guaranteed? Follow along with our "Instant Income Guaranteed" examples that will be highlighted after Joe's trading article. Here's what one subscriber has to say!

"Its been around a year since I enrolled in the IIG program. Probably the best "trading" decision I have ever made. It is amazing the annualized return you can produce if you keep flipping your money. I have taken shares on a couple of stocks because I chose to do so, I don't consider that a loss. Thanks, Randy C. (July 2016)"

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Matching Congestions

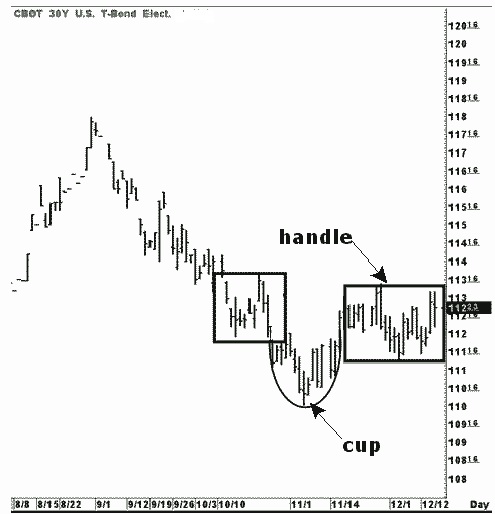

A few years ago I was asked about the chart below. The question was: "What do you think about what you see there?" The daily bond chart was showing a very interesting formation as I write this. It is a formation known in the Law of Charts as "matching congestions." Matching congestions are usually a prelude to a significant move. In this instance, the matching congestions were also taking place along with a formation known as a "cup with handle." Not all matching congestions are also cup with handle formations. The cup with handle, when seen as on the chart below, typically breaks out the upside. With the underlying economy weakening as of the reports at that time, it seemed likely that we would see an up move on the chart. The matching congestion are seen in the left and right boxes.

Matching congestions are discussed in my book Trading Is a Business.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Question from a letter I received

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

"Joe! You keep saying the markets have changed. But when I look at a chart of 50 years ago, it looks the same as a chart does today. Would you explain?"

Sure! Charts look the same. They look the same because a price chart reflects the action and interaction of traders as they view events that affect prices. Since human nature has not changed since Adam and Eve in the garden, a chart from before Noah’s flood would look the same then as it does today. But how the chart looks is not what I’m talking about when I say the markets have changed. What I am referring to is the way they trade throughout the day. Also I am referring to the fact of many new markets, and a multitude of time frames in which you can trade all markets.

Let’s look at only a few of the things that have caused these changes. The first major change that I noticed occurred soon after Richard Nixon took the U.S. off the gold standard. This led to a need to trade currencies. The dollar was based on a fixed price for gold, and most other currencies were based on the dollar.

The need to hedge in the currency markets brought about the need for currency futures and increased Forex trading. Additionally, this began to affect virtually all the commodity markets. Commodities that trade internationally now had to be adjusted for constantly fluctuating monetary exchange valuations. Trading interests who never before had to think about how much it would cost to buy commodities from other countries now had to hedge. Trading interests that sold commodities to other countries also now had to hedge. The effect of having a need to trade currencies has affected virtually every known market.

The next major event that caused vast changes in the marketplace was the advent of the personal computer and day trading. Over a relatively brief period of time, the markets have turned into giant casinos with people trading time frames all the way down to tick charts. Suddenly there was a tremendous amount of noise in the markets that was never previously there. Computers and advances in electronic technology have brought the world of trading to the point of a single global marketplace. No longer is trading confined to mostly the U.S. Trading is now a global phenomenon with millions of participants.

Of course, there are many more things I could mention that have changed the way the markets trade. But this is not the place for writing a new book. The impact for the trader of all the changes that have taken place is that the way you manage trades is in a constant state of flux. In general, no one method works forever; no one system can be relied on for very long. The trader must constantly adjust either his system, his method, or himself to the ever-changing market dynamics.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

NUS Trade

Instant Income Guaranteed

Developer: Joe Ross

Administrator: Philippe Gautier

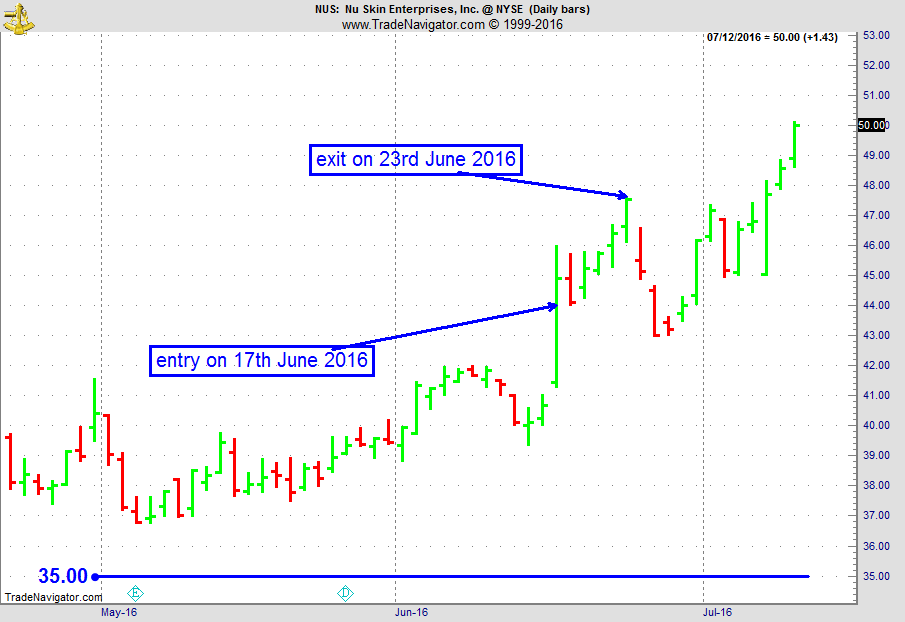

On 16th June 2016, we gave our IIG subscribers the following trade on NUS, which was in an established uptrend, and had a sharp move up on that day after winning a $210M investment from China. As the move was sustained by professional accumulation, we decided to sell price insurance as follows the following day:

-

On 17th June 2016, we sold NUS July 29 2016 35P @ 0.40$, ie. 40$ per option sold; the short strike was well below price action (22%away) and below a major support level, so that the trade was very safe, with 42 days to expiration.

- On 23rd June 2016, we bought back NUS July 29 2016 35P @ 0.20$, after 6 days in the trade.

$Profit: 20$

$Margin: 700

Return on Margin annualized: 173.81%

Philippe

Receive daily trade recommendations - we do the research for you!

Receive daily trade recommendations - we do the research for you!

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Stealth Trading Method

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Andy gives you a 2016 update on how well Stealth Trading Method, break-out method, is handling the markets. Net profit while trading in 25 markets, and an equity curve with impressive upward movement.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

This Week's Blog Post - Go to the Exchanges for the Best Basic Information

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Did you know that you can get good, free information at the exchanges web sites? Andy explains why. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

AlgoStrats.com - FX Free Trail starts July 25th

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com

AlgoStrats:FX Free Trial will start on July 25th.

- On Friday, July 22nd registration begins to create your accounts, take time to look around, read through the help section, and ask questions.

- Live trading starts on Tuesday, July 26th.

- Follow Marco on Facebook and Twitter.

If you have any questions, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., or post it in our Blog or Forum.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.