Edition 634 - August 5, 2016

Trading Educators was founded by Joe Ross and we hold true to his philosophy:

"Teach our students the truth in trading - teach them how to trade,"

and

"Give them a way to earn while they learn - realizing that it takes time to develop a successful trader."

For those new to our company, it's important that you understand this and we are here to help you. We offer quality products and services that assist and create independent traders which is our #1 goal. Feel free to contact any one of our traders. We hope that you have success in your trading, and are always striving to educate and improve yourself.

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Failed Entry?

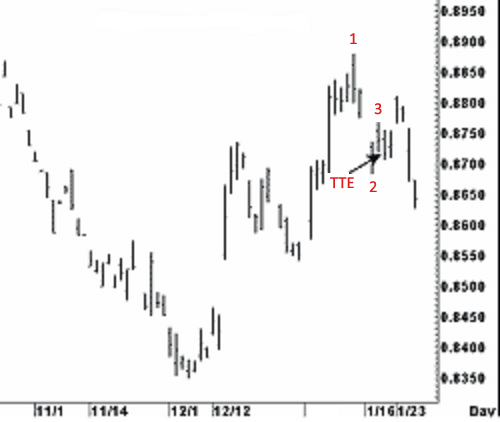

Consider this week's chart below. On this chart you see what some would call "a failed Traders Trick Entry" following a breakout of the number two point of what at the time was a 1-2-3 high formation. Does this mean that 1-2-3 formations are not valid? The Law of Charts describes a concept, not a method for trading. The 1-2-3 high was there at the time. There is no undoing that fact.

The Traders Trick describes one implementation of The Law of Charts. There are other implementations, and we teach them in our books, at our seminars, and in private one-on-one training sessions.

Does the fact that the Traders Trick seemingly failed mean the Traders Trick is no longer a viable implementation of a 1-2-3 high?

The answer to both questions posed above is trade management — at which point do you realize the trade isn't working out and extract yourself from a bad trade? Believe me, after trading countless thousands of times, I know and know that I know — I will have losses from failed trades.

Now consider this: Entry using the Traders Trick was at 8719. A position trader using only a daily chart for entry and exit could have sustained a loss. I say could have because there is no way for me to know the risk tolerance of another trader.

There were 11 possible profit-taking ticks in that trade, ($137.50) as prices move to 8708. Trading a ten-lot in most markets is not going to move the market, and taking 10 ticks offers a high percentage trade. If trade management were correct on a ten lot in a currency futures, $1,375 would have been available.

Let's say a daily position trader placed a first objective to buy back half the position at 10 ticks, with a second order to move the remaining portion of the position to breakeven, contingent upon the first objective being reached. Now, was that a bad trade? Can you see that once you are in a trade, success depends almost entirely on management beyond the initial fill?

In our seminars and one-on-one tutoring, we do not hand you a fish, we teach you how to fish. After that you will no longer need us, other than that we remain friends and mutually successful and profitable traders.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

How should you feel about losses? I once read somewhere that you are supposed to love losses. Does that make sense to you? It doesn't to me.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

The worst aspect of losing is that it tends to create pessimism. Traders should feel bad when they lose money only if they fought the market trend, or violated their own trading strategies. The best traders have a healthy "so what, big deal!" attitude that maintains a sense of humor about losses. There is no reason to feel bad about losses if the trading discipline was correctly used. On the other hand, there is no reason to learn to love them either.

Analyze losses, learn from them, and then let them go; move on, that's the best thing to do.

Understanding man's relationship to time is one of life's most important challenges. When man becomes free of time's constraints, he lives life to the fullest and achieves goals on his own terms. Pessimism traps traders in the past, destroys their present, and robs them of the future. Imagine a world without time where the thought of death is not a finality of existence. If money were not the reason for your work-related behavior, then who are you? Where are you, and what are you doing? Who shares this existence with you? In the philosophical sense, man creates himself and his existence when he takes responsibility for his actions and his time. Think how any individuals create order, structure, and discipline in their lives. How will you allow a trading loss today affect your life five years from today?

Thinking the wrong way can become self-fulfilling. The trouble with self-fulfillment is that many people have a self-destructive streak. Accident-prone drivers keep destroying their cars, and self-destructive traders keep destroying their accounts. Markets offer unlimited opportunities for self-sabotage, as well as for self-fulfillment. Acting out your internal conflicts in the marketplace is a very expensive proposition.

Traders who are not at peace with themselves often try to fulfill their contradictory wishes in the market. If you do not know where you are going, you will wind up somewhere you never wanted to be.

Every business has losses. I cannot think of any that don't. Shoplifting, embezzlement, internal pilferage, lawsuits, bad debts, spoilage, etc., I'm sure you can think of even more. You name it and businesses have one or more of the many ways to experience losses. Most businesses expect and accept such losses as part of doing business. Why, then, is it such a big deal when you have a loss in trading? If you know the answer to that, please let me know.

The way I handle a loss is this: I examine it, make every attempt to learn from it, and ascertain whether I had the loss by straying from my trading plan. If I have strayed, I reinforce my resolve to stick with my plan. If I have not strayed, then I learn from it what I can, and shrug it off as a cost of business. It is not an expense, it is a cost, and if you don't know the difference you need to take a course or read a book on the basics of accounting.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

ABBV Trade

Instant Income Guaranteed

Developer: Joe Ross

Administrator: Philippe Gautier

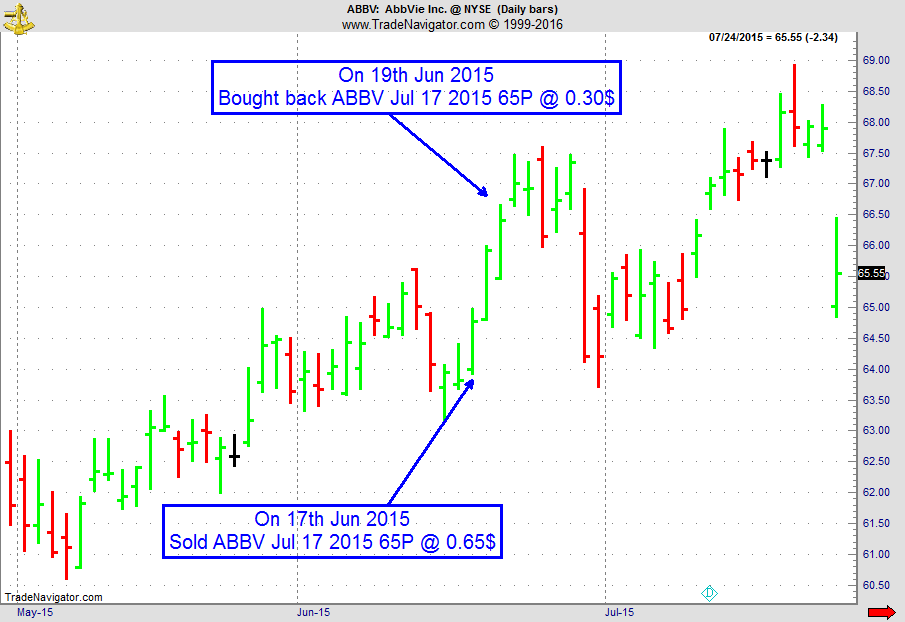

On 16th June 2015, we gave our IIG subscribers the following trade on ABBV, a strong stock in a strong sector. As momentum was back in our favor, we decided to sell price insurance as follows the following day:

- On 17th June 2015, we sold ABBV July 17 2015 65P @ 0.65$, ie. $65 per option sold; the short strike was below support level, with only 29 days to expiration.

- On 19th June 2015, we bought back ABBV July 17 2015 65P @ $0.30, after only 2 days in the trade

Profit: $35

Margin: $1,300

Return on Margin annualized: 491.35%

Another trade with quick premium compounding.

We have also added new types of trades for our IIG daily guidance, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Plan Series Part VI

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

In Part 6 of the Trading Plan Series, I'll explain what to do each day before the real trading activity starts.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

This Week's Blog Post - Is Trading a Clean Way to Earn Money?

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Many wannabe traders have trouble following their trading plans when they are seemingly in conflict with their basic beliefs. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

AlgoStrats.com - AlgoStrats: FX

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com

The free trial week of AlgoStrats:FX is almost over, so I decided to create a video giving you a summary of the first week. Thank you to everyone who participated in the free trial and I really appreciated your feedback!

Feel free to email with questions at This email address is being protected from spambots. You need JavaScript enabled to view it., or post it in our Blog or Forum. Follow me on Facebook and Twitter!

Ambush Method Trade and Performance Report

by Master Trader Marco Mayer

Educator for Forex and Futures, System Trader, and Creator of Ambush Trading Method

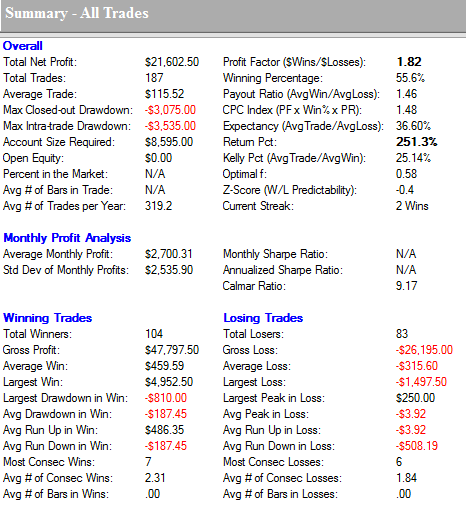

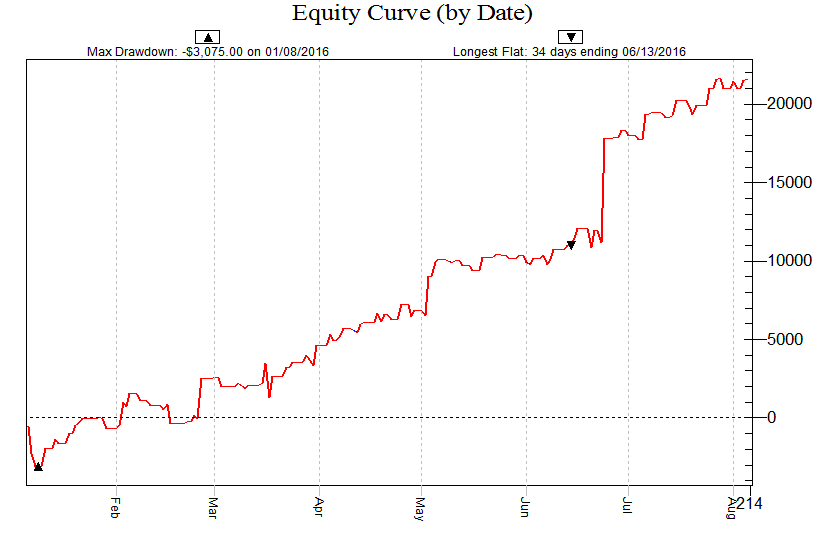

After Ambush had a tough start into 2016, during the last couple of months it literally took off in pretty much every market.

Let’s look at the performance of a typical Ambush-Basket with you:

- Henry Hub Natural Gas Futures (NG)

- E-Mini S&P 500 (ES)

- Dollar Index (DX)

- Australia Dollar (6A)

As you can see, Ambush managed to make a total of over $20,000 trading one contract in each of the markets (including $10 for commissions and slippage round-turn).

What makes Ambush so unique is that it achieved these results without holding any positions over-night. So these are day trades - but the only time you need to take action is at the market close each day!

Here’s the Equity-Curve, showing a rough start into 2016 but a really strong rally for the rest of the year so far:

Ambush didn’t just perform well in these markets. It did so across the board, and there are markets that did even better like Gas Oil for example.

Actually looking at the performance of all Futures markets, Ambush is trading at new all time equity highs again! We’d like to celebrate this with you and are offering you a special discount with 10% off this week! Use coupon code ambush10 when you check out. Offer valid until August 10, 2016.

Please look at the long-term performance of all other markets supported by Ambush. Check out the reports on the Ambush page.

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.