Edition 635 - August 12, 2016

"Price is what you pay. Value is what you get." ~ Warren Buffett

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

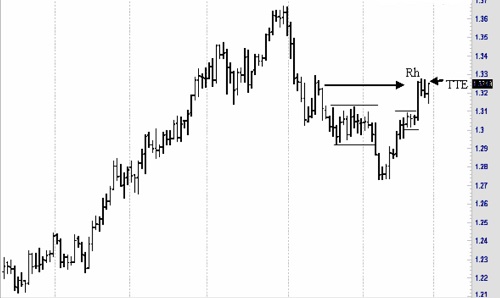

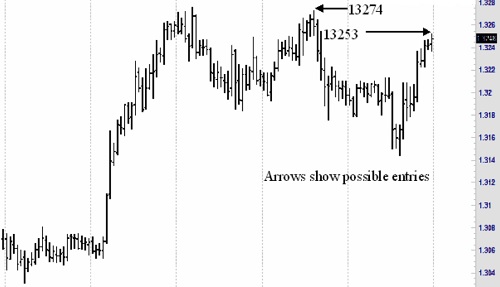

EURO/USD

Euro had formed a Ross hook with a Traders Trick entry on the daily chart. Implementation of The Law of Charts teaches that entry signals from a larger time frame can be entered and managed on a lesser time frame. So let’s look first at the daily chart and then see how we might have managed a trade on the chart of a lesser time frame.

We see on the chart a set of matching congestions. Matching congestions are described in my book “Day Trading” and also in my book “Trading Is a Business.”

The Law of Charts states that a Ross hook is the first failure of prices to move higher following a breakout from congestion. The Law also states that one of the best ways to enter such a trade is from a Traders Trick entry. In this case entry would be at 1.3253.

Now let’s go to a lesser time frame for actual entry and management. We’ll use a 60-minute chart.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

INTELLECT

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Recently, I wrote: "As a human being there is a component working in you that is comprised of the following elements: Your intellect, your emotions, your memory, your imagination, and your will. These elements work together to determine who you are and how you will behave in the market -- actually, in anything and everything you undertake to do." This week we are going to look at "Intellect" to see how this element can defeat you as a trader.

Over decades of trading and teaching others how to trade one of the greatest problem areas that regularly comes up is that of intellect. You might want to think about that for a moment (no pun intended). A component of intellect is "logic." How can logic undermine a trader?

Being intelligent, being a logical thinker, having a high degree of intellect is often the worst thing that can happen to a trader, yet it is those persons having these gifts who are most often attracted to the business of trading.

The problem for these aspiring traders is that there is little to do with logic when it comes to trading in the markets. Markets are driven by emotions, the two most prominent being fear and greed. There is not a shred of logic in either of those emotions. On a purely intellectual level the markets consists of a place to buy and sell. They are places, where to the best of man's ability, a somewhat fair price may be discovered. Finding out a price at which buyers are willing to buy and sellers are willing to sell, seems altogether a logical pursuit. Indeed, this process is called price discovery. Although price discovery is often corrupted by those who are able to manipulate prices it is the best method man has come up with.

On the surface markets appear to be logical and intellectually solvable. However, the truth is that because they are driven by emotions they are actually confusing and chaotic, and anyone trying to put the movement of prices into a box is doomed to failure.

Sadly, the majority of people who are attracted to trading are those who want everything about price movement to make sense. Their attempts at setting boundaries for price movement are truly tragic. They talk about support and resistance as though somehow, magically, those price levels will contain prices. They draw trendlines and defy prices to cross them. They draw angles and pitchforks, speak knowledgeably about Fibonacci ratios, Elliott Waves, MACDs, and so forth as if these concepts had any logic behind them at all.

I'm not saying that any of the above are not tools that can be used in trading, but they must be used with full knowledge of their weaknesses and with full knowledge of what they can actually show. Any and all tools used for trading can fail, and unless a trader is willing to be flexible, there will be little chance for success.

There is no end to knowledge and understanding that must be acquired by a trader. There are no rigid lines, no boxes, no be-all to end-all models that will always work. There are no perfect systems and no perfect methods. The problem with intellect is that its logical element wants safety and assurances. Intellect wants a perfect fit every time. But anyone who has traded with real money, soon finds out that trading simply isn't logical. Prices cannot be confined. Markets are like the proverbial 600 pound gorilla. They go wherever they want to go.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

SBUX Trade

Instant Income Guaranteed

Developer: Joe Ross

Administrator: Philippe Gautier

On 15th October 2014 we gave our IIG subscribers the following trade on SBUX. As the stock was bouncing back up around a major support level, we decided to sell price insurance as follows the following day:

- On 16th October 2014, we sold SBUX November 07 2014 68.5P @ $1.22, ie. $122 per option sold; the short strike was below support level, with only 21 days to expiration.

- On 20th October 2014, we bought back SBUX November 07 2014 68.5P @ $0.61, after only 3 days in the trade.

Profit: $61

Margin: $1,370

Return on Margin annualized: 541.73%

Another trade with quick premium compounding.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

This Week's Blog Post - Feeling Neutral

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Some traders unconsciously ratchet their emotions up a notch each time they avoid a trade when the market is not in their favor. So their emotions build, like steam pressure, to higher and higher levels. You can see the anger growing... Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

AlgoStrats.com - AlgoStrats: FX Update

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com

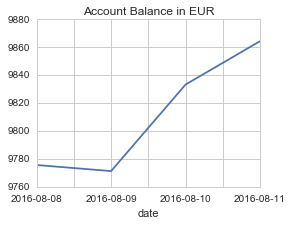

I’d like to give you an update on what happened trading AlgoStrats:FX during the second week after the Free Trial. We had a quite bumpy start in the first week, see my video from last week, the second week was quite a good one considering that most FX markets barely moved.

Here’s what happened in the live trading account this week (showing close equity balance including open trades):

After capturing a profit in EUR/USD on Wednesday we also got into a short trade in USD/CAD which turned out as a nice winning trade:

What’s interesting about this trade is that on Monday, we actually got a long signal for USD/CAD speculating for a continuation of last week's move. As this didn’t happen, another system kicked in specialized on capturing such failures on Tuesday, and we reversed the position. This turned out to be a nice trade that we closed out yesterday. One of the big advantages of trading systematically as we do with AlgoStrats:FX is the flexibility that is so hard to have as a discretionary trader. We all know how hard it is to not only close out a trade that doesn’t work out, but to actually reverse it. Luckily, our trading systems don‘t have that issue.

Join AlgoStrats:FX

Feel free to email questions to This email address is being protected from spambots. You need JavaScript enabled to view it., or post it in our Blog or Forum. Follow me on Facebook and Twitter!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.