Edition 636 - August 19, 2016

We were recently asked just what are commodities? This is how we replied. Enjoy!

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

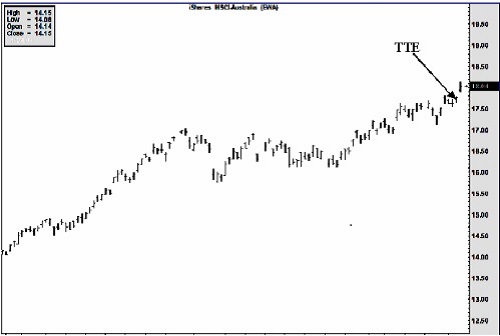

Exchange Traded Fund also known as "ETFs" or IShares

This was written awhile ago, but a good one to share with you. The Australian dollar had been rising against the U.S. dollar. I had been in the Aussie dollar for at least 3 years. In addition to dollar deposits using Australian interest bearing notes I had begun trading IShares. IShares are an index of some of the top companies in Australia. It is through ETFs that a trader can trade in another nation and still have the convenience of trading in the U.S. using U.S. dollars. Australian companies had been doing quite well supplying China with foodstuffs and raw materials. But in addition to the fat profits these companies were making, their stocks were rising because of the gain at the time of the Aussie Dollar against the U.S. currency. Trading or investing this way is a great way to hedge against a falling U.S. dollar.

One day, EWA offered up a Traders Trick for entry on March 3rd at a price of 17.74, 1 tick above the high of March 2nd. Entry was possible at that price and the shares Closed on March 4th at 18.04 for a gain of 30 cents, or $300 on 1,000 shares.

The Law of Charts and the Traders Trick work in all markets, even markets as little known as Exchange Traded Funds.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

DISCIPLINE

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

I received the following question:

"When you were teaching us at our forex office in Florida, you stressed discipline. Our head trader stresses discipline. What I want to know is if discipline can be acquired or is it just something you are born with? I’m having trouble finding it in myself."

Personally, I believe discipline can be learned, although at times it is very painful. When I began trading, I was an undisciplined person. But trading and the markets forced me to become disciplined. Was the discipline already there and just needed to be extracted? Or did I actually learn it? I can’t really be sure. I was a delinquent as a boy. I was in rebellion against all authority. I hated teachers and I hated school. I was really struggling with life as a young man.

One of the largest private trading firms, 1,500 S&P day traders, kept their offices near yeshivas. A yeshiva is a rabbinical school, which produces rabbis of the Jewish religion. The students coming out of the yeshiva were highly disciplined and made excellent traders. Was the discipline innate in those yeshiva students? Or did they learn it under the strict supervision of the rabbis who controlled their lives? I think they learned it.

I’ve mentioned previously that it can help to keep a journal if you want to learn discipline. The journal I kept was very basic and included what trades I made during the day and my reasons for getting into the trade. It is what I did with the journal that helped me to be disciplined. Anyone can make entries into a journal. I let the contents of my journal keep me in line. It became my supervisor. I took to heart what I wrote there. I no longer keep that kind of journal because it has served its purpose in making discipline into a habit in the way I trade.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

DAL Trade

Instant Income Guaranteed

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

On 20th January 2015, we gave our IIG subscribers the following trade on DAL, which was moving strongly to the upside. As there was short term support around $44, we decided to sell price insurance as follows the following day:

- On 21st January 2015, we sold DAL February 13, 2015 44P @ $0.53, ie. $53 per option sold; with 22 days to expiration.

- On 22nd January 2015, we bought back DAL February, 13 2015 44P @ $0.27, after 1 day in the trade, for quick premium compounding.

Profit: $26

Margin: $880

Return on Margin Annualized: 1,099.15%

We have also added new types of trades for our IIG daily guidance, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

This Week's Blog Post - Best Way

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Is there a best way of how to enter or exit spread trades? Read my latest blog post to get the answer. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

This Week's Blog Post - (Good) Trading is Boring

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com

When you start out trading, it’s pretty much all about the excitement. You watch every trade tick by tick, gazing at a chart ticking up and down together your P&L. You’re long. When it goes up, you feel excited because...read more.

AlgoStrats.com - AlgoStrats:FX

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.co

Learn all you need to know about AlgoStrats:FX during this presentation by Marco Mayer. What is it, what's the idea behind it, why it is different from other services and how you'd profit from AlgoStrats:FX as a subscriber!

Join AlgoStrats:FX today!

Feel free to email questions to This email address is being protected from spambots. You need JavaScript enabled to view it., or post it in our Blog or Forum. Follow me on Facebook and Twitter!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.