Edition 637 - August 26, 2016

Time, after time, after time we hear from traders who are ready to throw in the towel, call it quits, or hang up their trading hat. There's a common misconception that trading is easy, a fast way to earn money (a fast way to lose money too), or a program that has unbelievable returns. It takes years for your trading skills to reach a consistent level of gains. You should consider investing in yourself before walking away. Our traders have years of experience and have been through the good, the bad, and the ugly. Be smart and use the best resources which are right in front of you, our traders are here to help. It could be a simple tweak, major overhaul, or needing to trade in a different market. Whatever it may be, we are here to help. Invest in yourself!

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

1-2-3

Quite often I am asked to give an example of a #2 and a #1 point occurring on the same bar. While it doesn’t happen often, it does happen. My friend and superb trader, Marshall Sass, sent me this one. Here’s what he said:

“Here's an interesting situation on a chart. In 10 years of IBM daily data, it came up once. The bar of interest is pointed to by the black arrow. A 123 low and a 123 high both get their full correction by this same bar. This bar is 2 bars after the 3 point for both cases.”

If you look carefully, you will see a 1-2 on the same bar as well as a 2-3 on the same bar.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

An Interesting Problem

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

An example:

Trade 1: Buy 3 Dec Corn at 200.

Trade 2: Buy 2 Dec Corn at 210.

Trade 3: Sell 4 Dec Corn at 220.

What is your position?

Are you long 1 Dec Corn at 200 or at 210?

Do you randomly select which one or is there a generally accepted selection at the brokerage? - first in first out or last in first out...

Answer: You are long at 200. Last-in First-out (LIFO).

By the way, trading in the FOREX is different: They use First in First Out (FIFO).

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

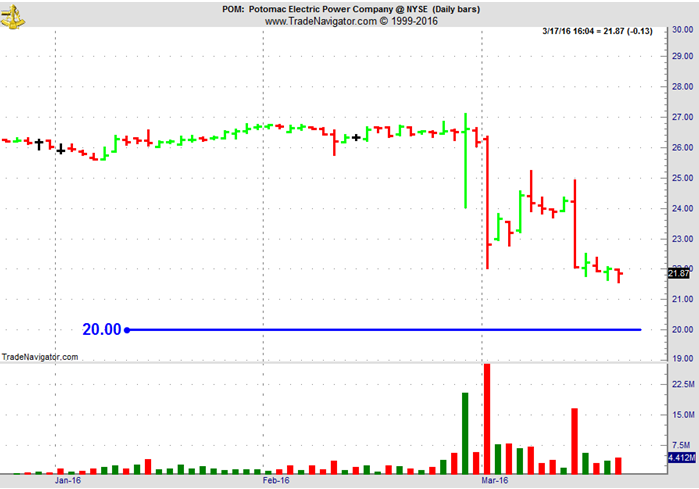

POM Trade

Instant Income Guaranteed

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

On 17th March 2016, we gave our IIG subscribers the following trade on POM, a natural gas and electricity company which had been in a take over deal with EXC (Excelon) for nearly 2 years at $27.25 per share. We advised to take only a position we would be comfortable being assigned:

- On 18th March 2016, we sold POM April 15 2016 20P @ $0.50, ie. $50 per option sold, with 27 days to expiration.

- On 23rd March 2016, we bought back POM April 15, 2016 20P @ $0.20, after 5 days in the trade, for quick premium compounding, as D.C. regulators approved Exelon-Pepco deal and the stock shot up 27.7% on the news.

Profit: $30

Margin: $400

Return on Margin Annualized: 547.50%

We have also added new types of trades for our IIG daily guidance, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

This includes a daily 80+ page report along with a daily podcast!

We review and supply the following:

-

our daily fills (entries, exits)

-

full real-time statistics of our weekly trades, closed trades for the current month, monthly statistics (detail and summary) since the beginning of IIG

-

daily market commentary (indices/sectors, volatility indices, main commodities related to our trade)

-

new trades for the following day

-

comments on our open trades, with all relevant news

-

updated earnings dates for our open positions

-

full details (days in trade, days to expiration, underlying close and price change, etc.) on our open trades (classic trades, complex positions, remaining rolled trades and covered calls)

-

active good till cancelled orders

-

dividends for the stocks owned

We also supply quite a number of extra "slides" in the appendix which are quite useful for new subscribers: recommendations, answers and explanations on the most frequent questions, techniques for entering trades, historical trades and real life examples, broker information, etc.

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Plan Series - Part 7

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

In Part 7 of the Trading Plan Series, Andy talks about Risk and Money Management. Probably the most important part of the whole Trading Plan!

View other videos in Andy's trading plan series:

Trading Plan Part 1 - The trading plan.

Trading Plan Part 2 - Who needs a trading plan? What will a trading plan do for you?

Trading Plan Part 3 - It is important to know yourself and your purpose.

Trading Plan Part 4 - How to set the right trading goals.

Trading Plan Part 5 - Explains the markets, time frames, trading vehicle, brokers, software, and much more.

Trading Plan Part 6 - What to do each day before the real trading activity starts.

This Week's Blog Post - Do I Deserve To Win

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

The world's most successful traders believe in themselves and their ability to win. In fact, many of them feel that they “own” the market. They are not necessarily being...read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

AlgoStrats.com - AlgoStrats:FX Update

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com

I’d like to give you an update on what happened trading AlgoStrats:FX during this week.

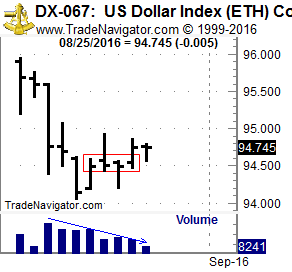

Or what didn't happen as we hardly got any signals this week. Sort of funny considering I wrote an article about why trading actually is quite boring. This week was especially true in the FX markets and, looking at some charts, this isn’t very surprising. On the daily chart of the US Dollar Index, we can see a really tight consolidation going on for days, with most days closing almost unchanged. Until Wednesday, literally nothing had happened, and most other currency markets looked pretty much the same:

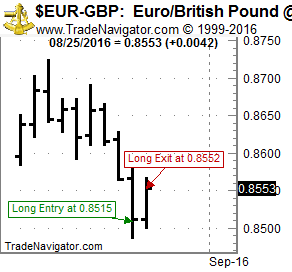

Because of this, we got no signals for three days in a row which doesn’t happen too often. Finally, on Wednesday the markets, especially the EUR and GBP pairs, moved and we got into 4 trades which we could all close with profits on Thursday. One of these trades happened in EUR/GBP (see chart). Yesterday, again no signals, so we finish this dull week with a profit of about 0.5% on the live trading account which isn’t too bad!

Learn all you need to know about AlgoStrats:FX during this presentation by Marco Mayer. What is it, what's the idea behind it, why it is different from other services and how you'd profit from AlgoStrats:FX as a subscriber!

Join AlgoStrats:FX today!

Feel free to email questions to This email address is being protected from spambots. You need JavaScript enabled to view it., or post it in our Blog or Forum. Follow me on Facebook and Twitter!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

This Week's Blog Post - (Good) Trading Happens Outside of Your Comfort Zone

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com

In his latest blog post "(Good) Trading happens outside of your comfort zone," Marco challenges another misconception about trading. Does trading have to feel good, should you always do what feels comfortable? Or do the best trades actually happen outside of your comfort zone? Read more to find out!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.