Edition 639 - September 9, 2016

"Wisdom is found on the lips of a Trader who has understanding, but a rod is for the back of a Trader who is devoid of understanding." Master Trader Joe Ross

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

MARKET CONDITIONS

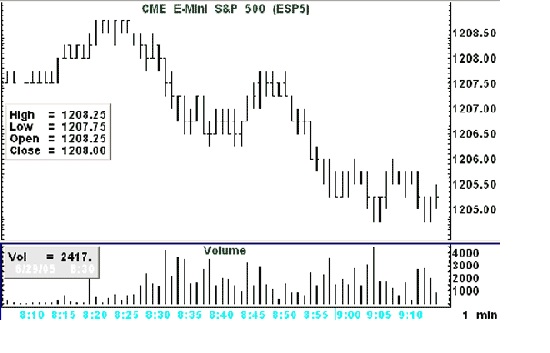

Quite often I am asked about what condition a market has to be in to be tradable. Sometimes it is easier to show with a picture when a market is not tradable other than to be a very short-term scalper.

When prices have a "boxy look to them, the market becomes very difficult to trade. What causes a boxy look? If you look closely at the chart, I will attempt to explain.

Notice the following:

- Volume at 8:30, the opening minute is only 2,417. 3 minutes later the per minute volume is 4,193, an acceptable amount it would seem. But is it? Volume does not take into consideration liquidity. Liquidity consists of both decent volume and good participation, meaning buyers are hitting the offer and sellers are hitting the bid. The volume of 4,193 might have involved as few as two traders.

- Prices tend to make multiple exact highs and lows, giving the chart a boxy look.

- Opens and Closes tend to cluster at the same level.

- Prices do not look much different from the way they looked in the early morning Globex trading.

If we go to a 5-minute chart things do not look a whole lot better.

Volume in the first 5 minutes of trading was 11,580, which amounts to an average of only 2,316 contract/minute. Not a very healthy volume for doing much of anything. The 5 minute chart displays the same type of problems we saw on the 1 minute chart. Double highs and lows, and clusters of Opens and Closes. The "boxiness" of the 5 minute chart is a sign of lack of liquidity. All this means that traders are not trading. The action that is going on is limited to a few traders who are literally picking each others´ pockets.

The e-mini S&P 500 has often been as you see it on the charts above. The situation goes back on and off for at least 10 years. Is it any wonder that 90% or more of newbies are getting their heads handed to them in this market? Unless you go out to the larger time frames you are facing a very difficult situation.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

DON'T CATCH A BAD MOOD

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Winning traders are eternal optimists. They must be to survive. Markets are constantly changing. What works in one market doesn't necessarily work in another. You can't complacently expect to perfect a trading strategy or method at a particular point in time and expect it to work forever. But many traders hold these unrealistic expectations. It's common to hear even a seasoned trader complain, "It's all a sham. There's no way to make money in trading anymore. The amateurs have left and there's no way to take profits from professionals." It can shake your confidence to hear such a bleak outlook. It can make you feel as if you might as well just throw in the towel and put your money in a mutual fund. But if you want to master the markets and take home huge profits, you can't let pessimists sway you. Don't catch their bad mood. Stay optimistic, sharpen your skills, and remain ahead of the crowd.

Seasoned traders have seen markets change over and over. They'll warn you that to stay profitable, it's necessary to continually search for new ways to trade profitably. This fact of trading can provide comfort when you hear your friends complain about how "it's all changed" and there's no longer a viable way to make a profit.

Sure, it's not going to be easy, but it's always possible. Acknowledging that trading is hard can actually soothe you. If you know that it's not your fault that market conditions change, then there's no reason to feel pessimistic and beat yourself up. It's not your fault. You didn't do anything wrong. Change is merely the nature of the beast. Your job is to avoid giving into pessimism. Instead, you must continually pick yourself up after being thrown down and courageously face market challenges with a fighting spirit.

An optimistic attitude alone isn't going to guarantee success, but it's an essential prerequisite for continuing to stay profitable. To stay on top, you're going to have to think creatively and you might have to change the way you've been doing things. Maybe you can't make as much profit as you were used to making on merely a few trades. Perhaps, you have to make more trades or just expect less per trade. Maybe you have to move into new sectors or into trading commodities or bonds. Again, it's not going to be simple, but with effort and practice, you can learn to adapt your trading style to new circumstances, instead of catching the pessimism that is rampant when the majority of traders are losing.

So when you hear a novice or old-timer complain, "it's impossible to make a profit," don't let it shake your resolve. Don't catch a bad mood. Everyone is different. You're different from other traders. You have your own resources and your own style. Maybe your friend with a bad attitude is right. Maybe he or she can't trade the markets anymore. Maybe his or her account is too big or too small. Whatever the issue is, don't make it your problem. Just go your own merry way and keep searching for a new set of tools that will make you profitable. They are out there. All you have to do is persistently search until you find them.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

CHK Trade

Instant Income Guaranteed

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

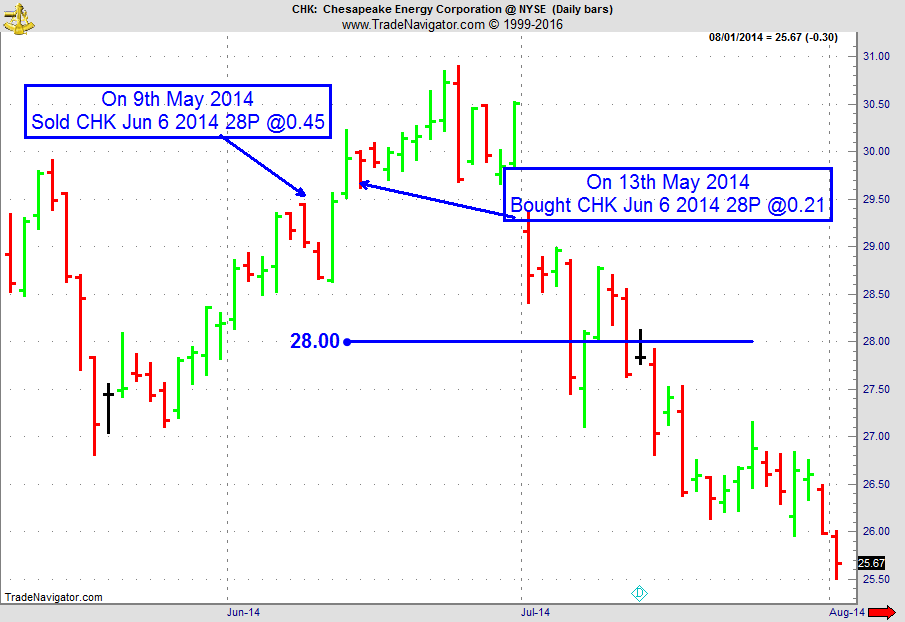

On 8th May 2014, we gave our IIG subscribers the following trade on CHK, which was in an established uptrend. We decided to sell price insurance as follows the following day:

- On 9th May 2014, we sold CHK June 06 2014 28P @ $0.45, i.e. $45 per option sold; the short strike was slightly below price action (4% away) but below the last support level, with only 27 days to expiration.

- On 13th May 2014, we bought back CHK June 06 2014 28P @ $0.21, after 4 days in the trade.

Profit: $24

Margin: $560

Return on Margin Annualized: 391.07%

We have also added new types of trades for our IIG daily guidance, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

This includes a daily 80+ page report along with a daily podcast!

We review and supply the following:

-

our daily fills (entries, exits)

-

full real-time statistics of our weekly trades, closed trades for the current month, monthly statistics (detail and summary) since the beginning of IIG

-

daily market commentary (indices/sectors, volatility indices, main commodities related to our trade)

-

new trades for the following day

-

comments on our open trades, with all relevant news

-

updated earnings dates for our open positions

-

full details (days in trade, days to expiration, underlying close and price change, etc.) on our open trades (classic trades, complex positions, remaining rolled trades and covered calls)

-

active good till cancelled orders

-

dividends for the stocks owned

We also supply quite a number of extra "slides" in the appendix which are quite useful for new subscribers: recommendations, answers and explanations on the most frequent questions, techniques for entering trades, historical trades and real life examples, broker information, etc.

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Let's check out a spread trading idea using the Softs at the ICE going long the March 2017 Sugar and short the May 2017 Sugar.

Traders Notebook - Receive Daily Trade recommendations

Sign up today!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

This Week's Blog Post - Becoming a Consistent Winner

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Don't underestimate your time it takes to become a profitable trader! Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

The price of Ambush Trading Method will increase to $1,299 on September 17, 2016.

Use coupon code "ambush10" to get an additional 10% off the current price.

Coupon is valid only through September 16, 2016 on the current price. No exceptions.

Coupon is valid for the Ambush only. It is not valid for the Ambush/Stealth combo.

Grab a copy at the current price while you still can!

Ambush Trading Method - Update

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com

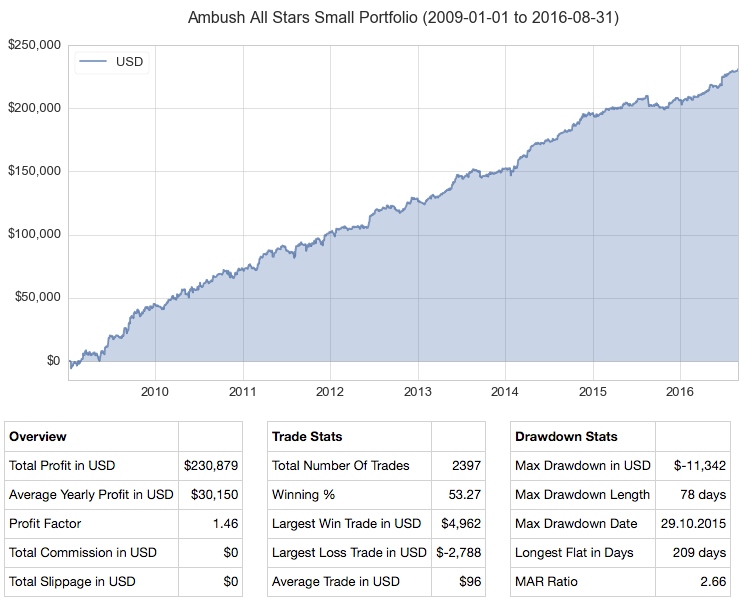

As Ambush continues this years gold rush across many markets, we did another update of our Futures Performance Page.

Additionally to up-to-date reports for each single market, there's three sample baskets of portfolios showing you the power of diversification trading Ambush in multiple markets!

Here's one of them for small account ($25k+) trading ES, 6A, NG and ZN:

The price of Ambush will rise significantly on September 17th, this is your chance to get it at a bargain price!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

AlgoStrats.com - AlgoStrats:FX

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com

Learn all you need to know about AlgoStrats:FX during this presentation by Marco Mayer. What is it, what's the idea behind it, why it is different from other services and how you'd profit from AlgoStrats:FX as a subscriber!

Join AlgoStrats:FX today!

Feel free to email questions to This email address is being protected from spambots. You need JavaScript enabled to view it., or post it in our Blog or Forum. Follow me on Facebook and Twitter!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.