Edition 640 - September 16, 2016

This is the final day before the Ambush Trading Method goes up in price. Grab a copy at the low current price while you still can!

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

TRADABLE MARKETS

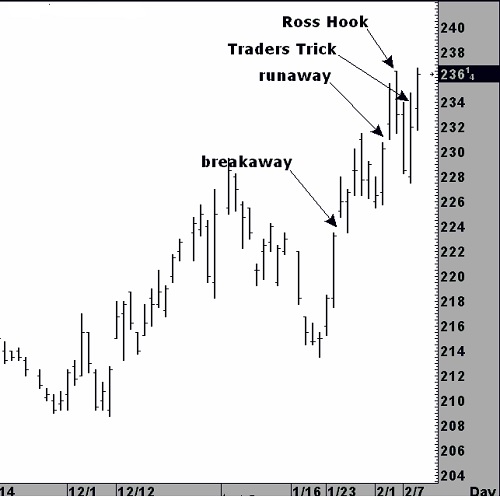

"Joe, would you analyze the attached futures for me?" So, here goes. This chart is easy to analyze using a combination of old-time, classical charting techniques, along with The Law of Charts and the Traders Trick Entry.

I've marked two gaps on the chart: a "breakaway gap" and a "runaway gap." The next gap up on the daily chart will bear the title "exhaustion gap," and should be the beginning of a correction or sideways area of distribution. Taking the Traders Trick Entry ahead of a breakout of the Ross hook is already showing a profit. 2 to 2.5 points should be taken so that you are paid to trade. Using that kind of management takes the pressure off the trade and off yourself as well. Then it is just a matter of where you now want to place your protection. Certainly you should not allow yourself to do any worse than breakeven on the remainder of your position. If I were trading a 10-lot in this situation, I would take 6 lots off at the point of the Ross hook, and move 4 lots to breakeven. However, that's me. You have to come up with your own management within your own financial, mental, and emotional level of comfort.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

START OUT STRONG

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Trading is a challenging business. Not only is it tough to repeatedly pick one winning trade after another, it is also hard to control our emotions. Our emotions often get the better of us. Our expectations tend to influence how we feel as we trade, and when we doubt our abilities, we may have difficulty maintaining a winning attitude. One good approach to staying optimistic as you battle with the markets is to build up psychological momentum: start off ahead of the game, and build on that success. However, many traders set themselves up for failure. They start off making trading errors, and dig themselves into an emotional hole from which they have trouble climbing out.

The expectations you have regarding a trade can dictate how you approach it. If you feel you are about to make a mistake, then you probably will make a trading error. You might have a perfectly good idea for a trade, for example, but you may feel so on edge that you have trouble taking advantage of it. It often starts out innocently enough. You have a good trading plan, but you make a few little errors. Perhaps you trade under less than ideal market conditions, or you set your stop too close to your exit point and get stopped out. Maybe you don't put up enough capital to make your trading plan work.

Whatever it is, you may make a few poor decisions, end up with a losing trade, and feel disappointed. Making one bad trade isn't a big deal, but what happens when you make another losing trade, and then another losing trade, and so on? At that point, you may feel that it is hard to get out of the minor slump you are in.

How can you set yourself up to win? First, realize that trading can be much like a self-fulfilling prophecy: you secretly believe that your trading plan won't produce a profit, and then you subtly self-sabotage your plan by feeling uptight, overly exacting, and constrained. It is vital to feel relaxed and carefree when you start out the trading day. Think optimistically.

Second, why not cheat a little? When you start the trading day, wait for an ideal trade, a trade you can afford to make which has a high probability of winning. If the first thing you do is make a profitable trade, even a small one, you'll feel good on your first trade, and then you can start building on your solid start.

When you set yourself up to win, you feel good, and this good feeling can help you trade more creatively. Instead of feeling uptight, you will trust your instincts and be more willing to risk capital. You won't make minor mistakes like risking too little capital, or placing your protective stop too tight and getting repeatedly stopped out. If you trade with wavering confidence, these minor errors can happen below your level of awareness, and at that point you may start mounting losses. Why set yourself up for a series of losers? Start off strong. Set yourself up for success, and build up the psychological momentum you need to trade with a winning mental edge.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

FMC TRADE

Instant Income Guaranteed

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

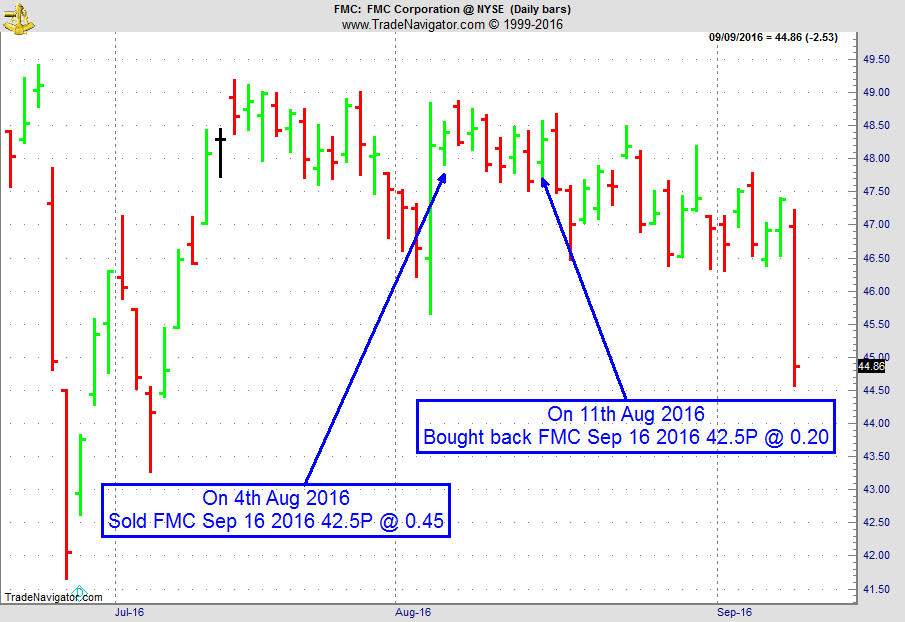

On 3rd August 2016, we gave our IIG subscribers the following trade on FMC, right after a strong move up on earnings. With strong support around $44, we decided to sell price insurance as follows the following day:

- On 4th August 2016, we sold FMC September 16 2016 42.5P @ $0.45, i.e. $45 per option sold, with 42 days to expiration.

- On 11th August 2016, we bought back FMC September 16 2016 42.5P @ $0.20, after 8 days in the trade, for quick premium compounding.

Profit: $25

Margin: $850

Return on Margin Annualized: 134.19%

We have also added new types of trades for our IIG daily guidance, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

This includes a daily 80+ page report along with a daily podcast!

We review and supply the following:

-

our daily fills (entries, exits)

-

full real-time statistics of our weekly trades, closed trades for the current month, monthly statistics (detail and summary) since the beginning of IIG

-

daily market commentary (indices/sectors, volatility indices, main commodities related to our trade)

-

new trades for the following day

-

comments on our open trades, with all relevant news

-

updated earnings dates for our open positions

-

full details (days in trade, days to expiration, underlying close and price change, etc.) on our open trades (classic trades, complex positions, remaining rolled trades and covered calls)

-

active good till cancelled orders

-

dividends for the stocks owned

We also supply quite a number of extra "slides" in the appendix which are quite useful for new subscribers: recommendations, answers and explanations on the most frequent questions, techniques for entering trades, historical trades and real life examples, broker information, etc.

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Sorry, no trading idea this week. Root canal is no fun!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

This Week's Blog Post - Markets Tend to Part the Foolish from their Money

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Sometimes you feel that you are able to throw caution to the wind. That is when you must be careful to not spit into it. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

The price of Ambush Trading Method will increase to $1,299 on September 17, 2016.

Grab a copy at the current price while you still can!

Ambush Trading Method - All-Stars Portfolio

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com

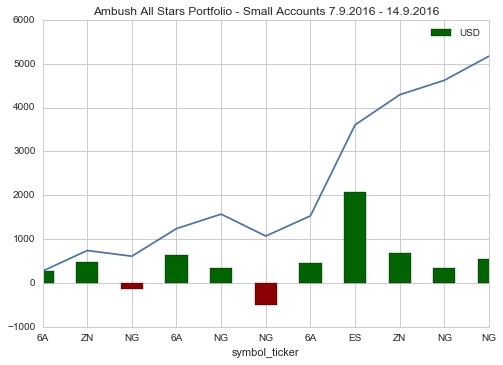

Here's an important update with Ambush Trading Method using the All-Stars Portfolio for small accounts E-Mini S&P 500 (ES), Australian Dollar (6A), Natural Gas (NG), 10 Year US T-Note (ZN)) trading one contract per market, except ZN where we use two contracts. For more information regarding the portfolio and long-term performance, see the Ambush Performance Page.

Last week was a difficult one for many traders, and as Ambush just made new equity highs at the end of August, how did it continue to perform? Here's the answer, play by play, Ambush had another crazy week making almost $5,000 performance in the small portfolio, making new all time equity highs across the board again:

As you can see Ambush killed it again in the markets, in the E-Mini S&P 500 alone there was one trade with a profit of about $2,000. That's also the answer to the question why we're raising the price of Ambush. The old price simply is in no relation to the crazy performance Ambush delivers anymore. This week alone, buying Ambush at the old price, it generated more than 5 times the profits of its costs trading the small Ambush All-Stars portfolio!

So don't miss your chance to get Ambush still at a bargain. Odds are price will increase further in the future and you will never be able to get on board at such a low price again.

The price of Ambush will rise significantly on September 17th, this is your chance to get it at a bargain price!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

On Vacation

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com

I am having a great vacation traveling in South Germany to enjoy the last days of the summer and to visit family and friends. We started in Munich for a weekend, then to Heidelberg, and are now enjoying the last week in Black Forest hiking and mountain biking! Fortunately, we had two weeks of nothing but sunshine! Here's a few of my favorite pictures while on vacation.

Learn all you need to know about AlgoStrats:FX during this presentation by Marco Mayer. What is it, what's the idea behind it, why it is different from other services and how you'd profit from AlgoStrats:FX as a subscriber!

Join AlgoStrats:FX today!

Feel free to email questions to This email address is being protected from spambots. You need JavaScript enabled to view it., or post it in our Blog or Forum. Follow me on Facebook and Twitter!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.