Edition 641 - September 23, 2016

“Destruction will come to the Traders of iniquity.” Master Trader Joe Ross

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

BOND TRADING

Someone asked me recently, "Can you trade the T-Bonds with cluster breakouts? Can I use the same technique you have in your 'Day Trading' book?"

The answer to the first question is "Yes!" You can trade the T-Bonds with cluster breakouts. The answer to the second question is "No," T-Bonds are a different market with different movement. You would have to make some sort of adjustment to your objectives and to your exit points. In other words, you would have to change your management.

To tell the truth, I've never tried trading T-Bonds on cluster breakouts. Certainly, you would have to do the trading only when T-Bonds were making swings or trends on the daily chart. It would not be something I would try to do every day. I think it would be murder to trade bonds with cluster breakouts when the market was going sideways.

Here's the 60-minute T-Bond chart at a time the daily chart was trending. You be the judge.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Some thoughts about trading

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

I’ve been asked many times: “Is there any meaning in trading? Does it serve a purpose? Does it produce anything of value to anyone?”

Those are good questions, and ones that I have frequently thought about over the years.

When I first began trading futures, a fair number of contracts actually ended up in a delivery — certainly more than we see today. Today only 3% of contracts result in delivery.

The economic and social justification for the futures markets is to provide a venue in which producers and users can hedge against excessive fluctuations in price. Price stability within the economy is seen as a desirable thing, and so it is. In effect, the hedger is seeking price insurance, and the speculator provides the insurance policy.

With hedging as its justification, speculation in futures serves as a way of providing liquidity, efficiency, and price discovery. The speculator serves as the person who is willing to take the risk the hedger wants to avoid. Without that justification, trading futures is nothing more than outright speculation.

Put options in the stock market provide the same thing by enabling an investor insurance against falling stock prices.

However, it is difficult to see how trading from a 1, 3, or 5-minute chart meets the criteria for providing liquidity and price discovery for the hedger. Does a producer or consumer need to hedge for only 1 minute? It is hard to argue on the basis of short-term intraday trading, that anyone is actually providing a social or economic benefit of any kind, other than to another day trader.

Whereas with longer-term trading it is easy to see the social and economic benefits provided by the speculator, or investor, it is virtually impossible to see that such benefits are derived from short-term trading. That renders day trading as nothing more than speculating. To that extent, the markets may have become giant gambling casinos.

That raises a question: What is the difference between the gambler and the speculator? True speculation is based on taking advantage of the realities of the market. Gambling is an attempt at trying one's luck.

Since trading is a business, the business-like speculator is willing to accept the risk of price fluctuation in return for the greater leverage that comes with that risk in the hopes of earning substantial profits. The business-like speculator makes his trading decisions based on knowledge gathered from information about the behavior of the underlying: Research, financial analysis, seasonality, historical and current trends, chart analysis, fundamentals, the market dynamics, and knowledge of those who trade it.

What about the gambler? How does he make his decisions?

The gambler makes his trading decisions on gut feelings, hopes, dreams of getting rich quick, tips from the broker, “inside information” from friends, opinions uttered in the financial news media, and from the improper understanding and use of indicators, oscillators, moving averages, and mechanical trading systems. In general, he is looking for a way to shortcut having to truly learn what is going on. He or she is in a hurry to make money. Unfortunately, most people who attempt to trade fall into this category. Many wannabe traders are gambling, and they don’t even realize it. Anyone who attempts to trade without essential knowledge of what the markets are all about and how they truly function, is gambling.

There is one more aspect to this subject. It has to do with morality. I am often asked if trading goes against the teachings of the Bible. Is it a sin to trade? Is it a sin to speculate in the markets? I have been asked this question numerous times even by church pastors. A friend of mine said it this way: “You did not pay to be born. Life is a gift that was freely given to you. The ways in which you repay God for your life is by using your natural talents to the best of your ability and constantly creating positive change in your life and the lives of others. This quest fulfills the meaning of life, to make the world a better place because you were here. What are your talents and abilities? What is the most important goal in your life? How do you exercise your talent on a regular basis to achieve that goal? How are you creating positive changes in your life and the lives of others? What is the legacy you will leave behind to show mankind that you ever existed? May God bless you and your efforts to become the best person and the most consistently profitable trader you possibly can be!”

In my own life, I use my trading to support a charity which works with the poor, for missionary work, and my local church. I believe that produces both economic and social benefits to the world in which I live.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

SLCA TRADE

Instant Income Guaranteed

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

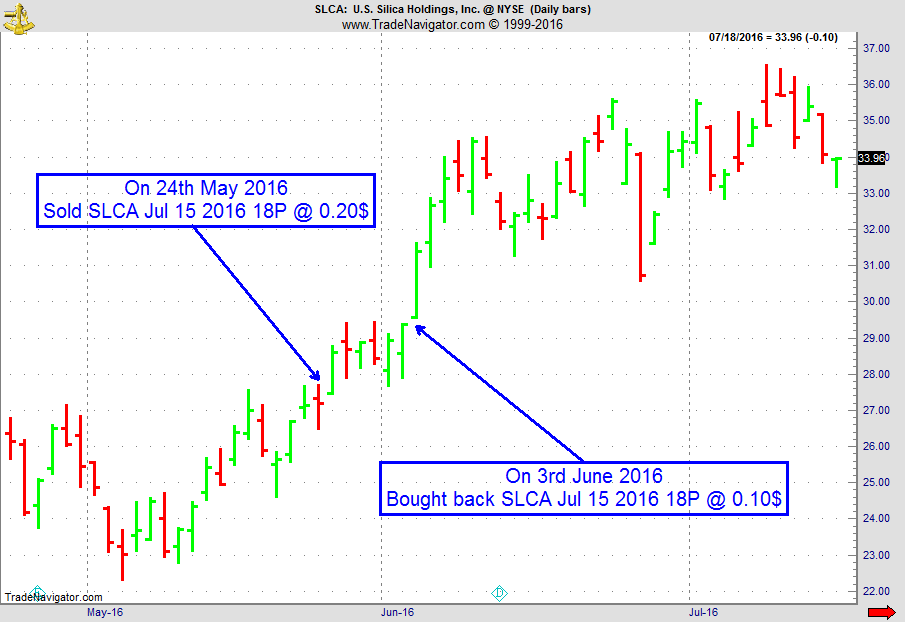

On 23rd May 2016, we gave our IIG subscribers the following trade on SLCA, right after exiting a trade on the same stock. With strong support around $22, we decided to sell price insurance as follows the following day:

- On 24th May 2016, we sold SLCA July 15 2016 18P @ $0.20, i.e. $20 per option sold, with 51 days to expiration, and 34% between price action and our short strike (difficult to make a trade any safer).

- On 3rd June 2016, we bought back SLCA July 15 2016 18P @ $0.10, after 10 days in the trade, for quick premium compounding.

Profit: $10

Margin: $360

Return on Margin Annualized: 101.39%

We have also added new types of trades for our IIG daily guidance, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

This includes a daily 80+ page report along with a daily podcast!

We review and supply the following:

-

our daily fills (entries, exits)

-

full real-time statistics of our weekly trades, closed trades for the current month, monthly statistics (detail and summary) since the beginning of IIG

-

daily market commentary (indices/sectors, volatility indices, main commodities related to our trade)

-

new trades for the following day

-

comments on our open trades, with all relevant news

-

updated earnings dates for our open positions

-

full details (days in trade, days to expiration, underlying close and price change, etc.) on our open trades (classic trades, complex positions, remaining rolled trades and covered calls)

-

active good till cancelled orders

-

dividends for the stocks owned

We also supply quite a number of extra "slides" in the appendix which are quite useful for new subscribers: recommendations, answers and explanations on the most frequent questions, techniques for entering trades, historical trades and real life examples, broker information, etc.

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

This Week's Blog Post - Market Technicians

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Are you in the middle? Most people are. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Drawdown is the norm, not the expection

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com

In his article "Drawdown is the norm, not the exception", Marco writes about why being in a drawdown most of the time is nothing unusual or bad in trading and why it's not a good idea to try to avoid drawdowns altogether. Read more.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Learn all you need to know about AlgoStrats:FX during this presentation by Marco Mayer. What is it, what's the idea behind it, why it is different from other services and how you'd profit from AlgoStrats:FX as a subscriber!

Join AlgoStrats:FX today!

Feel free to email questions to This email address is being protected from spambots. You need JavaScript enabled to view it., or post it in our Blog or Forum. Follow me on Facebook and Twitter!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.