Edition 643 - October 7, 2016

Experienced traders find time to work and play. If you're not at the level you desire, don't waste another day, contact us for help.

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

GAPS

“Hey Joe, I noticed that when I look at older charts as presented in books and historical data, I see a lot of gaps. There doesn’t seem to be so many these days. Can you explain?”

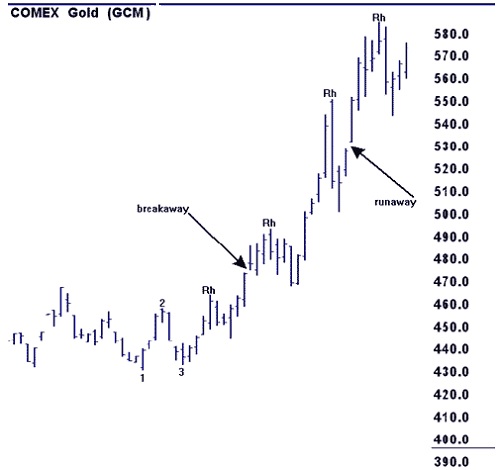

Prior to extended hour trading, prices would have lots of hours between trading sessions. As an example let’s look at a weekly gold chart. Gold traded at the Comex Exchange between the hours of 7:20AM US Central Time and 1:15PM, almost 6 hours.

However, people traded in gold for 24 hours—leaving 18 hours during which gold prices moved. The move in prices was reflected at the Open. There were many gaps, even on weekly charts as shown above. Gaps were so significant they even had names. The first gap out of consolidation was called a “breakaway” gap. If prices continued to rise, the next gap was called a “runaway” gap. At some point prices would make one last effort to move higher. That last effort often resulted in a final gap opening called an “exhaustion gap.”

With extended trading hours it is a rare week that will show any kind of gap at all in a futures market. Daily gaps have also become uncommon. However, daily chart gaps are still frequently seen in the stock market. There is a premarket and an aftermarket in stocks, but not a lot of price movement takes place during those hours.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Question from a Subscriber

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

"I just want to be prepared for the next legal holiday. I’ve been basically a Dow investor for years and now I've begun trading the Dow futures. Do you have any information about the Dow Industrial Average relative to legal holidays in the U.S?"

Thanks to Yale Hirsch’s excellent "Stock Traders Almanac" for the following: “The Dow closes higher before one day holidays 67% of the time, and three day holidays 75% of the time. It closes on Friday greater than Thursday 57% of the time, but when Friday closes weaker than Thursday, it also closes lower on Monday 73% of the time. This study was based over 100 years’ research.”

If anyone knows where you can still get a copy of the almanac, please let me know. I have the above information only in my notes.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Read Joe's latest blog, "In and around Uruguay" to find out how he spends his free time away from trading.

TAP TRADE

Instant Income Guaranteed

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

On 5th September 2016, we gave our IIG subscribers the following trade on TAP, which showed high premium levels at distant short strikes in a low volatility environment. We decided to sell price insurance as follows the following day:

- On 6th September 2016, we sold TAP October 21 2016 85P @ $0.85, ie. $85 per option sold, with 45 days to expiration, and our short strike 18% below price action;

- On 28th September 2016, we bought to close TAP October 21 2016 85P @ $0.30, after 23 days in the trade

Profit: $55

Margin: $1,700

Return on Margin Annualized: 51.34%

We have also added new types of trades for our IIG daily guidance, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

This includes a daily 80+ page report along with a daily podcast!

We review and supply the following:

-

our daily fills (entries, exits)

-

full real-time statistics of our weekly trades, closed trades for the current month, monthly statistics (detail and summary) since the beginning of IIG

-

daily market commentary (indices/sectors, volatility indices, main commodities related to our trade)

-

new trades for the following day

-

comments on our open trades, with all relevant news

-

updated earnings dates for our open positions

-

full details (days in trade, days to expiration, underlying close and price change, etc.) on our open trades (classic trades, complex positions, remaining rolled trades and covered calls)

-

active good till cancelled orders

-

dividends for the stocks owned

We also supply quite a number of extra "slides" in the appendix which are quite useful for new subscribers: recommendations, answers and explanations on the most frequent questions, techniques for entering trades, historical trades and real life examples, broker information, etc.

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Traders Notebook Outright Futures Trading

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook Complete and Traders Notebook Outrights

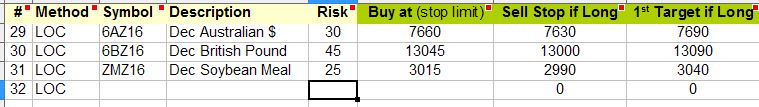

Today I will show you a trade from the other day with our new service. As you can see below, we were looking for a few entries in several markets.

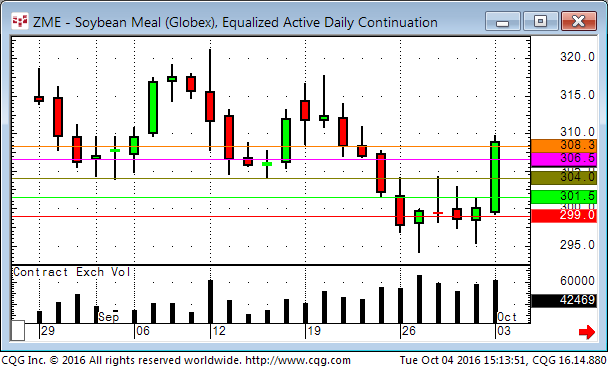

We were filled in the long Soybean Meal trade at 301.5 with an initial stop at 299.0 (the risk was $250 per contract traded). During the overnight session the market moved a bit, but everything was very quiet. At the open of the day session the market moved strongly lower but we were happy of not getting stopped out of the trade. Only ½ hour later the market was back up to our entry level and it climbed higher all day long. We took firsts profit at 304.0, then at 306.4 and finally at 308.3 as you can see on the daily chart below.

If you are interested in outright futures short term swing trading, you should check out our new service Traders Notebook Outrights.

Traders Notebook Outright Guide explains the Outright trading service from Trading Educators. It shows you around on the Outright Campus and how to use the information provided by the service.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

The Forex Trump Trade & Synthetic FX Pairs

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com

In the Forex world, the RUB/MXN cross has become known as the Trump Trade. But is it really? And how would you trade it if your broker doesn't offer that pair? If you'd like to know or ever wondered what synthetic Forex pairs are and how to create them, check out Marco's latest article on our blog! Read more.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.