Edition 645 - October 21, 2016

We offer different trading advisories for a variety of markets, so enhance your trading style today! Check them out to find your best fit.

Instant Income Guaranteed - Stock Options

Traders Notebook Complete - Futures, Options, and Spread Trades

Traders Notebook Outrights - Futures

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

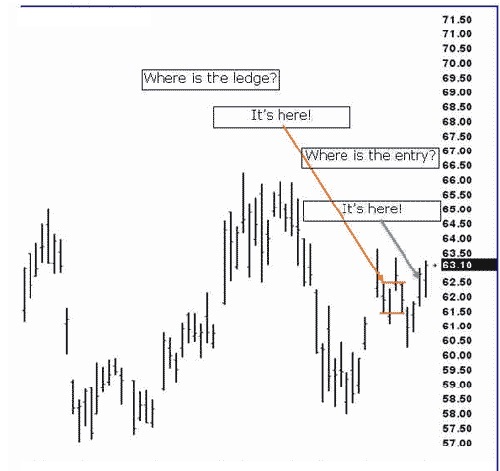

Where’s the Ledge?

I received a chart with a question: "Where is the ledge?" Below you see the chart with the ledge as I drew it. In order to understand the concept, you have to know how a ledge is defined within The Law of Charts. A ledge comes when prices are trending or swinging. It consists of 4 to 10 bars and has two matching or close to matching highs and two matching or close to matching lows. There must be at least 1 price bar between each of the matches. In the case below there were two bars between the matches. Entry is made when prices breakout in the direction of the most recent swing or trend. Entry was 1-tick above the high of the ledge as shown by the dark arrow. The swing in this case was up from approximately 58.00 to between 63.50-64.00.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Question from a Subscriber:

"Have you ever felt as if the more you know, the less you know, and the more you become confused? Why is this?"

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

People have the tendency to believe that the accuracy of their forecasts increases with more information. This is the illusion of knowledge – that more information increases your knowledge about something and improves your decisions. However, this is not always the case. Increased levels of information do not necessarily lead to greater knowledge. There are three reasons for this. First, some information does not help us make predictions and can even mislead us. Second, many people may not have the training, experience, or skills to interpret the information. And, finally, people tend to interpret new information as confirmation of their prior beliefs.

Let me give you an example of how too much information can lead to a paralysis of confusion.

I met a man who was an avid student of the teachings of W.D. Gann. Gann believed in the movement of prices along a 45 degree angle. He also believed that time intervals of 3, 5, 9, and others had great importance. So the man I knew created moving averages of 3-bars, 5-bars, 9-bars and multiples thereof. Of course, 3 x 9 equals 27 and so he kept 27 bar moving averages. 5 x 9 is 45, and so he also kept 45 bar moving averages. He also watched 135-bar moving averages (3x45) and others. He looked for agreement among all of these moving averages, which of course, led to great confusion, since it was rare indeed and most likely coincidental when all of the moving averages showed some sort of agreement (confluence). So this man suffered greatly from paralysis of analysis. He simply had too much information, and he was unable to pull the trigger on a trade.

I will never forget the statement he made to me: “Joe, I know so much. Why then is it that I never seem to be making money?”

I think from the above description you should be able to figure it out, just as I did.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WYNN TRADE

Instant Income Guaranteed

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

On 1st August 2016, we gave our IIG subscribers the following trade on WYNN, which was showing accumulation on a pullback. We decided to sell price insurance as follows the following day:

- On 2nd August 2016, we sold to open WYNN Sep 16 2016 75P @ $0.47, i.e. $47 per option sold, with 44 days to expiration, and our short strike 23% below price levels when we gave the trade, making it pretty safe.

- On 11th August 2016, we bought to close WYNN Sep 16 2016 75P @ $0.14, after 9 days in the trade, for quick premium compounding.

Profit: $33

Margin: $1,500

Return on Margin Annualized: 89.22%

We have also added new types of trades for our IIG daily guidance, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

This includes a daily 80+ page report along with a daily podcast!

We review and supply the following:

-

our daily fills (entries, exits)

-

full real-time statistics of our weekly trades, closed trades for the current month, monthly statistics (detail and summary) since the beginning of IIG

-

daily market commentary (indices/sectors, volatility indices, main commodities related to our trade)

-

new trades for the following day

-

comments on our open trades, with all relevant news

-

updated earnings dates for our open positions

-

full details (days in trade, days to expiration, underlying close and price change, etc.) on our open trades (classic trades, complex positions, remaining rolled trades and covered calls)

-

active good till cancelled orders

-

dividends for the stocks owned

We also supply quite a number of extra "slides" in the appendix which are quite useful for new subscribers: recommendations, answers and explanations on the most frequent questions, techniques for entering trades, historical trades and real life examples, broker information, etc.

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

The Whipsaw Song by Trading Tribe

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook Complete and Traders Notebook Outrights

Once in a while I stumble over a nice article, video or any other source of information about trading on the internet that I would like to share with all of you.

I found this video a long time ago and honestly, I like it a lot. It is fun to watch and the rules mentioned in the video are very simple to follow, and explains what a trader really needs. I’ve tried many different ways in trading, but I always coming back to the simple things because this is what works best for me. Using a simple strategy does not allow me to “doubt” on my entries. I do not have to re-think where to enter, where to put my stop, and where to take profits. For me, simple is GOOD.

Enjoy the video!

Traders Notebook Outright Futures Trading

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook Complete and Traders Notebook Outrights

If you are interested in outright futures short term swing trading, you should check out our new service Traders Notebook Outrights.

Traders Notebook Outright Guide explains the Outright trading service from Trading Educators. It shows you around on the Outright Campus and how to use the information provided by the service.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

This Week's Blog - Waiting for Confirmation? Don’t wait too long!

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com

In his newest article, Marco writes about why waiting for the confirmation of a trading idea often comes at a high price. Read more.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.